Best International Business Accounts [2026]

Having a separate business account is essential to keep your personal and company finances apart – and may even be mandatory depending on the type of business entity you have. If you transact internationally – taking customer payments from overseas, or sending money to suppliers and contractors abroad for example – you might be interested in international business banking solutions to help you manage your business finances across currencies more easily.

This guide walks through your options for a couple of the best international business banks in the US, and because the best global business banking for you may not come from a bank at all, we’ll also look at some non-bank alternatives like Wise Business and Revolut Business.

Quick summary: Best bank accounts for international businesses

Wise Business Account: Hold and exchange 40+ currencies, with the mid-market exchange rate

Revolut Business Account: Choose the account tier to suit your business needs, to support holding a balance in 25 currencies

Airwallex Business Account: Get paid by local transfer from 13 countries, and hold 22 currencies – plus easy ways to take customer card payments globally

Bank of America Business Fundamentals: Business account for small businesses transacting internationally every now and again, from a major bank

Chase Business Checking: Open a basic account and upgrade if you need to, good for businesses sending higher value overseas payments

Best banks for international business

You can open a global business bank account with a local US or global bank, or you can choose an international business account from a non-bank provider. This guide will explore both options, including a look at Wise, Revolut and Airwallex as non-bank options, and 2 major US banks – BoA and Chase. First, an overview of the international business account options from each:

| Account name | Account fees | Currencies covered | Key features |

|---|---|---|---|

| Wise Business Account | 31 USD for full account access No ongoing fees | 40+ currencies for holding and exchange Receive payments with local details in 10 currencies | Mid-market exchange rates Multi-user access, batch payments, accounting integrations, powerful API |

| Revolut Business Account | 0 USD – 119 USD monthly fee depending on account selected | 25 currencies for holding and exchange Receive payments with local details in USD, and SWIFT payment details | Choose different account types according to your needs All accounts have some no fee currency conversion before fair usage fees |

| Airwallex Business Account | No account opening fee | 22 currencies for holding and exchange Receive payments with local details for 13 countries, and SWIFT details for 20 | Easy ways to accept card payments from customers No code options available Tailored packages offered |

| Bank of America Business Fundamentals | 16 USD a month | USD only | Checking account from a major bank Send and receive international transfers easily |

| Chase Business Checking | 15 USD a month | USD only | Checking account from a major bank Ways to have the monthly fee waived if you use your account frequently |

*All features and fees correct at time of writing – 27th February 2024

As you can see, the features and fees associated with different international business accounts can vary a lot.

- Business accounts from US banks usually allow a balance in USD only, but you can still receive and send international payments and spend overseas with a linked debit card in most cases.

- Online specialist alternatives like Wise and Revolut may be more flexible with multi-currency holding options, linked cards, instant overseas payments and some no-fee ATM withdrawals, for example.

Read on for more on each of the providers and banks we’ve selected above, to see if any suit your needs.

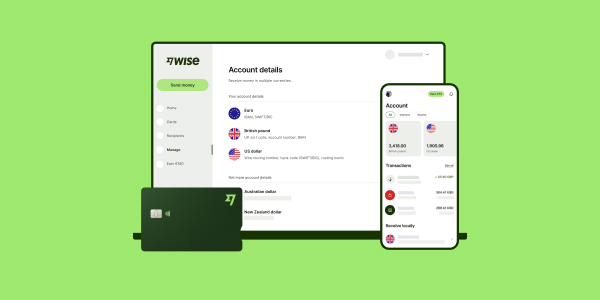

Wise Business account

🏅 Great for: Sole traders and business owners looking for flexible ways to hold, send, spend and receive multiple currencies with mid-market rates and low, transparent fees

Wise Business accounts can be opened online or in the Wise app and support 40+ currencies for holding and exchange. There’s a one time fee of 31 USD to get full account access, then no ongoing fees to worry about. Accounts offer ways to send money to 160+ countries, often instantly, with mid-market exchange rates and low fees from 0.42%, and local account details to get paid in 10 currencies conveniently by clients, PSPs and marketplaces.

Accounts offer: linked debit and expense cards for easy spending and withdrawals – plus batch payment solutions, multi-user access, cloud accounting integrations and a powerful API to streamline workflow and cut admin.

