5 Alternatives to Wise [2026 Updated]

If you need to send payments overseas, you may have heard of Wise.

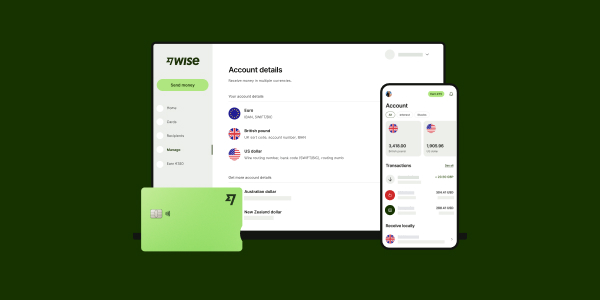

Wise offers fast international money transfers to 160+ countries, which use the mid-market exchange rate to convert your dollars to the currency you need. Wise is popular with customers thanks to its intuitive app and transparent fees – but they’re not the only option. Comparing a few sites like Wise can be a smart way to find the best provider for your specific payment.

In this guide, we’ll look at some alternatives to Wise, to help you decide which service is best for you.

Table of contents:

- Which Wise alternative to choose

- About Wise

- Alternatives to Wise money transfer

- Alternatives to Wise account & card

- Comparing the alternatives with Wise

Quick summary: Which Wise alternative to choose when

While choosing the best provider for your needs will depend on the specific details of your transfer, here are some guidelines to consider if you’re looking for sites like Wise for your next payment:

Consider Xe – if you want to send a payment to a less commonly used currency – 139 currencies and 220+ countries and territories are covered by Xe Money Transfer.

Consider OFX – when you need specialist currency risk management services, or personalized support from a broker.

Consider Remitly – if you’re sending relatively small transfers on popular routes – good range of payout options available.

Consider MoneyGram – when you want to have your transfer collected in cash or for home delivery to your recipient.

Consider PayPal – if you’re sending to someone who uses PayPal regularly, and when speed and convenience are more important than cost.

About Wise (formerly TransferWise)

Wise was launched in the UK in 2011, and now operates in all but a handful of countries around the world, helping over 13 million customers to send, receive, hold and exchange money. Wise is working on making it easier, cheaper and more convenient to send and receive transfers across borders, driving down prices and making fees and delivery times as transparent as possible for customers.

Wise services include:

- Wise money transfer: Low cost money transfers to 160+ countries

- Wise account:Multi-currency accounts to hold 40+ currencies

- Wise Multi-Currency Card: International debit cards to spend in 150+ countries

- Wise business: Wise business accounts, debit cards and payments

Learn more: Wise review

When Wise might be a good option:

- If you’re sending money to a bank account in a supported country, and need a fast online or in-app payment

- If you need to hold or exchange 40+ currencies in an online account

- If you receive payments from overseas in foreign currencies regularly from 30+ countries

- If you like to travel or shop online with international retailers – the Wise Multi-Currency Card has no foreign transaction fees to pay

When it may not be the best option:

- If you want to send money for cash collection

- If you’re looking for an interest bearing account for saving

- If you like face to face services in a branch

| Pros of Wise | Cons of Wise |

|---|---|

| ✅ Hold, exchange, send and spend 40+ currencies ✅ Mid-market exchange rate when sending money, converting in the Wise account, or spending with the Wise Multi-Currency Card ✅ Transparent fees and fast payment delivery times – 50% of transfers are instant ✅ No ongoing account or card fees – just pay for the services you use ✅ Accounts come with local bank details for 10 currencies, plus international debit cards are available for spending in 150+ countries | ❌ Transaction fees apply, depending on how you use your account ❌ No branch services – so you can’t pay in cash of get face to face support ❌ No option to send money for cash collection or home delivery ❌ Accounts are not interest bearing |

Wise money transfer alternatives

Below, we’ve listed 5 companies you can use as alternatives to Wise money transfer. We’ve taken their level of convenience, costs and security into consideration so you can decide who to use for your next international money transfer.

First, though, let’s look at a quick side by side comparison for convenience:

| Provider | Fees (low value transfers) | Fees (high value transfers) | Speed | Benefits compared to Wise |

|---|---|---|---|---|

| Xe Money Transfer | No transfer fee – exchange rate markup will apply | No transfer fee – exchange rate markup will apply | Transfer times vary based on the currency you’re sending | Send to almost any country in the world, in 139 currencies |

| OFX | Transfer a minimum of $1,000 No transfer fee, exchange rate markup will apply | No transfer fee, exchange rate markup will apply | Usually within 24 hours | OFX offers currency risk management products, and a personal service with brokers who are available by phone 24/7 |

| Remitly | Fees vary based on currency, Express and Economy services available | Fees vary based on currency, Express and Economy services available | Express and Cash collection payments may be instant Economy services may take several days | Good range of payout options including cash for collection and delivery and mobile money services |

| MoneyGram | Fees vary based on currency, destination and how you pay | Fees vary based on currency, destination and how you pay | Cash collection payments may be instant | Pay online, in the app, or in cash – and have your recipient get their money in cash, as a bank deposit or through a mobile wallet |

| PayPal | Pay with PayPal balance, bank account or Amex Send account: 5% fee – from $0.99 to $4.99 Pay by credit card: Above fee applies, plus 2.9% card fee + fixed fee In all cases 3% – 4% currency conversion fee applies | Pay with PayPal balance, bank account or Amex Send account: 5% fee – from $0.99 to $4.99 Pay by credit card: Above fee applies, plus 2.9% card fee + fixed fee In all cases 3% – 4% currency conversion fee applies | Payments arrive in PayPal accounts instantly – withdrawing to a bank account may take a day or two | Convenient ways to pay people fast, in a broad range of currencies |

