Best Euro account in the US 2026

A euro (EUR) account makes it easier to receive, hold and spend euros, while cutting the cost of switching between EUR and other currencies. Euro accounts can be handy for both individuals and businesses, helping them to save time and money when transacting across borders.

However, opening a euro account in the US isn’t always straightforward. Most US banks don’t offer personal EUR accounts, and the few that do often come with high costs and strict requirements. Online providers like Wise and Revolut offer a simpler, low-cost alternative.

In this article, we’ll walk through everything you need to know about opening a euro account, including the best Euro accounts in the US, the costs, and how to open one.

Euro account in the US: Key points

| 💡 Quick summary: Euro accounts | |

|---|---|

| 💻 Online accessibility | Many Euro accounts in the US are easily accessible online, allowing users to manage their finances from anywhere with internet access. |

| 💶 Local account details | Some Euro accounts, like Wise, offer local account details in Europe, enabling users to send and receive Euros as if they were locals living in the EU. |

| 💳 Linked debit card to spend in Euros | Many Euro accounts come with a linked debit card, making spending and withdrawing in Euros straightforward. |

| 🏦 Account fees | Wise and Revolut offer no-fee accounts with no opening or monthly maintenance fees. |

| 💱 Competitive exchange rates | Euro accounts generally provide competitive exchange rates and low conversion fees to make it worthwhile for those who make frequent transactions in Euros. |

What is a Euro account?

A euro account allows you to hold and exchange EUR, often alongside a selection of other currencies. A euro account can be useful for

- people who travel often and need to send or spend in EUR,

- people who shop with international e-commerce stores and pay in euros,

- individuals with recurring EUR payments like a mortgage on a vacation home.

Euro accounts are also handy for business owners with customers, contractors or suppliers in the Euro area, and freelancers and entrepreneurs who get paid by clients overseas. You’ll be able to

- collect payments from PSPs like Stripe and marketplaces like Amazon,

- and then hold your euro balance,

- withdraw to your local USD account

- or convert it to the currency you need.

How does a Euro account work?

| 🎯 Get the best out of your Euro bank account | |

|---|---|

| Hold and exchange money in euros | Keep a balance in EUR and convert to other currencies when you need to, often at more competitive rates than banks. |

| Receive payments using Euro local account details | Some accounts, like Wise, provide local EUR account details (IBAN) so clients or marketplaces in Europe can pay you as if you were based there. |

| Spend in Euros with linked debit card | Many providers offer a debit card connected to your EUR account, making it simple to spend or withdraw directly in euros. |

| Transfer funds to and from Europe | Use your euro account to send money to European suppliers, contractors or family, and withdraw back to your USD account when needed. |

| Save on fees | Avoid multiple currency conversions, cut international transfer costs, and choose the right moment to exchange euros to dollars. |

Can I open a Euro account in the US?

Unfortunately, many US banks don’t offer euro accounts for personal customers – they’re are usually for business customers only – and where they do they may be offered through an international banking subsidiary and have restrictive eligibility criteria. Online sellers, freelancers and small business owners might have the same challenge when it comes to getting a EUR bank account in the US.

If you’re looking for a flexible and low cost way to manage your money in euros and dollars side by side, a specialist provider like Wise or Revolut may suit you better. Both providers offer accounts for individuals and business customers alike, covering a selection of dozens of currencies. You can manage your account from your phone conveniently, and get a linked debit card for easy spending and withdrawals. With Wise you’ll also get EUR bank details to get paid like a local from anyone in the Euro area.

This guide will walk through some smart options whether you’re looking for the best EUR account in the US for yourself, your business or as a freelancer working across borders.

6 Best Euro accounts in the US

There’s not a huge choice of euro accounts available for US based customers. However, there are a few great providers with flexible, low cost accounts for individuals and businesses. Picking the best one for you will depend on your specific needs and the sort of transactions you’ll want to make. Here are a few options to consider:

| Provider | Availability | Account fees | Limits | Features to know |

|---|---|---|---|---|

| Wise | Personal and business customers | Personal accounts are free to open, with no monthly charges One time 31 USD payment for business account – no ongoing fees | No cash or check deposits. No credit or lending services | Multi-currency account with 40+ currencies Local account details for 8+ currencies Send payments to 140+ countries |

| Revolut | Personal and business customers | No-fee standard plan. Paid personal plans up to 16.99 USD/month, business up to 140 USD/month | Some features are restricted to higher-tier plans. Conversion fees apply beyond plan limits or out of hours | Personal and business accounts available in 25+ currencies Offers budgeting and saving tools |

