9 Best Multi-Currency Accounts in the US [2026]

Opening a multi-currency account is advantageous for those dealing with international transactions, such as paying bills abroad, receiving payments from overseas clients, or managing foreign currency payments.

While some major US banks offer multi-currency accounts, they may lack flexibility and come with high costs. Specialist providers like Wise and Revolut can be good alternatives.

Table of contents:

- Quick overview: Best foreign currency accounts

- What is a multi-currency account?

- Best foreign currency accounts

- How to open a foreign currency account

Overview: Best multi currency accounts in the US

First, a quick look at some of the key US multi-currency account providers we’ll explore:

| Multi currency bank accounts | Great for: |

|---|---|

| Wise account | Personal and business accounts with 40+ currencies, local account details in 10 currencies. Mid-market exchange rate with low and transparent fees |

| Revolut account | Hold and exchange 25+ currencies, and offers some international ATM withdrawals and transfers without fees |

| Payoneer account | Accounts for digital business owners and e-commerce sellers, to pay and get paid in foreign currencies |

| OFX Global Currency Account | For business customers only, with 7 currencies. Payments and currency risk management solutions with 24/7 phone support and no transfer fee |

| Wells Fargo foreign currency bank account | Allows businesses to receive payments in foreign currencies, for corporate customers only |

| Chase Commercial Banking international services | International services tailored to large enterprise level organizations |

| Citibank foreign currency account | Offers foreign currency accounts through Citi International, very high minimum balance requirement |

| HSBC Global Money account | Existing HSBC US customers can open a Global Money account to hold and exchange 6 currencies with preferential rates |

| Everbank / TIAA Bank multi currency bank accounts | Accounts and Certificates of Deposit in single currencies or a basket of foreign currency options |

| East West Bank multi currency bank account | Traditional Demand Accounts and Certificates of Deposit in major foreign currencies |

What is a multi-currency account?

A multi-currency account can be useful for individuals who live an international lifestyle, freelancers and online sellers getting paid from abroad, and businesses who trade around the world.

Being able to get paid in foreign currencies, hold multi-currency balances, and send money overseas without needing to convert the currency can cut your costs.

With a multi-currency account you can hold various currencies in one place other than US dollars, including the following most popular: Pound Sterling (GBP) 🇬🇧, Euro (EUR) 🇪🇺, Canadian Dollar (CAD) 🇨🇦, Australian Dollar (AUD) 🇦🇺, Hong Kong Dollar (HKD) 🇭🇰, Japanese Yen (JPY) 🇯🇵, and Singapore Dollar (SGD) 🇸🇬.

| Pros of multi currency accounts | Cons of multi currency accounts |

|---|---|

| ✅ Flexibility: Hold and transact in multiple currencies ✅ More favorable exchange rates: Take advantage of more favorable rates ✅ Low conversion fees: Save money on currency conversion ✅ Convenience: Make easy international transactions | ❌ Limited availability: Not all banks offer these accounts, leaving specialist providers ❌ Complexity: Can be more complex to manage compared to a single currency account ❌ Fees and charges: Some accounts may have high fees ❌ Low or no interest rate: Not all multi currency bank accounts offer interest on foreign currencies |

Here are some of the frequently asked questions, and answers:

| Questions | Answers |

|---|---|

| Which US banks offer multi currency accounts? | A few US banks offer multi currency bank account options, like East West, HSBC, TIAA, Citibank, while Chase, Bank of America and Wells Fargo offers foreign currency bank accounts for business customers only. |

| How can I open a foreign currency account in the US? | Many accounts can be opened online or through a provider app – but you’ll probably need to pop into a branch to get an account through a bank. With Wise and Revolut, you can open an account online. |

| How does a foreign currency account work? | Foreign currency account features vary – you’ll usually be able to to hold and exchange foreign currencies, send and receive payments internationally. |

Best multi-currency accounts in the US

Ultimately, the best multi-currency account for you will depend on your specific needs and personal preferences. To help you pick, let’s look at an overview of some of the most popular foreign currency and multi-currency accounts in the US. We’ll start with the accounts you can open from non-bank alternative providers:

| Provider | Availability | Monthly fee | Min. balance | Currencies | Debit card |

|---|---|---|---|---|---|

| Wise | Globally available for business and personal customers in all but a small number of countries | Free | No minimum balance | 40+ currencies | Available |

| Revolut | Available in a range of countries including the US, UK, EEA and Australia | No monthly fee for standard account – up to 16.99 USD for Metal account | No minimum balance | 25+ currencies | Available |

| Payoneer | Available in a range of countries | Free – an annual fee applies for dormant accounts | No minimum balance | 7 currencies | Available |

| OFX | Business customers only | No fee | No minimum balance | 7 currencies | Not available |