Wise account and card alternatives

The Wise account and Wise Multi-Currency Card are designed to help you save money around the world, allowing you to make transfers to 160 countries and supporting 40 currencies at the mid-market exchange rate. Ideal for those that are cost-conscious, you can save when sending, spending, and withdrawing money across the globe – with low and transparent fees.

Plus, with Wise account you can get local account details for 10 different currencies, meaning you can receive money and make payments as if you were a local. Whether you’re a frequent traveler, business owner, or simply someone looking for smarter international financial management, Wise has you covered, all while keeping your money secure.

| Wise and alternatives | Coverage | Fees | Exchange rates | Card |

|---|---|---|---|---|

| Wise account | 40+ currencies for holding and exchange Spend in 150+ countries | No foreign transaction fee No account opening fee First 2 withdrawals up to total of 100 USD in a month for no fee, then 1.5 USD + 2%* | Mid market rate, currency exchange from 0.43% | Debit card |

| Revolut | 25+ currencies for holding and exchange Spend in 150+ currencies | No foreign transaction fee No account opening fee Monthly fees may apply to your account, depending on the tier you select No-fee withdrawals to plan limit, 2% after that | Mid market rate to plan limit, 0.5% fair usage fee after that | Debit card |

| PayPal | 25+ supported currencies Available in 200+ countries | No account opening fee 2.50 USD withdrawals 2.5% foreign transaction debit card fee | 3% or 4% conversion fee | Debit and credit card |

| OFX | Send to 50+ currencies to 170+ countries Hold and receive 7 currencies | No opening fee or monthly fees | Currency conversion includes a markup | No card available |

*ATM operators may charge their own fees

1. Xe Money Transfer – send money to 170+ countries

Summary: Xe offers a range of currency tools and data, including live and historical exchange rate information. You can also use Xe Money Transfer to send payments to pretty much any country in the world, in a broad range of currencies. It’s worth noting that while Xe’s currency data shows the mid-market exchange rate, the rates used for sending payments with Xe do include a markup on the mid-market rate.

Summary: Xe offers a range of currency tools and data, including live and historical exchange rate information. You can also use Xe Money Transfer to send payments to pretty much any country in the world, in a broad range of currencies. It’s worth noting that while Xe’s currency data shows the mid-market exchange rate, the rates used for sending payments with Xe do include a markup on the mid-market rate.

Best Features

Xe’s main attraction may be in the sheer range of countries and currencies served. You can send payments to more or less anywhere you want, for delivery to bank accounts in almost any currency.

| Pros of Xe Money Transfer | Cons of Xe Money Transfer |

|---|---|

| ✅ Send 139 currencies to 220+ countries and territories ✅ Large, established company processing $115 billion in payments annually ✅ Create your account online or by phone | ❌ Exchange rates include a markup on the mid-market exchange rate ❌ Fees and delivery times vary based on where you’re sending money to ❌ No option to send cash payments |

2. OFX – fee free transfers

Summary: OFX supports international money transfers from over 190 countries in more than 55 currencies. If you’re making an online transfer, it is definitely worth looking at OFX as an alternative to Wise. In addition, OFX has personal broker services you can access by phone, any time of the day or night.

Summary: OFX supports international money transfers from over 190 countries in more than 55 currencies. If you’re making an online transfer, it is definitely worth looking at OFX as an alternative to Wise. In addition, OFX has personal broker services you can access by phone, any time of the day or night.

Best Features

OFX has an easy to use website and app, much like Wise. So if you like doing everything online, they could be a good option. However, if you prefer the reassurance of talking to someone when you arrange your payment, the phone service can be a great way to get connected with a broker 24/7. Learn more in this OFX review.

| Pros of OFX | Cons of OFX |

|---|---|

| ✅ OFX is one of the oldest money transfer companies and they have the expertise to go with it ✅ Their rates are often better than the banks, especially for larger transfers ✅ 24/7 phone support | ❌ Exchange rates will include a markup which is a less transparent way of pricing compared with Wise ❌ No cash, cards, checks or bank drafts are accepted – payments by bank transfer only |

3. Remitly – Send small transfers to South America, Asia and Africa

Summary: Similar to Wise, Remitly is a company that was born online and has grown rapidly. Unlike Wise, however, they specialize in sending smaller transfers amounts or remittances to countries which are mainly in South America, Asia and Africa. Check out this Remitly review before you arrange your payment.