| HSBC | Personal customers | No account opening fees No transfer fees – exchange rate markups will apply | Requires an HSBC Premier checking, Premier Savings, or Premier Relationship Savings account Limited to 8 currencies | Hold major currencies Mobile only account |

| OFX | Business customers | No fee to open or operate account Currency exchange rate markups might apply when converting currencies or sending international payments | Only available for business customers. No maximum amounts on transfers | Currency risk management products available No fee international transfers |

| Airwallex | Business customers | No fee to open a standard account. Currency conversion 0.5% above interbank for major currencies, 1% for others. | Only available for business customers. No cash deposits or ATM withdrawals | Accounts in 20+ currencies Free local transfer to 120+ countries Bulk payments and expense management tools |

| Wells Fargo | Corporate customers | Not disclosed | Not disclosed | Not available to personal or small business customers |

*About Wise pricing: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information. Information correct at the time of writing, 29th September 2025.

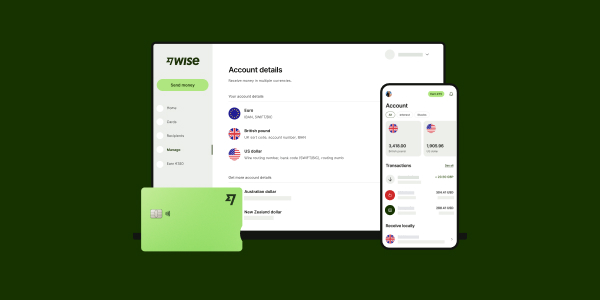

Wise account

| ⭐ Great for personal customers and businesses who need low-cost euro and multi-currency banking with transparent fees |

Wise personal and business customers can open international accounts to hold, send and spend euros as well as 40+ other currencies.

You’ll get your own account details for 20+ currencies including EUR, so you can receive payments conveniently from 30+ countries.

Both personal and business customers can get Wise Multi-Currency Card for everyday spending and ATM withdrawals at home and abroad.

| Features | 💡 Wise pricing and limits |

|---|---|

| Wise euro account fees | No fee to open a personal account. 31 USD one-off fee for a business account. No monthly or annual fees and no minimum balance. |

| Currency conversion | The mid-market exchange rate with transparent fees starting from 0.57%. |

| Receiving euro payments | Free to receive EUR via local account details (IBAN). Fees apply for receiving SWIFT payments in EUR or other currencies. |

| Wise limits | Per transfer: up to 1 million USD (personal and business) or up to 20 million EUR Nevada, American Samoa, Mariana Islands: stricter limits ($50,000 per transfer; $250,000 yearly). |

| ⭐ Great features | Hold and convert 40+ currencies. Local account details for 8+ currencies including EUR. Receive SWIFT payments in 20+ currencies. Send payments to 140+ countries. Spend in 150+ countries with the Wise Multi-Currency Card. |

⭐️ Learn more: Wise Euro account

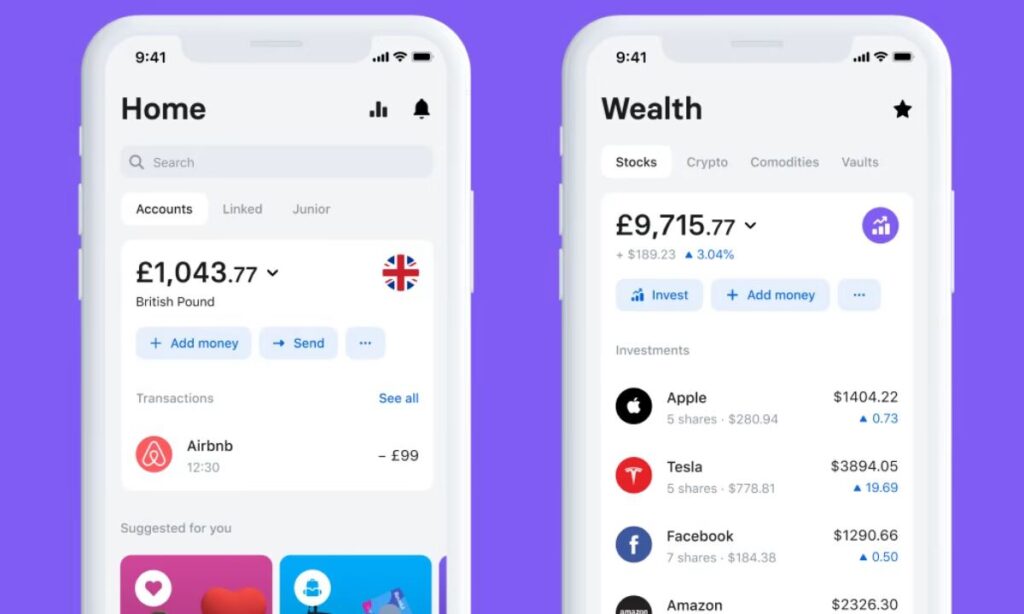

Revolut account

| ⭐ Great for personal and business customers who want flexible euro banking with budgeting tools and plan-based perks |

Revolut accounts can hold 25+ different currencies including euros, and are available for both personal and business customers. Choose a standard plan with no monthly fee or upgrade to a paid plan for more features and no-fee transactions. All Revolut plans come with a linked debit card you can use for cash withdrawals.

There are no fees for withdrawals from in-network ATMs, although the ATM operator may charge its own fee. For out-of-network ATMs, Revolut offers a monthly allowance before a 2% fee applies

| Features | 💡 Revolut pricing and limits |

|---|---|

| Revolut euro account fees | There are no monthly fees for the Standard plan. Paid personal plans up to 16.99 USD/month; business plans up to 140 USD/month |

| Currency conversion | Revoluts own rate within monthly fair-usage limit. After exceeding it (or during out-of-market hours), a 0.5% markup may apply. (Standard plan) |

| Receiving euro payments | SEPA Instant Credit Transfer limit of 100,000 EUR per incoming transfer |

| Revolut limits | US domestic wire: 50,000 USD per transfer; 200,000 USD cumulative per day. |

| ⭐ Great features | Hold 25+ currencies, budgeting and savings tools, plan-based benefits and a linked debit card |

HSBC US Global Money Account

| ⭐ Great for HSBC Premier customers who want a mobile-only account to hold and send euros alongside other major currencies. |

The HSBC Global Money Account is designed for personal customers who want to hold and convert multiple currencies, including euros, within a single account. Available through the HSBC U.S. Mobile Banking app, it supports 8 currencies (USD, EUR, GBP, CAD, AUD, NZD, SGD, HKD) and lets you send money internationally in 60+ currencies to over 200 countries and territories.

| Features | 💡 HSBC pricing and limits |

|---|---|

| HSBC euro account fees | No fees to open or send global transfers. Requires an HSBC Premier checking or savings account. |

| Currency conversion | Exchange rates are likely to include a markup. |

| Receiving euro payments | Can receive EUR using your HSBC Global Money IBAN. Incoming payments must be funded via your linked HSBC deposit account and there are no cash or check deposits |

| HSBC limits | Daily transfer limit up to 250,000 USD. Instant payments up to 50,000 USD to HSBC accounts. No withdrawals directly from the Global Money Account |

| ⭐ Great features | Hold 8 major currencies including EUR. Send money in 60+ currencies to 200+ countries. |

Learn more about HSBC Global Money Account here.

OFX Global Business Account

| ⭐ Great for international businesses, with 25+ currencies and no maximum transfer limits |

OFX is a specialist in currency exchange, currency risk management and international payments. If you’re an international business, OFX has a Global Business Account which lets you receive and spend in 25+ different currencies including euros. You can also access OFX’s currency risk management products like forward exchange contracts which can be used to lock in an exchange rate for a future payment.

| Features | 💡 OFX pricing and limits |

|---|---|

| OFX euro account fees | No fees to open an account, no ongoing fees for Standart plan. Other plans have varying monthly fees with different suite of features. OFX transfers and currency conversion has no upfront fees |

| Currency conversion | Exchange rates might include a markup, which may be smaller than a typical bank markup |

| Receiving euro payments | Receiving domestic transfers with certain payment methods is free. SWIFT payments have fixed fees. |

| OFX limits | No imposed maximum limit on international transfers. |

| ⭐ Great features | Supports 25+ currencies, currency risk management tools and 24/7 support. |

Airwallex

| ⭐ Great for US businesses that need a EUR account with local IBAN details plus multi-currency tools for global growth. |

Airwallex offers EUR Global Accounts for US businesses, with local IBAN details to make it easy to receive, hold, and send payments in euros. Accounts are business-only and sit within Airwallex’s multi-currency platform, which supports 20+ currencies. You can also issue debit cards to team members for expense management and cashback.

| Features | 💡 Airwallex pricing and limits |

|---|---|

| Airwallex euro account fees | No fee to open a standard account or 99 USD for the Grow plan. No ongoing monthly fees if you choose the standard account |

| Currency conversion | 0.5% above the interbank rate for major currencies. 1% for all other currencies. |

| Receiving euro payments | EUR Global Account comes with local IBAN details to receive payments from clients and platforms. Also supports SWIFT transfers in multiple currencies. |

| Airwallex limits | Transaction limits and availability vary by region and business profile. No ATM withdrawals supported. No cash deposits. |

| ⭐ Great features | Accounts in 20+ currencies. Free local transfers to 120+ countries and payouts to 130+ currencies, plus bulk payments and expense management tools |

US banks with Euro bank accounts

There are very few banks in the United States that offer their customers Euro accounts, but these tend to be more geared towards business customers rather than for personal use, and there aren’t many of them.

Major banks such as Wells Fargo provide accounts, primarily catering to businesses engaged in international trade or making frequent transactions within the Eurozone. Whereas, Bank of America doesn’t offer a Euro account or an account with multi-currency function. Only USD accounts can be opened with BoA.

However, it’s important to note that these Euro accounts frequently come with specific requirements, such as high minimum balances and other potential costs, making them less accessible or cost-effective for individuals or small businesses. So, while these accounts can be a great option for certain customers, they might not be suitable for everyone looking for Euro banking solutions in the US.

| Provider | Availability | Fees | Debit card | Other features |

| Wells Fargo accounts | Corporate customers | Not disclosed | Not disclosed | Not available to personal or small business customers |

| Chase (JPMorgan Commercial Banking) | Corporate and institutional clients via JPMorgan | Fees are customized | No standalone EUR balance for standard customers | Access to international FX, liquidity, payments, and global advisory |

*Information correct at the time of writing, 29th September 2025

Wells Fargo Corporate European Treasury Accounts

| ⭐ Great for large corporate clients that need treasury services in EUR and other currencies through US or UK accounts. |

Wells Fargo offers some EUR and other foreign currency services for corporate clients through its UK and EMEA offices, as well as US-based Foreign Currency Accounts. These services are not available for regular retail customers or small businesses. Corporate clients can open accounts in multiple currencies, make SEPA payments and collections, manage foreign receivables, and integrate with Wells Fargo’s global treasury platform for reporting and cash management.

| Features | 💡 Wells Fargo Corporate Treasury pricing and limits |

|---|---|

| Wells Fargo euro account fees | Contact Wells Fargo Corporate Treasury directly. Fees vary by client profile. |

| Currency conversion | Exchange rates include a markup; weekend premiums may apply. |

| Receiving payments | Incoming funds are credited directly in EUR without FX conversion. |

| Wells Fargo limits | Limits depend on the treasury setup and client profile. No published per-transaction limits. |

| ⭐ Great features | 28 currencies supported through US Foreign Currency Accounts. GBP, EUR, USD + 17 more via UK branch accounts. |

Chase (JPMorgan Commercial Banking)

| ⭐ Great for large corporate clients that need treasury services in EUR and other currencies through US or UK accounts. |

Chase itself doesn’t offer a standalone EUR account for US businesses. Instead, euro and other multi-currency services are provided through JPMorgan Commercial Banking, designed for corporate and institutional clients. Services are highly customized, with access to liquidity solutions, FX management, global payments, and international advisory across 100+ countries.

| Features | 💡 Chase (JPMorgan Commercial Banking) pricing and limits |

|---|---|

| Chase euro account fees | Contact Chase (JPMorgan Commerican Banking) directly. Fees aren’t publicly disclosed and likely vary by client profile |

| Currency conversion | Exchange rates and conversion costs are bespoke and client-specific |

| Receiving payments | Businesses can receive cross-border payments via JPMorgan’s global banking network |

| Chase limits | No published standard limits |

| ⭐ Great features | Global presence across 100+ countries, FX, liquidity, and payments solutions in 60+ currencies |

How to open a Euro account in the US

The process for opening a euro account in the US will depend a lot on the provider you prefer to use. As we have seen, few traditional banks in the US have euro accounts available – which may mean you prefer to use an online service. In this case, opening an account can usually be done easily online or on your mobile device.

Here are the basic steps you usually need to take to open a Euro account in the US:

- Choose the best provider for your needs

- Register for your account online, through the provider app, or in a branch

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

At some point in the process you’ll be asked to provide paperwork for verification and to check your ID and residential address. The exact documents you need to open a Euro account will vary depending on the account type, but can include:

- Government issued photo ID

- Proof of address – a utility bill or bank statement in your name for example

- Business registration documents if you’re opening a business account

How to open a euro account online

If you’re not a resident in Europe, you can still open a non-resident account online in Europe, with a specialist provider like Wise or Revolut. Let’s look at how you open a euro account with Wise as an easy example:

- Download the Wise app or open the Wise desktop site

- Register with your email, Facebook, Apple or Google ID

- Complete the verification step

- You’re ready to send or receive a transfer, order a card or add a balance

The verification step here is important to keep your account secure and comply with international laws. It’s pretty simple to complete this verification – in fact, all you need to do is follow the prompts to upload an image of:

- Proof of ID – like your passport, driving license or ID card

- Proof of address – like a utility bill or government letter in your name

If you’re opening a business account you may need to add some business information, too, but you’ll be guided through the process by prompts on screen and can also stop the process, save and return later if you’d prefer.

Euro account details

We mentioned that some providers offer local account details which work alongside their EUR accounts. One option – which we’ll cover in more detail later – is Wise.

To give an example of how this works, with Wise you’ll simply need to set up your Wise account online or in the Wise app to get local details for EUR and a selection of other currencies.

- Log into your account,

- tap Open and then Balance,

- You’ll see a list of currencies, including currencies with account details.

- From that list, select ‘Euro’

- Thats it, your Euro balance will be opened, and you can get your account details.

You’ll then be able to pull up local account details – like your IBAN and SWIFT/BIC code for euros – which you can share with someone who needs to send you a Euro payment.

Euro currency accounts with debit card

If you need an account to hold euros, and want to make it easier to spend your euro balance, you might want to consider opening an account with a provider like Wise or Revolut. You’ll get a debit card you can use to spend from your balance, so all you need to do is add money to your account in the currency of your choice, and get started spending euros right away.

- Wise account & card: Hold euros alongside 40+ other currencies, and spend any currency you hold for free with your linked Wise Multi-Currency Card. If you don’t have the currency you need, you can convert automatically with the mid-market rate and low fees from 0.57%

- Revolut account & card: Hold dozens of currencies and spend around the world with no-fee currency conversion to your plan limit. Once you exhaust your plan limit you’ll pay a fair usage fee of 0.5% for conversion, plus there may be out of hours fees to pay, depending on when you’re using your card

What are the advantages of a Euro bank account in the US?

If you get paid in euros, need to hold a EUR balance, or send money to Europe regularly you may benefit from a EUR account.

Being able to receive and hold foreign currencies can make it easier to manage fluctuations in the currency exchange rates. You’ll be able to hold your EUR balance if exchange rates deteriorate rather than being forced to convert it to USD immediately and lose out because of a bad exchange rate. And you can choose to buy euros for future use when the rates look good, and hold them in your account until you need them.

Having a euro denominated account can also make it easier to get paid by European customers or clients who would rather use their home currency. Maybe you’re a business owner, freelancer or contractor – give your EUR bank account details to clients and have them pay you with a local transfer. Or if you’re an online seller use your account to collect EUR payments from PSPs like Stripe and marketplaces like Amazon. You can then hold your balance in euros, or convert it to the currency you need using your preferred provider.

If you travel to Europe often, this guide can be helpful: Best ways to take money to Europe

Foreign currency bank accounts in the US for euro

A handful of major banks in the US do offer foreign currency accounts, but these are often aimed at high wealth individuals, business owners and corporate clients. An alternative is to open an account with a digital provider like Wise or Revolut.

Read about some of the best multi currency accounts in the US here. Here’s a quick summary of the providers we covered earlier, as a reminder:

- Wise account: Free to open a personal account, to hold 40+ currencies, and get a linked card to spend in 150+ countries. Currency exchange uses the mid-market rate and low fees from 0.57%

- Revolut account: Choose from a no-fee standard account or upgrade to an account with a monthly fee for more features. Currency exchange uses the mid-market rate to plan limits, subject to fair usage and out of hours fees

- HSBC Global Money Account: Hold 8 currencies, no fee to open an account. Manage your money through a mobile app – there’s no debit card, but you can send global transfers easily in a selection of currencies

- OFX Global Business Account: Business owners and freelancers can hold and exchange 25+ currencies, and receive payments from customers and platforms easily. Currency exchange uses a small markup on the mid-market rate

Do you need to send money between the US and Europe?