*Information on the table last updated in April 2024

Best multi currency bank accounts

Next, let’s take a look at the foreign currency accounts you can open from banks in the US. It’s useful to know that most foreign currency accounts from banks are aimed at particular target customers, such as high wealth individuals looking to invest, or businesses which need to manage international payments.

| Foreign currency bank account | Availability | Monthly fee | Min. balance | Currencies | Debit card |

|---|---|---|---|---|---|

| Wells Fargo | Business customers only | Services are tailored to client needs | Services are tailored to client needs | 28 currencies | Contact bank directly |

| Chase | Business customers only | Services are tailored to client needs | Services are tailored to client needs | Services are tailored to client needs | Contact bank directly |

| Citibank | High wealth individuals | Varied fees based on account type | 200,000 USD | 21 Currencies | Available |

| HSBC Global Money Account | HSBC customers with eligible accounts only | No fee | No fee | 6 currencies | Not available |

| Everbank / TIAA Bank | US residents | Varies by currency | 2,500 USD | 20 currencies | Not available |

| East West Bank | US residents | Varies by currency | No fee | 14 currencies | Not available |

*Information on the table last updated in April 2024

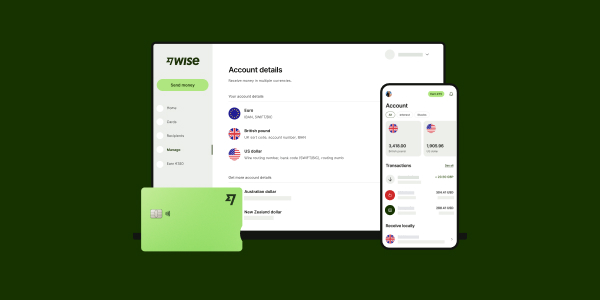

Wise multi-currency account – 40+ currencies

You can open a Wise multi-currency account online or in the Wise app for free, with options available for business and personal customers. There are no ongoing fees to pay and no minimum balance to maintain, so you can use the account as and when you need it, to access currency exchange which uses the mid-market exchange rate and low, transparent transaction fees.

Order a linked Wise Multi-Currency Card for a one time fee, to spend and make withdrawals in 150+ countries, hold 40+ currencies in your account, send payments to 160+ countries, and get paid with local bank details from 30+ countries.

- Foreign currencies: 40+ currencies supported for holding and exchange

- Local account details in: GBP, EUR, USD, CAD, AUD, NZD, SGD, HUF, RON, and TRY

- Supported currencies for hold & exchange: 40+ currencies including AUD, INR, CZK, EUR, GBP, HUF, JPY, NZD, PLN, USD, and many more

- Fees & exchange rates: Low transaction fees and the mid-market exchange rate

- International transfers: Send to 160+ countries, with fees from 0.43%

- Multi currency debit card: Available – Wise Multi-Currency Card

Learn more: Wise Account Review & How to use Wise Account

Learn more: Wise Account Review & How to use Wise Account

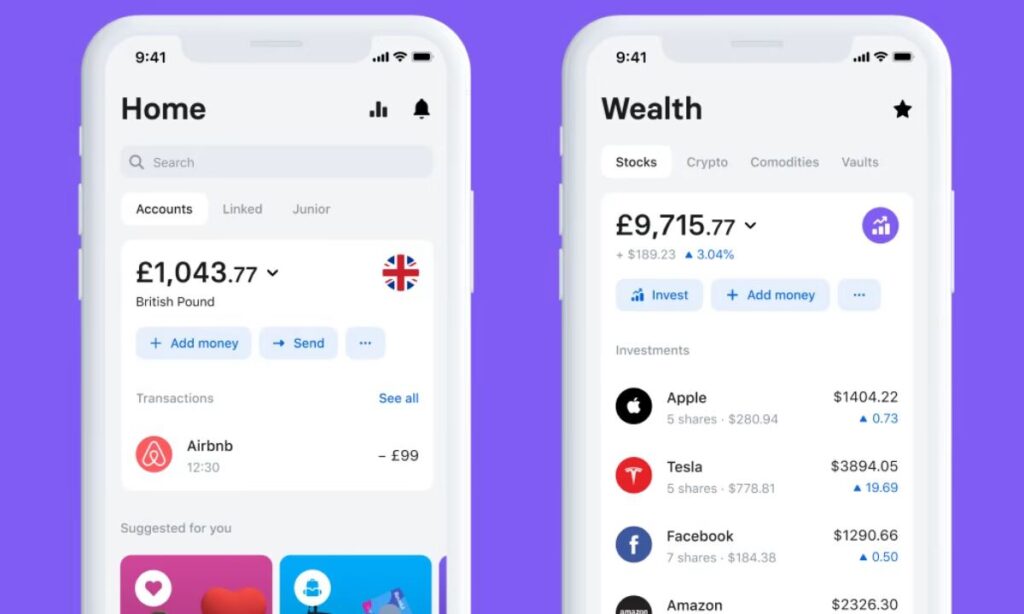

Revolut multi-currency account – 25+ currencies

Revolut describes itself as a financial super app, offering services to individuals and businesses in the US and a range of other countries.

There are standard Revolut plans without monthly fees available for all customers, which come with the option to hold and exchange 25+ currencies and get a linked debit card for easy spending. If you want to access an even broader range of features you can also choose to pay a monthly fee of up to 16.99 USD as a personal customer, to get lifestyle perks and more no-fee transactions.

- Foreign currencies: 25+ currencies supported for holding and exchange

- Supported currencies: AUD, BGN, CHF, EGP, EUR, GBP, HKD, JPY, MXN, USD, and more

- Fees & exchange rates: 0 USD – 16.99 USD monthly fees for personal customers, all accounts have some no-fee currency exchange which uses the mid-market exchange rate. Fair usage fees apply when you hit the exchange limits on your plan

- International transfers: Available to a range of countries, up to 10 USD for payments under 200 USD in value, and 5% for higher value transfers

- Multi currency debit card: Available – Revolut debit card

OFX multi-currency account (business customers only) – 7 currencies

OFX is a currency specialist which has multi-currency accounts for business owners and online sellers. You can get local bank details to get paid by clients in foreign currencies, or withdraw from PSPs and marketplace sites easily.

Hold or exchange your funds, or use them to pay VAT and suppliers overseas. OFX has a 24/7 phone service for customers which can be helpful if you’d rather talk through your options before transacting.

- Foreign currencies: 7 currencies supported for holding and exchange

- Supported currencies: AUD, CAD, EUR, GBP, HKD, USD, and SGD

- Fees & exchange rates: No monthly fee, exchange rates include a small markup

- International transfers: Send to a range of countries – no transfer fee

- Multi currency debit card: Not available

Payoneer multi-currency account – 7 currencies

Payoneer offers online and in-app account services for ecommerce sellers, people who run digital businesses and anyone earning from a third party site like a marketplace or vacation rental portal.

You can get paid with local receiving accounts in a range of currencies, and get a linked card if you want to spend and make withdrawals directly.

- Foreign currencies: 7 currencies supported for holding and exchange

- Supported currencies: USD, JPY, AUD, EUR, HKD, SGD, CAD, GBP, AED

- Fees & exchange rates: No monthly fee, but annual fee applies for dormant accounts. Exchange rates include a markup

- International transfers: Send to a range of countries

- Multi currency debit card: Available

Learn more: Payoneer review

Which US banks offer foreign currency accounts?

Unfortunately popular banks such as Wells Fargo, Chase and Bank of America don’t provide foreign currency bank accounts for personal banking, their foreign currency accounts are for business customers only.

There are a couple US banks that offer multi-currency bank accounts for personal users. Here, we’ll give an overview of HSBC, TIAA, East West personal multi-currency account options, and also Wells Fargo and Chase for business accounts. Keep in mind that this is not a complete list, and there might be other banks that provide foreign currency accounts in the US.

Wells Fargo foreign currency account (Business customers only)

Wells Fargo offers international treasury management services, and multi-currency account services to corporate business clients. These services are operated through offices based in Europe and Canada and allow business customers to receive foreign currency payments, and accumulate foreign currency deposits with one institution.

Key features:

- Corporate clients only – contact Wells Fargo directly for advice about the accounts which may suit your business needs

- Supported currencies: GBP, EUR, USD, among 28 currencies offered

- Fees and exchange rates: As services are tailored to business needs, the features and fees available can vary widely

- International transfers: Transfers available by ACH, SWIFT and global transfer services, in most major currencies. Fees apply for some services, which can include exchange rate markups

Chase Commercial International banking

Chase does not offer a foreign currency account for personal customers, but does target business customers with a broad range of international services. In particular, Chase works with businesses in sectors like healthcare, finance, retail and real estate which are likely to have high annual turnovers, and complex international banking needs.

Chase services for commercial businesses are tailor made to suit the needs of the individual organization. To learn more about what’s available – and whether Chase might be able to help you with your own business requirements – you’ll need to complete an online form and wait for a call back.

Citibank foreign currency account (from Citi International)

Citibank offers multi-currency and foreign currency account options to customers who maintain a high minimum relationship balance. These accounts are available in 21 currencies and allow customers to access detailed investment advice and favorable fees for foreign exchange services.

Citibank USA doesn’t offer multi-currency account, but they can refer you to Citi International. But even with Citi International, there is a high minimum balance requirement of 200.000$.

Key features:

- Supported currencies: AUD, CAD, DKK, EUR, GBP, HKD, PLN, SEK, CHF, USD, and more

- Suited to high wealth individuals with a balance of at least 200,000 USD held by Citi

- Debit card provided for worldwide use, online and mobile banking features available

- Get foreign exchange solutions to help manage fluctuating exchange rates

- Hold balances in different currencies, switch between them and send global payments

HSBC Global Money Account – 6 currencies

HSBC is a big global banking brand which supports US personal customers with an option to get a multi-currency account to hold and exchange 6 currencies and make payments to others.

You’ll need to have another HSBC account product to access your Global Money Account – and once you have it all set up you can access competitive FX rates and instant payments in a range of currencies to other HSBC customers.

- Foreign currencies: 6 currencies supported for holding and exchange

- Supported currencies: AUD, EUR, GBP, HKD, SGD, and USD

- Fees & exchange rates: No monthly fee, but you do have to hold another eligible HSBC account which may have a maintenance charge. Competitive FX rates

- International transfers: Send to a range of countries – fees and rates disclosed in the HSBC app

- Multi currency debit card: Not available

Check our review here: HSBC Global Money Account review

TIAA Access Accounts – 20 currencies

TIAA has Access Accounts for day to day use which you can hold in foreign currencies, as well as Certificates of Deposit (CDs) in single currencies or a basket of foreign currency options. CDs may be a good option if you want to boost your savings in a foreign currency and don’t mind locking away your funds for a fixed period in order to get the best available rate of return.

- Foreign currencies: 20 currencies supported for holding and exchange

- Supported currencies: AUD, GBP, CAD, DKK, EUR, HKD, SGD, CHF, JPY, NZD, and more

- Fees & exchange rates: Fees and rates vary by currencies involved – minimum balance requirements may apply

- International transfers: Send to a range of countries

- Multi currency debit card: Not available

East West multi currency bank account – 14 currencies

Get Demand Accounts and Certificates of Deposit in major foreign currencies from East West. There’s a pretty good range of currencies and you’ll get a better exchange rate with this account than you may otherwise with East West. No minimum balances apply, but you may need to pay a monthly fee depending on the account and currencies you select.

- Foreign currencies: 14 currencies supported

- Supported currencies: CNH, AUD, HKD, GBP, EUR, SEK, CHF, DKK, CAD, MXN, and more

- Fees & exchange rates: Fees and rates vary by currencies involved

- International transfers: Send to a range of countries

- Multi currency debit card: Not available

How to open a foreign currency account online

Exactly what you need to do to open a multi-currency account in the US will depend on whether you choose a bank, digital or specialist provider. Many accounts can be opened online or through a provider app – but keep in mind that you might need to pop into a branch to get a foreign currency account through a US bank.

Here is how to open a multi-currency account online:

- Choose the best provider for your needs

- Check you meet any eligibility criteria

- Register for your account online, or through the provider app

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

US legislation means that all banks and account providers must complete verification steps to make sure that customers don’t use their products fraudulently or illegally. That means you’ll usually have to provide some paperwork in person or by uploading an image when you choose a digital account provider. Usually the documents you’ll be asked for verification are:

- Government issued photo ID to prove your identity

- Proof of address – a utility bill or bank statement in your name for example

- Business registration documents if you’re opening a business account

If you are interested in a specific currency account, these guides might help:

- How to open a Canadian Dollar account in the US 🇨🇦

- How to open a Euro account in the US 🇪🇺

- How to open a British Pounds account in the US 🇬🇧

Free multi currency bank accounts

There are always some costs involved with managing your money, which could take the form of ongoing charges or transaction fees. However, there are some multi-currency accounts from banks and non-bank providers which do offer some services with no fees. These can be a good option if you’re not sure how frequently you’ll use your foreign currency account, or if you just want a low risk way to test out the accounts on offer.

Different banks and non-bank alternatives have their own approaches to fees. Some may offer you a fixed number of free transactions before any charges begin for example, while others may offer multi-currency features you can access as long as you hold a minimum deposit. Here are a few to consider:

- Wise account: No fee to open a personal account, no ongoing charge or minimum balance, some ATM withdrawals monthly with no Wise fees, and low, transparent charges where costs apply

- Revolut account: Choose a standard account with no ongoing fee, or pay monthly for more features. All accounts have some no-fee currency conversion and ATM use before charges begin

- HSBC Global Money: No fee for your Global Money account, although you’ll also need another eligible HSBC USD account which may have costs attached

- Citibank foreign currency accounts: As long as you hit the minimum balance requirements you may find your account can be opened and operated with few or no fees – minimum balance needed is from 200,000 USD

When is a multi-currency account needed?

Multi-currency accounts let you hold and exchange a range of currencies, which can be handy for both personal and business customers.

Holding foreign currencies can cut the costs of currency exchange if you get paid from abroad, or if you need to send money internationally often. If you pick a multi-currency account from a specialist service you may also get a linked international debit card for low cost withdrawals and spending overseas, as well as local bank details to get paid like a local from a range of countries.

How do multi currency accounts work?

Account features do vary depending on the provider you select, but if you pick a modern provider with flexible account options you can often do the following with your multi-currency account:

- Top up your account in USD or a foreign currency from your regular bank or card

- Check your balance and review transactions on your phone – often with instant transaction alerts

- Manage your card – freeze and unfreeze – on the go in the provider app

- Exchange currencies within your account

- Send payments to others to be deposited into their bank accounts

- Spend with your linked debit card, all around the world

- Receive payments with local bank details

Multi currency debit cards

Multi currency accounts like Wise and Revolut have linked debit cards that allow you to spend from the account. If you’re interested in a multi currency cards, these guides might be helpful:

What is the eligibility for a multi currency bank account?

Multi-currency accounts with US banks are usually aimed at corporate and large business customers which need a full suite of financing and treasury services. As a result they may have relatively high fees and minimum balance requirements, plus strict eligibility restrictions which make them unsuitable for individuals and small business owners.

Multi-currency and foreign currency accounts from modern alternative providers are chosen by both personal, business and enterprise level customers. Depending on your needs, these specialist services can offer greater flexibility, lower fees and more convenience compared to the options available from many big US banks.

What are the advantages of multi currency bank accounts?

There are advantages to multi-currency accounts for both individual and business customers.

- As an individual you might want to buy a foreign currency when the exchange rates look good, to hold on to and use as travel money for a future vacation.

- As a business owner maybe you get paid by customers, marketplaces or PSPs in a foreign currency, and want to use these funds to cover your VAT or taxes overseas.

How to choose the right foreign currency account for your needs

Before you pick a multi-currency bank account, it’s worth comparing a range of options, and looking carefully at both the features and the fees of each. Consider:

- Are the currencies you need covered?

- What are the ongoing fees and charges?

- How high are transaction fees for the transactions you’ll need to make often?

- Can you get a linked debit card?

- Do you get local bank details to get paid easily in foreign currencies?

- What security measures are in place?

Related: Best ways to receive money from overseas

Conclusion: What is the best foreign currency bank account?

As more people travel, work and trade internationally, multi-currency accounts are becoming more popular with both personal and business customers. Holding a range of currency balances can mean you spend less on unnecessary currency conversion, and can pay and get paid more easily in foreign currencies.

The choice of multi-currency accounts in the US from banks can be limited – and the features, flexibility and fees do vary significantly. Alternative providers like Wise and Revolut can be a good option for both personal and business needs, with easy account opening processes, low fees and great exchange rates.

Make sure you do a bit of research before you get started to find the best match for your needs from the US banks, online and specialist providers out there.

Best multi currency bank account FAQs

Can a multi-currency account be opened in the US?

Simply, yes you can open a multi currency account in the US. There are a handful of multi-currency accounts available from banks in the US, but the options tend to be limited. Most banks specialize in corporate services and only support a small number of currencies.

Check out instead specialist online providers like Wise and Revolut, to open a low cost digital multi-currency account which may have lower fees and a better exchange rate compared to US banks.

Can I open a Wise Multi-currency Account in the USA?

Yes. You can open a Wise Account from the US, online or in the Wise app, in just a few simple steps.

How to choose a multi currency account provider?

Before you pick a multi currency bank account, it’s worth comparing a range of options, and looking carefully at both the features and the fees of each.

Can you transfer money abroad from a foreign currency account?

Yes. Exactly what you can do with your foreign currency bank account will vary by provider, but you can usually send international payments – often with lower fees and better rates than with standard checking accounts.