Best International Money Transfer Apps Reviewed 2026

International money transfer apps allow you to send payments to friends, family and businesses all around the world, right from your phone or smart device.

There are plenty of international money transfer apps available to customers in the US. However, each has different features, fees, exchange rates and delivery times – comparing a few is the best way to find the right one for you.

Read on to learn more about the 5 best international money transfer apps for US customers.

Best international money transfer app in the US in 2026

Here’s a quick summary of the best online money transfer apps – and what we love about them:

All providers offer their services online, through their website, as well as Android and iOS apps.

We’ve picked these providers from customer review and rating data, from both the Apple App store and the Google Play store, as well as the services available, exchange rates and fees.

Ultimately which is best for you will depend on your specific needs – so use this guide as a starting point, to review and research your preferred apps a little further. We’ll cover more details on them, next.

Which app is best for international money transfer?

There’s no one best international money transfer app – different options suit different customer needs. Here’s a quick overview so you can pick the best one for your specific payment:

| App Name | Great for | Fees and exchange rates | Transfer speed | Transfer limits | Coverage |

|---|---|---|---|---|---|

| Remitly | Personal payments on popular remittance routes | Fees vary by destination and service chosen | Express payments can be instant, Economy payments may take a few days | Up to 30,000$ | Send from 21 countries, to up to 100 |

| Wise | Mid-market exchange rate with low fees, multi-currency accounts with 40+ currencies | Low fees from 0.43%. Transparent fee structure. Mid-market exchange rate. | Payments can be instant | 1 million GBP or equivalent for most currencies | Send to 160+ countries, in 40+ currencies |

| OFX | In app transfers plus phone service | No transfer fee, but exchange rate markups may apply | Most payments arrive within 24 hours | Usually no limits applied | Send in 50+ currencies |

| Western Union | Wide delivery coverage, offers cash collections | Fees vary by destination and service chosen | ‘Money in Minutes’ payments are almost instant, Bank deposits may take 1 – 2 days | 3,000 USD for unverified accounts, up to 50,000 USD for verified | Send almost anywhere in the world |

| Revolut | Low fee international transfers, multi-currency accounts with 25+ currencies | Usually switch a variable fee of 0.3% – 2%. Mid-market rate within plan limits. | Transfers to cards can take minutes, Bank deposits may take 3 – 5 days | No limits for most currencies | Hold 25+ currencies, send money almost all over the world |

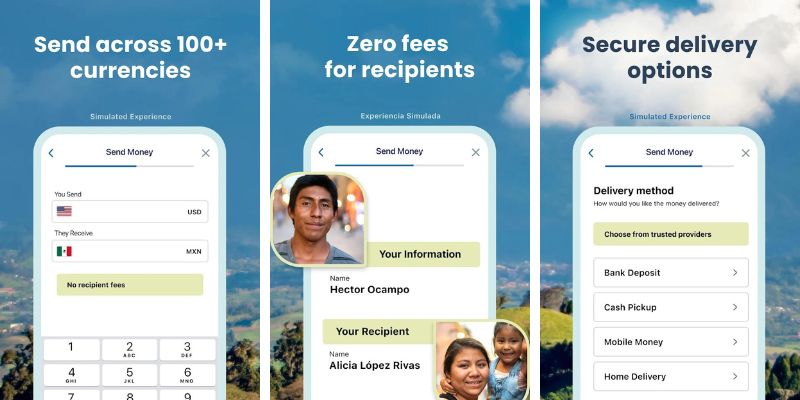

Remitly – wide range of payout options

💡 Great for: Remittances with a range of payout options on popular currency routes

- Fees and exchange rates: fees vary by destination country and service – exchange rates may include a markup

- Safety: registered and regulated by the appropriate bodies in all the countries served

- Speed: delivery times vary – express payments may be instant, while economy transfers can take a few days

- Transfer limits: Up to 30,000$

- Customer reviews: 4.8/5 rating on Play Store, from over 654,000 reviews; 4.9/5 rating on the App Store from 1.1 million+ reviews

Remitly payments can be made from 21 countries, to around 100 countries on popular remittance routes. Depending on the country you’re sending to you may be able to choose from bank deposits, cash collection, mobile money transfers or home delivery. Fees vary, but you can often select a faster Express service, or a cheaper Economy service depending on your preferences.

Remitly transfers are intended for personal use only. Limits apply based on your account tier, including maximum limits per day, 30 days and 180 days. Upgrade to the Tier 3 account by uploading your verification documents and providing more details about your payments, to send higher amounts.

Remitly offers simple international transfers from large global economies, on common remittance routes. It’s extremely popular with its users, and can be a great way to send money quickly – and with a low fee – to someone on the other side of the world, even if they don’t have access to a bank account. However, as you can’t make business payments, and Remitly payments can not be made from one send country to another, it’s not the perfect match for everyone.

Remitly pros and cons

| Remitly pros | Remitly cons |

|---|---|

|

|

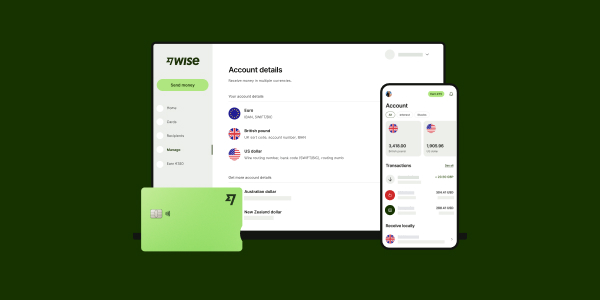

Wise – mid-market exchange rate with low fees

💡 Great for: Fast payments with the mid-market rate and no hidden fees

- Fees and exchange rates: mid-market exchange rate, and low transparent fees from 0.41%

- Safety: Fully regulated by many global regulatory bodies around the world

- Speed: 50%+ of transfers are instant, 90% arrive in 24 hours

- Transfer limits: High limits, set by currency, usually the equivalent of around 1 million GBP

- Customer reviews: 4.7/5 rating on Play Store, from 455,000+ reviews; 4.6/5 rating on the App Store from 29,100+ reviews

Wise offers international money transfers, and multi-currency accounts for personal and business customers. You can easily create an account online, and get verified through the Wise app to start.

You’ll be able to send payments to 160+ countries or in 50+ currencies, with the mid-market exchange rate and low, transparent transfer fees. Wise payments are delivered directly into the recipient’s bank account, so the recipient doesn’t need to have a Wise account to receive the payment.

If you’d like a Wise multi currency account you can open one online or in the app, to hold 40+ currencies, and receive payments like a local from 30+ countries. There’s a linked debit card for easy spending and withdrawals, too. There’s no monthly fee or minimum balance to pay, so you can just use your account as and when you need it for travel, shopping with international e-commerce retailers, or sending international payments.

Wise money transfers are typically quick, with more than 50% arriving instantly. You’ll see a delivery estimate in the app when you set up your payment, and can track the transfer in the app easily once it’s on its way. There are limits on the amount you can send per currency, but these are generally high – at around 1 million GBP or the equivalent in other currencies.

Wise pros and cons

| Wise pros | Wise cons |

|---|---|

|

|

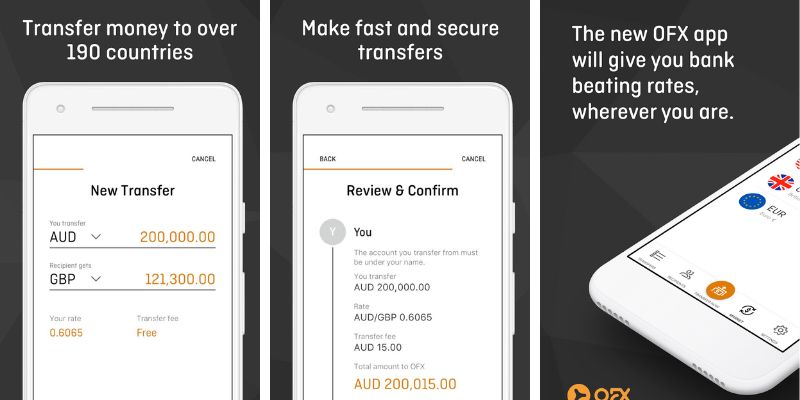

OFX – no transfer fees

💡 Great for: App payments where you can also speak to a team member easily if you’d like to

- Fees and exchange rates: no transfer fee applies – exchange rates may include a markup

- Safety: authorized and regulated everywhere that services are offered

- Speed: Usually delivered in 24 hours

- Transfer limits: Usually unlimited

- Customer reviews: 4.6/5 rating on Play Store, from over 3,600 reviews; 4.9/5 rating on the App Store from 2,300+ reviews

OFX is a currency specialist which offers international payments for individuals and businesses, alongside currency risk management solutions and multi-currency holding accounts for business customers.

The OFX app is fairly well rated, but with quite a low number of customer reviews – possibly because OFX also offers a 24/7 phone service which is one of their stand out features. This offers reassurance if you’re sending a high value transfer or if you want to talk through your options first and then send in the app a little later.

OFX transfers are usually uncapped, as the service is used by businesses sending high value payments as well as retail customers sending lower amounts.

OFX pros and cons

| OFX pros | OFX cons |

|---|---|

|

|

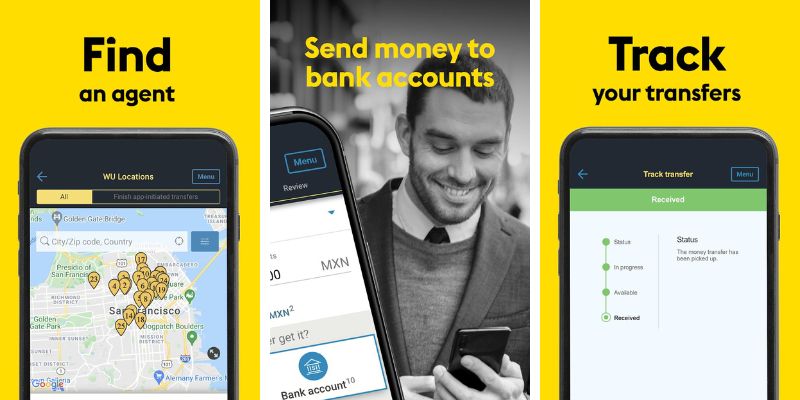

Western Union – wide global coverage

💡 Great for: Cash collection payments, thanks to its huge agent network around the world

- Fees and exchange rates: fees vary by destination country and service – exchange rates may include a markup

- Safety: authorized and regulated in the US and around the world

- Speed: cash collection payments can be available in minutes, bank deposits take up to 2 days

- Transfer limits: 3,000 USD initially, then up to 50,000 USD once you have verified your account

- Customer reviews: 4.6/5 rating on Play Store, from over 273,000 reviews; 4.8/5 rating on the App Store from 622,000+ reviews

Western Union is one of the world’s biggest money transfer companies, with services in person, online and through their app. You can make payments for cash collection, to bank accounts or to mobile wallets – and you can pay in the app by card or through a bank transfer to Western Union.

Western Union fees vary based on the service you want and the destination country. You’ll be able to see a quote and all your payment and delivery options in the app before you confirm. It’s good to know that the exchange rates can also vary based on the payment type, and will include an exchange rate markup.

You can send up to 3,000 USD with Western Union by registering an account with just your basic personal information. Once you’ve verified your account, you’ll be able to send up to 50,000 USD. Western Union advises you only make payments to people you know and trust – never send to anyone you don’t know, as transfers can not usually be reversed once they’re initiated.

Western Union pros and cons

| Western Union pros | Western Union cons |

|---|---|

|

|

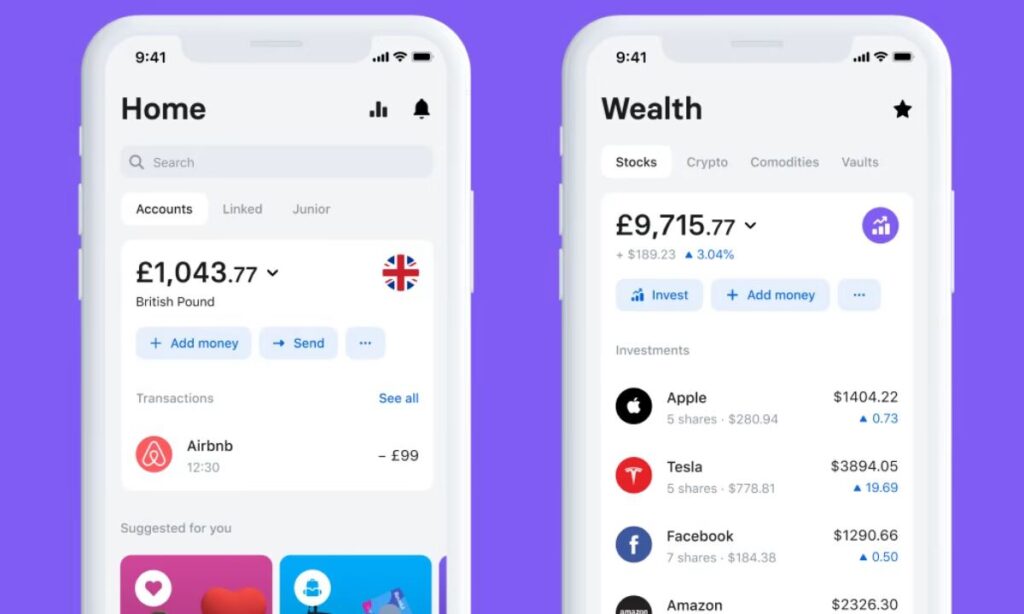

Revolut – account types to suit different customer needs

💡 Great for: Broad range of services including savings and investments

- Fees and exchange rates: exchange currency to your plan limit using the mid-market exchange rate and transfer with a variable fee

- Safety: Revolut is regulated and trades safely around the world

- Speed: transfers to cards usually take minutes, payments to bank accounts take 3 to 5 days

- Transfer limits: Varies by currency and payment type

- Customer reviews: 4.5/5 rating on Play Store, from over 2.3 million reviews; 4.7/5 rating on the App Store from 36,000+ reviews

With Revolut you’ll need to register an account and get verified by uploading your documents to get started. Standard accounts don’t have monthly fees or any fees to open the account, or you can upgrade to a plan with a monthly fee to unlock more features.

As well as international transfers, Revolut accounts offer a great range of services. Even with no-fee standard plans you can hold and exchange 25+ currencies, spend with a linked debit card, earn interest on your balance, and unlock lots of investment and budgeting tools.

There are no limits for most international transfers with Revolut – if any specific limitations apply to your payment you’ll be notified when you set it up in the app.

Revolut account holders can exchange funds with the mid-market exchange rate to plan limits – 1,000 USD per month for a standard plan – and send transfers with a low, variable fee based on the currency. If you’ve upgraded to a paid plan you may be able to exchange unlimited amounts with the mid-market rate, and get discounts on your international transfers.

Revolut pros and cons

| Revolut pros | Revolut cons |

|---|---|

|

|

Best international money transfer apps: Mobile app reviews

Here is an overview of these providers’ mobile apps on popular app stores:

| International Money Transfer Apps | App Store | Play Store | ||

|---|---|---|---|---|

| Ratings | Number of Reviews | Ratings | Number of Reviews | |

| Remitly | 4.9 | 1.1million+ | 4.8 | 654k+ |

| Wise | 4.6 | 29.1k+ | 4.7 | 455k+ |

| OFX | 4.9 | 2.3k+ | 4.6 | 3.6k+ |

| Western Union | 4.8 | 622+ | 4.6 | 273k+ |

| Revolut | 4.7 | 36k+ | 4.5 | 2.3 million+ |

* Rating and review data was taken on 12 July 2023 from App store and Play Store.

Best apps to send money instantly

If you need to get your money somewhere in a hurry you may be looking for an international wire transfer app for instant deposit, or to send money your recipient can collect in cash near them in minutes.

- Wise: 50% of Wise transfers are deposited instantly into the recipient’s bank account, and 90% arrive in 24 hours. Wise to Wise transfers deposited to another Wise account are instant

- Western Union: Money in minutes services are available on some payment routes, which allow you to send funds for cash collection at an agent near your recipient

- WorldRemit: 95% of payments sent for cash pick up are available in minutes, and 90% of payments to a mobile money account arrive in 10 minutes or less

Ultimately, the time it takes for your transfer to arrive may vary due to the amount you’re sending, the currency, and the way you want to pay. If you’re sending money for cash collection, don’t forget that agent and store opening times will also make a difference, as well as any public holidays here or in the destination country.

Best apps to receive money from abroad

Looking to get money deposited to an online or digital account of your own? These international payment apps also come with multi-currency accounts you can use to receive and hold payments from others:

- Wise: get local bank details to receive payments conveniently from 9 different currencies, plus hold 40+ currencies and exchange between them with the mid-market rate and low fees

- Revolut: local account details available for USD and GBP, plus SWIFT details for other incoming transfers – hold 25+ currencies, and make fee free currency exchange to your plan limit

- OFX: business customers and online sellers can open Global Currency Accounts which support 7 currencies, and allow you to receive payments from customers, payment gateways and marketplace sites

How to send money internationally

Money transfer apps are typically offered by specialists in online transfers – which means there’s a smooth in-app onboarding so you can get an account online, get verified, and get your money moving, all without even leaving the house.

The exact steps you take to make a global money transfer will depend a bit on which international payment app you select. Most wire transfer apps require you to register an account first, and get verified for security before you can use your account and access all features. In some cases you may be able to make small transfers without being verified, but to comply with the law all money transfer apps will need to complete a verification step at some point, depending on how you use your account.

Let’s walk through a basic step by step of how to send money internationally with a wire transfer app:

- Choose the app you want to use and download it

- Register an account by entering your personal details

- You may need to upload a photo of your ID and address documents, and enter your SSN

- Once your account is verified, enter the amount you want to send

- Choose the destination currency to get a fee and rate quote

- Add your recipient’s information following the prompts

- Fund the payment – usually by bank transfer or card – and you’re done

Conclusion: What is the best app to send money internationally?

There are plenty of different international money transfer apps you might choose from – and each one will suit a different customer, with different payment needs.

At Exiap you can compare providers transparently, to find the best money transfer service for your needs based on both the fees and exchange rates available.

Use this guide as a starting point to pick the right one for you – and don’t forget to check out the Exiap comparison page to get more live fee and exchange rate information.

Key takeaways: best app to send money internationally

- Wise: currency exchange with the mid-market exchange rate, low transfer fees with fee discounts on higher amounts

- Revolut: accounts for 25+ currencies with linked cards and low cost international payments

- Remitly: payments to friends and family for cash collection or account deposit, on popular remittance routes

- OFX: 24/7 phone service available to back up the app, if you need a more personal touch

- Western Union: send personal payments almost anywhere in the world, to bank accounts or for cash collection

FAQs on best international money transfer apps

What money apps work internationally?

Popular money apps like Venmo, CashApp and Zelle don’t work internationally. The providers we covered in this guide, such as Remitly, Wise and OFX international money transfer specialists that allow you to send money abroad from the US, and also receive money from overseas in the US.

What is the cheapest app to send money internationally?

The price you pay for your international transfer will depend on the value of the payment, the currencies involved, and where you’re sending to. Different providers have their own features – such as cash collection payments from a service like Western Union or Remitly, which can also change the costs.

The good news is that services like Wise and Remitly let you model your payment in advance, so you can see and compare the fees and exchange rates that apply. Get quotes from the providers which offer services you’re interested in, to see which is cheapest for your specific transfer.

What is the safest international money transfer?

The international money transfer services we’ve profiled in this article – Wise, Revolut, Remitly, Western Union and OFX – are all regulated for the services they provide, and safe to use. As you’d expect, you’ll need to take normal common sense precautions like keeping your account and password information secret, and only sending money to people you know and trust – but as long as you do, you should be able to send payments securely with any of our featured providers.

Which money transfer apps work internationally?

Many international money transfer services have apps – check out OFX, Remitly, Western Union, Revolut, Wise or XE as a starting point.

Which apps transfer money instantly?

Delivery times for international transfers do vary widely depending on where you’re sending payments to, and how you want them to be collected. For near-instant cash collections, check out Remitly or Western Union, and for fast transfers to banks, take a look at Wise. More than 50% of transfers with Wise are delivered instantly.

Are money transfer apps safe to use?

All the providers we’ve highlighted in this review are fully licensed and regulated, making them a safe way to send your payment.

How do international money transfer apps work?

To make a payment with an international money transfer app you’ll need to create an account, and get a quote for the fees and exchange rate available. Pay with your card, or through a bank transfer, and your money will be on its way.

Can you use Zelle or Venmo internationally?

Unfortunately, no. Zelle and Venmo doesn’t support international money transfers. You can learn more about them here:

- Does Venmo work internationally?

- Does Zelle work internationally?

- Does CashApp work internationally?

What is the easiest app to send money?

There’s no single easiest international money transfer app – use this guide to pick the right one for you based on our analysis and the customer rating information shared from Apple App store and Google Play.