If you’re moving between the US and Europe, working abroad, or paying for expenses like property or family support, you may need to send money regularly between dollars and euros. The best provider for you depends on how much you send, how often, and whether you prioritize speed, low fees, or high transfer limits.

Here’s an overview of some popular options:

| 💰 Transfer fees | 💱 Exchange rates | 💡 Transfer limits | 🌎 Coverage | |

|---|---|---|---|---|

| Wise | Low fees starting from 0.57% | Mid-market rate | High – up to 1 million USD | Send money to 140+ countries |

| Xe | No transfer fee for sending USD to EUR to Germany (this varies depending on the currency, destination and payment method) | Markup on the exchange rate | 500,000 USD online For larger transfers with no upper limits contact Xe directly | Send to 190+ countries in over 130+ currencies |

| Currencyfair | 3 EUR flat fee | Markup on the exchange rate of around 0.53% | No stated upper limit | Send money to 150+ countries in 20+ currencies |

| OFX | No transfer fees for sending USD to EUR to Germany | Markup on the exchange rate | No maximum upper limit | Send money to 170+ countries and 50+ currencies |

| Remitly | No transfer fees (depends on send and receive countries and chosen transfer speed) | Includes a markup | Up to 100,000 USD | Send money across 100+ currencies to over 170 countries |

*Information correct at the time of writing, 29th September 2025. About Wise pricing: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.”

➡️ Summary: If you need to send money frequently between the US and Europe, watch out for hidden fees and poor exchange rates that can add up. Wise provides transparent mid-market pricing and high limits, while OFX, Xe and CurrencyFair also work well for larger transfers. Remitly may be better for smaller, personal payments.

Conclusion: What is the best Euro account in the US?

If you need to transact in euros frequently, a EUR account can save you time and money, and make it easier to ride out changes in the USD to EUR exchange rate. However, the main US banks don’t have a great range of euro accounts on offer – especially for personal customers.

The good news is that there are several great online providers which may be able to offer you the perfect EUR account, whether you’re a personal or business customer, freelancer or online seller. Use this guide to kickstart your research and find your perfect match.

Providers like Wise and Revolut can be a really good pick, depending on your needs. Wise lets you hold 40+ currencies including USD and EUR, and receive payments in 8+ currencies. You can also spend with your Wise Multi-Currency Card in 150+ countries.

Revolut lets you hold 25+ currencies, and upgrade to a fee paying account if you want full feature access – both are worth comparing to see if they fit your needs. Use this guide to kickstart your research and find your perfect match.

FAQs on Euro bank accounts

Can I open a EUR account in the US?

You can open a euro account in the US.However, many major banks don’t offer EUR accounts to personal customers, so you may find it easier and more convenient to use an online specialist service like those listed in this article.

Which US banks offer euro currency accounts?

Few US banks offer EUR accounts to personal customers. One to check out is HSBC, which has a mobile account that allows you to hold and exchange euros – otherwise, you might find your perfect fit with specialist providers like Wise and Revolut, for a flexible low cost account you can do more with.

Can a foreigner open a euro account in the US?

If you have a US residential address and a valid proof of ID you’ll be able to open a euro account with a major bank if you can find one that fits your needs – or with a specialist service like Wise or Revolut. Your nationality isn’t usually an issue when it comes to opening bank accounts – but for verification purposes you’ll usually need proof of ID and a local residential address.

How much does it cost to open a EUR account?

Many EUR accounts are free to open with low, or no ongoing fees. Use this guide to start your research to find the perfect EUR account for your needs.

Can a US citizen have a euro bank account?

Yes. A US citizen can open a euro bank account with a major bank or a specialist provider. Few US banks have euro accounts for personal customers, although businesses and corporate clients are better served. If you’re looking for an easy way to open an account to hold and exchange euros, check out specialist services like Wise and Revolut to see if they suit your needs.

If you need to open a bank account in a European country, these guides may be helpful:

- How to open a bank account in Spain

- How to open a bank account in Italy

- How to open a bank account in France

- How to open a bank account in the Netherlands

- How to open a bank account in Portugal

- How to open a bank account in Germany

- How to open a bank account in Ireland