Eligibility: Available for sole traders and registered business owners in the US – if you’re not based in the US you may still be able to register a Wise Business account using your local documents wherever your business is based

Best features of Wise Business account

- 40+ supported currencies

- Mid-market exchange rates and low fees

- No ongoing costs or minimum balance requirements

| Advantages of Wise Business account | Disadvantages of Wise Business account |

|---|---|

| ✅ Powerful international features ✅ Mid-market exchange rates ✅ Transparent fees ✅ Time saving solutions like batch payments and cloud accounting integrations | ❌ No branch network ❌ Variable currency exchange costs |

Supported currencies: Hold and exchange 40+ currencies, get paid in 10 currencies internationally

Receive with local details: 🇦🇺 Australian dollars (AUD), 🇨🇦 Canadian dollars (CAD), 🇪🇺 Euros (EUR), 🇬🇧 British pounds (GBP), 🇭🇺 Hungarian forint (HUF), 🇳🇿 New Zealand dollars (NZD), 🇷🇴 Romanian Lei (RON), 🇸🇬 Singapore dollars (SGD), 🇹🇷 Turkish lira (TRY), 🇺🇸 US dollars (USD).

Hold and exchange: 40+ currencies including currencies listed above, as well as 🇨🇳 Chinese yuan (CNY), 🇭🇰 Hong Kong dollar (HKD), 🇮🇩 Indonesian rupiah (IDR), 🇮🇳 Indian rupee (INR), 🇯🇵 Japanese yen (JPY), 🇲🇽 Mexican peso (MXN), 🇲🇾 Malaysian ringgit (MYR), 🇵🇭 Philippine peso (PHP), 🇹🇭 Thai baht (THB),🇻🇳 Vietnamese dong (VND). Click here for the full list.

Read our Wise Business Review to learn more.

Revolut Business account

🏅 Great for: Business owners looking to hold and exchange 25 currencies, with an option to trade up to an account with monthly fees and extra features

Revolut Business accounts let you hold 25 currencies, and all account tiers offer a linked card for easy spending and withdrawals. There are 4 different account tiers for US businesses, from the Basic account which has no monthly fees, to tailor made account packages which might best suit enterprise level customers. This means you can choose the tier that suits your business needs today and trade up in future if you want to.

All Revolut accounts have some no fee weekday currency conversion, although the amount you can exchange before fair usage fees varies depending on the account tier you select.

Eligibility: Available for freelancers and registered business owners in the US – if you’re not based in the US you may still be able to register a Revolut Business account using your local documents wherever your business is based

Best features of Revolut Business account

- Different account tiers available, including some with no ongoing fees

- All accounts have linked payment cards and support 25 currencies

- Some no-fee weekday currency conversion available for all accounts

| Advantages of Revolut Business account | Disadvantages of Revolut Business account |

|---|---|

| ✅ Choose from 4 different account tiers ✅ Hold 25 currencies ✅ Some no fee currency conversion during the week ✅ All accounts have linked cards | ❌ Ongoing fees apply for full account features ❌ Transaction fees and fair usage fees may apply |

Supported currencies: Hold and exchange 25+ currencies

Hold and exchange: 25+ currencies including🇦🇺 Australian dollar (AUD), 🇨🇦 Canadian dollar (CAD), 🇨🇭 Swiss franc (CHF), 🇪🇺 Euro (EUR), 🇬🇧 British pound (GBP), 🇯🇵 Japanese yen (JPY), 🇲🇽 Mexican peso (MXN), 🇵🇭 Philippine peso (PHP), 🇸🇬 Singapore dollar (SGD), 🇹🇭 Thai baht (THB), 🇹🇷 Turkish lira (TRY), 🇺🇸 US dollar (USD). Click here for the full list.

Receive with local details: Accounts come with local details for USD, and SWIFT details for other currencies

Read our Revolut Business review to learn more.