Best Features

Remitly offer to send your money “Express” which is faster, but comes with a higher fee or “Economy” which is cheaper, but can be slower. Like Wise, their site is easy to use and their fees, exchange rates and services are clear at each step of the way when making a transfer.

| Pros of Remitly | Cons of Remitly |

|---|---|

| ✅ Very easy to make a transfer ✅ Great range of payout options ✅ 24/7 customer support online or over the phone | ❌ Services vary by destination, and mainly cover common remittance routes ❌ Maximum transfer sizes apply |

4. MoneyGram – Convenient cash collection

Summary: MoneyGram is the second largest money transfer service in the world, after Western Union. Chances are that you’ve seen their logo in one of your go-to stores such as 7-Eleven, Walmart and the Post Office. With over 380,000 locations, MoneyGram offers in-person cash collection of money transfers around the world, as well as payments to bank accounts and mobile wallets. Read our MoneyGram review to learn more.

Best Features

Arrange your payment online or in the MoneyGram app – or choose to pay in cash at an agent location if that’s more convenient for you. MoneyGram’s key strength is probably its extensive agent network in the US and around the world – making this a good way to get money to someone fast even if they can’t access a bank account or ATM.

| Pros of MoneyGram | Cons of MoneyGram |

|---|---|

| ✅ Send money quickly to family and friends around the globe ✅ Fast and reliable money transfers ✅ Easy and convenient – available 24/7 | ❌ Services can be on the pricier side ❌ Exchange rates include a markup on the mid-market rate |

5. PayPal – Instant worldwide transfers

Summary: PayPal is one of the world’s most popular payment systems to purchase goods and pay for services. It is a convenient way to transfer money to people in the same country and internationally, if they also have an active PayPal account.

PayPal transfers are pretty much instant. However, Wise will generally have more straightforward fees – and can be cheaper – than PayPal for cross border transfers. Learn more about how PayPal works.

Best Features

Convenient and fast transfers to family and friends all over the world – you don’t even need to know their bank account number to get started.

| Pros of PayPal | Cons of PayPal |

|---|---|

| ✅ Accept a variety of payment methods ✅ Send money to people using just an email address or phone number ✅ If you’ve used PayPal before, the process is very straightforward | ❌ Good for sending money within the same country, but can be expensive internationally. ❌ Several fees can apply to a single transaction, including a transfer fee and currency conversion charge |

Comparing money transfer apps like Wise

So – now we’ve introduced our Wise alternatives, let’s compare each international money transfer app with Wise, to see which may work for you.

Xe Money Transfer vs Wise

You can send money with Xe to pretty much any country in the world, to be deposited into the recipient’s bank account for convenience. There’s no Xe fee to pay, aside from a markup that’s added into the exchange rate used to convert your dollars to the currency you need. If Wise doesn’t support the country you’re sending to, it’s well worth seeing if Xe can help.

Get a full Wise vs Xe Money Transfer comparison here.

OFX vs Wise

OFX has a slightly different range of services compared to Wise – including currency risk management solutions for individuals and businesses. If this is what you’re looking for – or if you simply want to talk through your payment with a broker before you get started, OFX may be a good fit.

Learn more about Wise vs OFX in this guide.

Remitly vs Wise

Remitly might be a good Wise alternative if you’re looking to send money instantly to be collected in cash at an agent location near to your recipient. Remitly has a couple of different service options which can also be handy – including lower cost economy payments and faster express services, so you can pick the one you need most.

More on how Wise vs Remitly compare here.

MoneyGram vs Wise

MoneyGram is another money transfer service with a truly impressive range of services, spanning pretty much the entire globe. If you want to pay for your transfer in cash, MoneyGram could be a good choice as a Wise alternative – it’s also worth looking at if Wise doesn’t support the country you’re sending to, as MoneyGram has more or less the whole world covered.

There’s more on Wise vs MoneyGram in this guide.

PayPal vs Wise

PayPal lets you send money instantly to other PayPal accounts around the world, with just an email address or phone number. If the person you’re sending money to is already active on PayPal, and convenience and speed is the most important thing for you, PayPal could be a viable Wise alternative to pick.

Still not sure? Get this Wise vs PayPal comparison guide.

Conclusion: Wise Alternatives

When it comes to sending an international transfer, you’ve got options. Wise is known for having great rates and low, transparent fees – but comparing a few apps like Wise before you make your payment is still a good idea. That way you’ll always know you’re getting the best possible deal for your international money transfer.

Use this guide as a jumping off point to research different services like Wise, and pick the perfect fit for your needs.

FAQs on Alternatives to Wise Money Transfer

What is the best company to transfer money internationally?

Using a specialist provider can be cheaper than sending an international payment with your normal bank. However, services, coverage, fees and rates do vary between providers, so comparing a few is a smart move. Use this guide to get your research started and find the best available deal for your transfer.

Which is the best multi currency account?

Many specialist online and mobile services which offer international transfers also have multi currency account products for individuals or businesses. Check out the Wise multi-currency account, or the OFX Global Currency Account for online sellers to get some ideas about which might work for you.

What is the cheapest way to send money internationally?

Comparing a few different online and mobile specialist services will make sure you get the cheapest available international transfer, and beat bad exchange rates and high bank fees.

Sources: