AUD card in the US: What are the options? [2026]

If you’re planning a trip to Australia you might be wondering about the best way to get an AUD card before you head off to make it easier and cheaper to spend Australian dollars while you’re away. Using an AUD card can also help you manage your travel money budget and access better exchange rates – but which AUD cards are best to pick?

This guide walks through all you need to know, including a look at how AUD cards from providers like Wise and Revolut can help you get a better deal on your overseas spending.

What is an AUD card? 🇦🇺

An AUD card is a card that can be used conveniently for spending and withdrawals in Australian dollars. In the US, customers have a couple of distinct options – multi-currency cards which come with other currencies available aside from just AUD, or travel debit and credit cards which are optimized for overseas use.

With multi-currency cards you’ll be able to top up your account in USD or the currency of your choice based on the specific provider’s options, and convert to Australian dollars before you travel or simply buy Australian dollars. That means you can plan your budget in advance, and lock in exchange rates before spending.

With other travel optimized cards, you’ll be able to view your account online or with your phone, and may access preferential exchange rates, rewards when you spend internationally, or low foreign transaction fees.

What is an AUD card good for?

Getting an AUD card is a great bet if you’re headed to Australia for work or leisure.

It can make it safer for spending while you’re away as you won’t need to carry a lot of cash – and your travel money account isn’t linked to your regular bank account so even if you were unlucky enough to have your card stolen, the thieves won’t have access to your main USD funds.

Using an AUD card while you’re away can also cut the costs of currency conversion, and allow you to get a better exchange rate. With some cards like the Wise and Revolut cards, you’ll be able to add money in USD and switch to Australian dollars when you spot a good rate – often with no markup rolled into the exchange rate used.

Pros and cons of AUD card

Pros:

- Cards can often be used for AUD and a range of other currencies

- Some providers offer preferential exchange rates to card holders

- Using a travel money card when you’re abroad can be safer than relying on cash or your normal card

- It’s usually free to spend currencies you hold in your account

- You can avoid currency exchange stores and simply make cash withdrawals on arrival in your destination

Cons:

- Different accounts come with their own fees which can include monthly charges or currency conversion costs

- Foreign transaction fees may apply if your card doesn’t support AUD

- Topping up your card might incur a fee, depending on how you make your payment

5 best AUD cards in the US

The good news is that there’s a pretty wide choice of AUD cards you can get from the US. Let’s look at our top 5 picks so you can decide which is right for you.

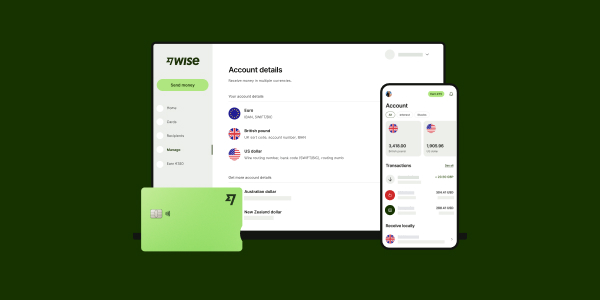

Wise

Open your Wise account online or in-app, to hold and exchange 40+ currencies. Order your Wise Multi-Currency Card for a low one time fee, and top up for free in USD. Then convert to AUD using the mid-market rate and low, transparent fees for simple spending when you travel.

You can get local account details for up to 9 currencies to get paid easily to your Wise account, and you can also send payments to 70+ countries with Wise money transfer.

Pros:

- Currency conversion fees from 0.43%, with the mid-market rate

- Convert in advance or let the card automatically switch to Australian dollars as and when required

- No monthly fees or minimum balance

Cons:

- Some transaction fees apply, including ATM fees once you’ve exhausted your fee free allowance

- No cash top up options

Read our Wise Multi-Currency Card review to learn more.

Revolut

You can open a free Revolut account or choose to upgrade to an account with more features, for a monthly fee of up to 16.99 USD. All accounts come with the option to hold and exchange AUD, and linked physical and virtual cards for easy spending.

Depending on the account you hold you can get some fee free currency conversion, too, with relatively low fees once your plan allowance is exhausted – 0.5% in most cases. A couple of other charges might apply, including an out of hours conversion fee of 1% which you’ll want to watch out for.

Pros:

- Choose the account plan that suits your needs

- All accounts have some fee free currency conversion

- Physical and virtual card options

Cons:

- Fees apply for the most feature packed account tiers

- Out of hours fees of 1% apply when converting currencies at night and at the weekend

Bluebird American Express prepaid debit card

You can order a Bluebird prepaid debit card for free online. You’ll then be able to top up in cash or from a bank account. You can also add checks or have funds deposited by others – fees apply for some top up methods. While this card doesn’t allow you to hold foreign currencies, you won’t pay a foreign transaction fee to spend your USD balance abroad, which makes it a good choice when you’re in Australia.

Pros:

- Get a card for free by ordering online

- Top up in a range of ways in USD

- No foreign transaction fee when spending overseas

Cons:

- ATM withdrawal fees of 2.5 USD or the equivalent when overseas

- American Express cards are not always accepted internationally – check coverage before you travel

Capital One Venture Rewards

The Capital One Venture Rewards card has no foreign transaction fees when you spend overseas. There’s also a comparatively low cash advance fee when you use an ATM, at 3 USD or 3% whichever is higher. You’ll need to repay your bill in full every month to avoid fees and interest, but can earn travel rewards and miles on your day to day spending.

Pros:

- No foreign transaction fee

- Earn travel rewards on spending

- Get extras like lounge access and free travel insurance

Cons:

- Variable interest rates which apply if you don’t pay off your bill in full

- 95 USD annual fee, and a 3 USD or 3% cash advance fee – whichever is higher

Where can I use an AUD card?

A currency card allows you to pay in the local currency when you travel, without incurring extra costs. A multi-currency AUD card is perfect if you’re headed off to Australia, as you can top up in USD and switch over to AUD in advance so you know your budget in the local currency. Some cards also offer the option to convert at the point of payment, which means you don’t need to worry about getting set up in advance.

If you’d prefer a credit card like the Capital One Venture Rewards card, or a prepaid card like the Bluebird American Express prepaid card, you can’t switch over to AUD in advance of travel – but there’s no foreign transaction fee when you spend in Australia. That can mean it’s still cheaper than using a standard bank card.

AUD card in the US

All of the AUD cards we have profiled above can be used in the US too. If you have an AUD balance, but don’t hold a USD balance in your account, and you use your multi-currency AUD card here at home, you might pay a conversion fee to switch back from Australian dollars to US dollars.

With multi-currency accounts, you can open a bank account in Australia. With Wise account, you can open an AUD balance, get local account details in Australia, hold and exchange AUD in your account.

Costs of getting an AUD card in the US

Each provider will have their own fees for AUD cards – which can vary pretty widely. It’s important to review the costs in detail before you pick a card as the charges applied may be quite different to using a regular debit card. You might find fees to top up, for example, and different charges for spending and withdrawing in different currencies.

AUD card fees

Here’s an overview of the fees applied on the AUD cards we picked out earlier, to give you a bit of a picture. Other charges may also apply, so do check out the provider you’re choosing carefully.

| Provider/Service | Wise | Revolut | Bluebird | Capital One |

|---|---|---|---|---|

| Get a card | 9 USD | No extra fee (monthly account fees may apply) | No fee | No fee |

| Add money | Free to add money in 10 currencies | Free from debit cards and bank accounts in the US (fees may apply for some other top up methods) | Free by bank transfer, and in cash at Family Dollar (fees may apply for some other top up methods) | Not applicable |

| Account maintenance fee | None | 0 USD – 16.99 USD/month depending on tier | None | 95 USD annual fee |

| Spend in AUD | Free to spend currency you hold Convert currencies from 0.43% | Free to spend currency you hold Some fee free currency exchange to plan limits, 0.5% fair usage fee after that | No foreign transaction fee – network rates will apply | No foreign transaction fee – network rates will apply |

| ATM withdrawal* | First 2 withdrawals, up to the total value of 100 USD in a month for no fee, 1.5 USD + 2% after that | Standard accounts: 1,200 USD/month free, 2% after that | 2.5 USD | 3 USD or 3%, whichever is greater |

*ATM operators might charge their own fees

What exchange rate will be used?

You’ll likely need to convert currencies at some point when you use your AUD card, so the exchange rate you get matters. If you top up in USD and convert to AUD, either before you spend, or at the point of making a purchase, getting a bad rate will mean everything is more expensive in the end. Different providers have their own approaches to calculating the exchange rate.

Wise exchange rate: Wise offers mid-market rates, and has a transparent fee which is split out, starting from 0.43%, for example.

Revolut account holders can all convert some funds fee free, but the amount you can convert might be limited depending on your account tier. Once you’ve exhausted your allowance you’ll pay a fair usage fee of 0.5%, plus 1% out of hours costs if relevant. Other providers may take a different approach, adding a markup or foreign transaction fee when you convert or spend in a foreign currency.

How to get an AUD card in the US

All the providers we’ve looked at above allow you to order an AUD card online or through an app. You’ll usually need to have a suitable form of ID to get your card – a passport or driving license for example, and you might be asked to provide your proof of address as well. Once you’ve ordered your card it’ll arrive in the post shortly after.

Check out the AUD card order process for the provider you prefer, so you can prepare everything that’s needed.

Related: How to get a Wise Multi-Currency Card

Our other guides from this series:

Conclusion: What is the best card to use for Australian Dollar?

AUD cards are extremely useful for travelers – and can also be handy for people who shop online with retailers based in Australia.

With multi-currency cards you can get your AUD card in advance from the US, add USD and convert to Australian dollars so you’ve got your travel money sorted and can see and manage your budget easily.

Depending on the provider you pick you might also find you get better exchange rates and lower overall costs compared to using your standard bank card overseas. Options like Wise and Revolut offer easy ways to hold and convert dozens of currencies, to make travel cheaper and easier.

Australian Dollar card FAQ

What are the benefits of using an AUD card?

Using an AUD card when you’re in Australia can mean you get a better exchange rate and lower overall fees. With multi-currency AUD cards you can convert USD to AUD in advance, so you’ll also be able to manage your budget in Australian dollars easily.

Are AUD cards available in the US?

Yes. You can get a travel optimized card from a credit card company like Capital One, a prepaid card such as the Bluebird American Express prepaid – or a multi-currency AUD card from a service like Wise or Revolut for a card and account that offers even more features.

How much does an AUD card cost?

Most AUD cards have low or no initial fees, but you’ll need to look at the transaction costs that apply when you use your card. These costs include fees for topping up, ATM withdrawal charges and inactivity or closure fees.