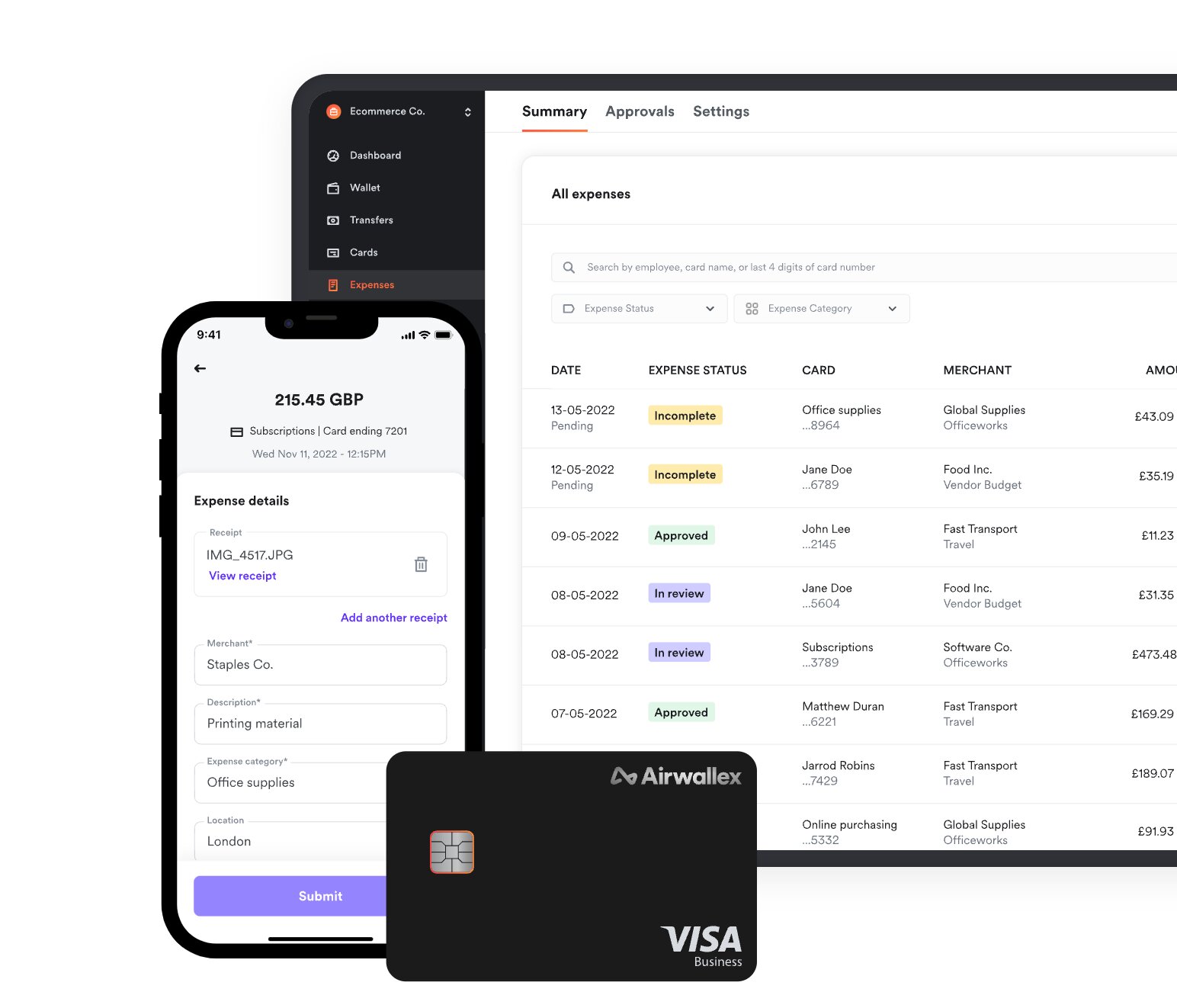

Airwallex Business account

🏅 Great for: ECommerce businesses needing to accept customer card payments globally, and hold a balance in any of the 22 supported currencies

Airwallex has global accounts, which have features that suit ecommerce businesses and others taking customer card payments online, as well as invoicing. Local and domestic card payments are available, as well as 160+ other local payment methods. You can hold 22 currencies and send money globally – if you need currency conversion you’ll pay an FX fee of 0.5% or 1% depending on the currency you need.

Airwallex accounts offer a pay as you go service – but you can also get a tailor made package if your business has more complex needs or you’d benefit from bulk discounts.

Eligibility: Available for businesses in the US – if you’re not based in the US you may still be able to register an Airwallex account using your local documents wherever your business is based

Best features of Airwallex Business account

- Hold 22 currencies

- Get paid by local transfer and SWIFT from overseas

- Take customer card payments conveniently online

Supported currencies: 22 supported currencies for holding and exchange, including 🇺🇸 USD, 🇬🇧 GBP, 🇪🇺 EUR, 🇦🇺 AUD, 🇨🇳 CNY, 🇭🇰 HKD, 🇨🇦 CAD.

Receive with local details: Receive local domestic payments from 13 countries, in a selection of currencies. Receive SWIFT payments from around 20 countries, in a selection of currencies.

| Advantages of Airwallex Business account | Disadvantages of Airwallex Business account |

|---|---|

| ✅ No ongoing account fees ✅ Hold multiple currencies ✅ Accept local and domestic card payments ✅ Send money overseas easily | ❌ No branch network ❌ Fees apply for most transaction types |

Learn more on Airwallex Business accounts.

Bank of America Business account

🏅 Great for: Businesses looking for an account from a US bank, receiving international payments fairly infrequently – ways to have monthly fee waived are available

Bank of America has several different business account options which you can select based on your business size and requirements. The Business Fundamentals account offers a checkbook and easy ways to send and receive international payments which can be helpful if you need to pay suppliers overseas. There’s a 15 USD fee to receive an incoming international payment though, so this account may not be ideal if you’re regularly paid from abroad. Accounts support USD balances only.

Eligibility: US registered business owners, minimum deposit requirements may apply

Best features of Bank of America Business account

- Branch network is available if you need in person help

- Accounts have helpful integrations to cut admin

- Send payments overseas with no upfront transfer fee

Supported currencies: Accounts hold USD only

| Advantages of Bank of America Business account | Disadvantages of Bank of America Business account |

|---|---|

| ✅ Branch network for face to face service ✅ Ways to have monthly fees waived if you maintain a minimum balance ✅ Send and receive international payments ✅ Upgrade to business accounts with more features if you need to | ❌ Monthly fees apply ❌ Transaction fees can be quite high |

Learn more on BoA business checking accounts.

Chase Business account

🏅 Great for: US businesses dealing mainly in US dollars, sending occasional larger overseas transfers to suppliers – fees are waived for transfers of 5,000 USD or more

Chase has several different business accounts which may suit businesses of different types and sizes. For small businesses, the Chase Business checking account lets you hold a balance in USD and send and receive overseas transfers. Incoming international wire fees apply, but the charge for sending a larger payment of 5,000 USD or more overseas online is waived.

Monthly fees apply, but these can also be waived if you use your account regularly enough.

Eligibility: US registered business owners, minimum deposit requirements may apply

Best features of Chase Business account

- No Chase fee to send a payment of 5,000 USD or more overseas

- Monthly fees may be waived if you transact regularly

- Branch and ATM network for easy access

Supported currencies: Accounts hold USD only

| Advantages of Chase Business account | Disadvantages of Chase Business account |

|---|---|

| ✅ Business account from a major US bank ✅ Send payments of 5,000 USD or more overseas with no Chase fee ✅ Receive international payments ✅ Upgrade to a Chase account with more features when your business grows | ❌Transaction fees apply ❌ Smaller overseas payments have transfer fees |

Learn more on Chase for Business.

Benefits of international business accounts

Having an international business account can help you connect more easily with customers based abroad, and can also help you cut costs of transacting in foreign currencies. Here are some of the benefits you might get from an overseas business bank account:

- Cut down the fees for international payments to suppliers and contractors

- Hold and exchange multiple currencies with good exchange rates and low fees

- Let your customers pay in their preferred currencies, even from abroad

- Get debit and expense cards for overseas spending and withdrawal

How to choose the best international business account in the US

There’s no single best international business account in the US, so picking the best for you will depend on the features you need.

Some business owners would prefer to stick with a bank which has a full suite of financial services like loans and overdrafts on offer, as well as a branch network to transact in person and deposit cash. However, international bank accounts for businesses do tend to have drawbacks, including transaction fees and no multi-currency holding facility.

Other businesses benefit more from the flexibility available from non-bank alternatives, which let you hold and receive dozens of currencies and manage your account with just a phone. Here are a couple of the features most business owners and freelancers need to consider when selecting the best international business account for their needs.

Multi-currency holding and exchange

If you’ll get paid by others in foreign currencies, and need to then pay taxes, suppliers or team members abroad, it makes sense to have an account which lets you hold a balance in foreign currencies to cut the costs of unnecessary currency conversion.

- Wise supports holding and exchange for 40+ currencies,

- Revolut has 25 supported currencies,

making both a good bet if this is important to you.

No ongoing fees

If you’re not sure how often you’ll use your account it’s a good idea to pick one with no monthly charges – ongoing fees eat into your profits, after all. Wise accounts have no monthly fees, and the business accounts profiled from Chase and BoA both also have relatively easy ways to have ongoing fees waived if you transact frequently or hold an account balance.

