Bank of America Foreign Currency Account Alternatives [2026]

Bank of America does not offer a foreign currency account – or any multi currency accounts – for personal customers in the US. The promoted personal accounts on offer from Bank of America are designed to hold USD only, and while you can still spend with a card overseas, or send money to others abroad, fees are likely to apply for these services.

If you need a foreign currency account – or a multi-currency account for spending, holding, receiving or sending money overseas, we’ve got some great alternatives for you, like Wise, Revolut and OFX.

Quick summary: Bank of America multi currency account alternatives

| Alternatives | Great for: |

|---|---|

| Wise Account | Extensive international features covering 40+ currencies for holding and exchange, low-cost ways to receive payments with local account details, and a linked debit card. Currency conversion uses the mid-market rate. |

| Revolut Account | Several different account tiers which support 25+ currencies, with linked debit cards, some no fee conversion monthly, and extra perks for premium accounts like travel benefits and priority service |

| OFX Global Currency Account | Business accounts for receiving, holding and exchanging 7 major currencies, ideal for getting paid by customers, PSPs and marketplace sites |

| HSBC Global Money Account | Holding and exchanging 6 major currencies through the HSBC app, with preferential rates |

Does Bank of America have a multi-currency account?

No. Bank of America does not promote any multi-currency accounts or foreign currency accounts to personal customers.

Business, corporate or enterprise level customers may find some foreign currency options around treasury management – but account options for individuals are designed to manage USD only.

A multi-currency account can help you cut costs if you transact in foreign currencies regularly.

While your bank may not have many solutions for you, alternative providers are available, including Wise and Revolut:

- Wise accounts support 40+ currencies for holding and exchange, and have a linked debit card option for low cost spending and withdrawals. Currency conversion uses the mid-market rate.

- Revolut accounts support 25+ currencies, with a debit card, some no fee conversion monthly, and lots of other account features. More on both, coming right up.

Bank of America foreign currency account alternatives

Bank of America may not be able help you if you want a personal foreign currency account. But there are plenty of great Bank of America alternatives out there.

We’ve highlighted a few here – Wise, Revolut and OFX as alternative options, and HSBC as a global bank which has some foreign currency services available for personal customers in the US.

Here’s a summary on features, fees and more:

| Wise | Revolut | OFX | HSBC | |

|---|---|---|---|---|

| Availability | For personal and business customers | For personal and business customers | For business customers | For personal customers |

| Eligibility | Available for residents in supported countries | Available for residents in supported countries | Available for business owners and online sellers in supported countries | Available for existing HSBC customers |

| Currencies supported | 40+ currencies | 25+ currencies | 7 currencies | 6 currencies |

| Account fees | No ongoing fees | 0 USD – 16.99 USD/month | No ongoing fees | No ongoing fees |

| Linked debit card | Physical and virtual cards available for spending and withdrawals | Physical and virtual cards available for spending and withdrawals | Not available | Not available |

| Best features | 40+ currencies supported for holding and exchange Mid-market exchange rates | 25+ currencies supported for holding and exchange Choose from several different account types | Business and online sellers can open accounts instantly No ongoing account fees | No additional HSBC account management fee Accounts support 6 currencies |

Specialist providers like Wise and Revolut may offer lower fees and better exchange rates compared to the few multi-currency or foreign currency accounts you can find from US banks. However, as all providers offer good features with their own advantages, you’ll need to do some research to find the one which suits you best. We’ve got a bit more details about each of the providers featured here, coming up next.

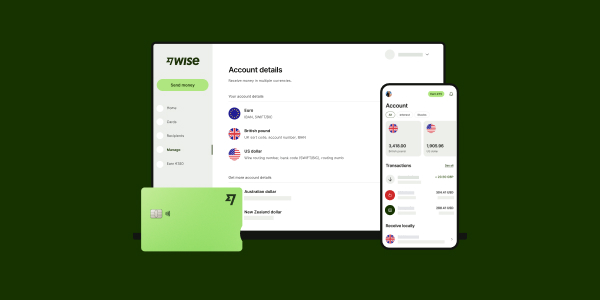

Wise multi currency account

You can open the Wise account as a personal or business customer in the US, to hold and exchange 40+ currencies, and receive payments in 8+ currencies with local account details.

You’ll also be able to get a linked debit card for spending in store or online, and cash withdrawals, making this a good choice for travelers and anyone looking to hold money, send and receive payments in foreign currencies.

Currency exchange uses the mid-market rate and low conversion fees from 0.33%. Wise Multi-Currency Cards don’t have foreign transaction fees.

Currencies supported: 40+ including AUD, EUR, GBP, HKD and SGD

Local account details: Available in 8+ select currencies

Account & card fees: No fee to open or maintain account, currency exchange from 0.33%; one time fee for card order, then no ongoing fee. Learn more on Wise fees here.

Exchange rates: Mid-market exchange rate

Debit card: Available

| Wise account pros | Wise account cons |

|---|---|

| ✅ 40+ currencies supported for holding and exchange ✅ Mid-market exchange rates ✅ Ways to receive, send and spend currencies conveniently ✅ No ongoing account fees ✅ Some free monthly ATM use

| ❌ Currency conversion costs from 0.33% ❌ Some transaction fees apply, depending on account use ❌ No branch network |

Learn more: Wise Account Review

If you are not sure which Wise account would be the best for your needs, these comparison guide might help you: Wise personal vs business account.

Revolut multi currency account

Revolut US has a selection of accounts including some with no ongoing fees. Other products have a monthly charge but get extra discounts on services like international transfers, and also perks like lounge access and travel extras. All accounts offer a linked debit card for spending and withdrawals, and some no fee weekday currency exchange which uses the Revolut exchange rate, before fair usage fees apply.

Currencies supported: 25+ including AUD, EUR, GBP, HKD and SGD

Local account details: Not specified – you can get SWIFT details for select currencies

Account & card fees: 0 USD to 16.99 USD monthly fees, other transaction fees apply including international payments fees of up to 5%

Exchange rates: Revolut rate on weekday conversion to plan limit, 0.5% fair usage fees, 1% out of hours fees

Debit card: Available

| Revolut account pros | Revolut account cons |

|---|---|

| ✅ 25+ currencies supported for holding and exchange ✅ Choose from several different account types ✅ All accounts have some no fee features and services ✅ Top tier accounts get lots of extras and higher no-fee transaction limits ✅ Budgeting and saving tools provided | ❌ Ongoing fees apply for higher tier accounts ❌ Out of hours and fair usage fees may apply on currency exchange ❌ Transaction fees apply once any no-fee transaction limit is exhausted |

OFX

If you’re looking for a multi-currency account for your business or as an online seller, the OFX Global Currency Account may be a good bet. Accounts support 7 major currencies and you can switch between them in the app or online. OFX also offers payments overseas in 50+ currencies, no ongoing fees, a 24/7 phone service, and more complex currency risk management products.

Currencies supported: 7 including AUD, EUR, GBP, HKD and SGD

Local account details: Available for 7 currencies

Account & card fees: No maintenance fees, often no transfer fees. Card not available

Exchange rates: Rates which may include a markup

Debit card: Not available

| OFX pros | OFX cons |

|---|---|

| ✅ Business and online sellers can open accounts instantly ✅ No ongoing account fees ✅ Receive, exchange and send foreign currency payments ✅ Overseas transfers may have no transfer fee | ❌ Exchange rates include a markup ❌ No debit card |

HSBC Global Money account

HSBC US account holders can also apply for an app-based Global Money account which is helpful if you need to transfer in and out from HSBC accounts in select foreign currencies. Your Global Money Account can hold 6 currencies and currency conversion uses the HSBC exchange rate. Use your account to send money overseas to other HSBC accounts, or to save in a foreign currency for future spending needs.

Currencies supported: 6 including AUD, EUR, GBP, HKD and SGD

Local account details: Not specified – transfer in from your linked HSBC account

Account & card fees: No additional maintenance fees for this account, but you may pay monthly fees on your HSBC USD account – transfer charges might apply

Exchange rates: HSBC rates which may include a markup

Debit card: Not available

| HSBC account pros | HSBC account cons |

|---|---|

| ✅ No additional HSBC account management fee ✅ Fully in app management tools ✅ Accounts support 6 currencies ✅ Preferential exchange rates offered ✅ Service from a global bank with a full suite of other international products | ❌ For HSBC existing customers only – open an eligible HSBC account to apply ❌ Exchange rates include a markup ❌ Best for transferring to other HSBC accounts |

How to open a foreign currency account with Bank of America

Bank of America doesn’t offer foreign currency accounts for personal accounts. If you have a business, corporate or enterprise level account, you might find some foreign currency options with treasury management services – but account options for individuals are designed to manage USD only.

If you want to open a foreign currency or multi currency account in the US, our guide might be helpful: How to open a foreign currency account in the US.

We also have guides on foreign currency accounts for:

- Best Australian dollar accounts 🇦🇺

- Best Canadian dollar accounts 🇨🇦

- Best Euro accounts in the US 🇪🇺

- Best GBP account in the US

- Best GBP business accounts

- Best CAD business accounts 🇨🇦

- Best Euro business accounts 🇪🇺

Conclusion: Bank of America Foreign Currency Account Alternatives

Bank of America does not offer any foreign currency account services for personal customers.

Instead, consider a Bank of America alternative like Wise, Revolut or OFX. Wise and Revolut serve both personal and business customers in the US, while OFX is a specialist in business account products. Wise supports 40+ currencies with currency conversion that uses the mid-market exchange rate; Revolut has several different account tiers to suit different customers, all with 25+ currencies – and OFX lets businesses and online sellers get paid in 7 major currencies from customers, PSPs and marketplaces.

Use this guide to learn more about your options and pick the perfect one for you.

BofA foreign currency accounts FAQs

Does Bank of America offer foreign currency accounts?

No. Bank of America does not offer any foreign currency account services for personal customers.

Can I deposit foreign currency into my Bank of America account?

No. Bank of America personal accounts are designed to hold and accept deposits in USD only. If you’re sent a payment from abroad in another currency it will be converted to USD before being deposited to your account. This can mean paying fees.

If you’re looking to buy foreign currencies from BofA, this guide might help: Bank of America foreign currency exchange.

Does Bank of America have foreign transaction fees?

Yes. While different accounts may have their own terms and conditions, the normal foreign transaction fee with Bank of America is 3%.

Learn more: Does Bank of America have foreign transaction fees?

Can I access my Bank of America account overseas?

You will retain access to your online and mobile banking when you’re abroad. Make sure the bank has your accurate contact information so they can get in touch if there are ever any issues with your account.