Easy ways to get paid from overseas

A final point for many business owners – looking for an account with ways to get paid in local currencies from customers, PSPs and marketplace sites can help you connect with new markets more easily. Let your customers pay in the currency they prefer, with accounts which offer local account details in foreign currencies, such as Wise and Airwallex.

Fees for international business accounts

The costs of operating your international business account are very important when it comes to protecting your profits. Different account providers and banks take different approaches to fees so you’ll need to look carefully at the account terms and conditions before you sign up. Pay attention especially to the types of transactions you make frequently to see if fees apply.

It’s also useful to note that banks like BoA and Chase may not charge a fee to send a foreign currency transfer – but they do add fees to the exchange rates used, which can be more expensive than other providers in the end.

Here’s an overview of some of the key costs of operating an international business account from the providers we featured earlier:

| Wise Business account | Revolut Business account | Airwallex Business account | Bank of America Business account | Chase Business account | |

|---|---|---|---|---|---|

| Open account fee | 31 USD | None | None | None | None |

| Monthly fee | None | Up to 119 USD | None | 16 USD | 15 USD |

| Send international payment fee | From 0.42% | Depends on account tier | Free for some currencies 15 USD – 25 USD for SWIFT payments | No fee for foreign currency payments | No fee for foreign currency payments |

| Receive international payment fee | Receive payments with local details for free USD wires: 4.14 USD incoming fee CAD SWIFT payments: 10 CAD fee | Receive payments in USD with local details for free | Receive payments with local details for free Fees apply to receive card payments | 15 USD | 15 USD |

| Currency conversion and exchange rate | Mid-market rates, exchange from 0.42% | Some no fee currency conversion for all accounts | Mid-market rates, exchange 0.5% – 1% | Exchange rates include a markup | Exchange rates include a markup |

*All features and fees correct at time of writing – 27th February 2024

How to open an international business account

The exact process to open an international business account will vary a lot depending on the provider or bank you select. Some offer online account opening, but with some banks you may need to call into a branch in person – check ahead to make sure you know what’s expected.

Here’s an outline of the usual steps to open an international business account:

- Choose the bank and account that you’d prefer

- Double check if you’re eligible to apply online – this is often an option, but not always

- Gather the documents needed, usually including ID and proof of address, and business documents

- Complete the application process online or in person at a branch

- Get verified and add money to your account

- You may be able to get your debit card instantly or you may need to have it delivered to your home later

All banks and financial service providers need to ask customers for documents and information for verification purposes when processing an account application. Exactly what information and documents you need will depend on your business entity type and structure.

The documents and information needed to open an international business account can include:

- Business location, industry, social media and web presence

- Business registration document or details

- Documents showing who owns or controls the company

- The names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business.

If you have a sole proprietorship, this guide can help you find the right account for your international business: Best business checking accounts for sole proprietors

Conclusion: What is the best bank for international business banking?

There’s not one single solution when it comes to the best international business banks out there – in fact, if you’re a US freelancer or business owner, you might find that the best international business account for you isn’t from a bank at all.

US banks do offer global business banking services, but generally you’ll only be able to hold a balance in USD, and you might find there are ongoing account charges. You’ll get the advantage of accessing a full suite of financial services from one provider – but there are drawbacks too, particularly when it comes to fees.

Use this guide to weigh up how best to open an overseas business bank account, including looking at international business banking solutions from non-bank alternatives like Wise and Revolut. Both offer powerful international accounts you can use to hold foreign currency balances, linked debit and expense cards, ways to send and receive global payments and low fees.

International business banking FAQs

What is the best business account for international payments?

There’s no single best international business bank for overseas payments. Both Chase and Bank of America offer some payments which waive transfer fees for business customers – but be aware that fees may be included in the exchange rate in the form of a markup. Compare bank solutions with non-bank alternatives like Wise and Revolut which offer overseas payments with great exchange rates and low costs.

How long does it take to open an international business account?

Opening an international business account with a digital provider can usually take just a few minutes, if you have the right documents to hand. Make sure you have your ID and proof of address, as well as your business paperwork with you, and you can usually apply with just your phone.

Related: How to open a business account in the US

Can I open an international business account online?

Yes. Digital non-bank services offer international business accounts you can open online or in an app, and many banks also offer this service for select customers. Check out Wise and Revolut, or Chase and Bank of America as examples, depending on which account type you’d like.

Learn more: How to open a business account online