Revolut in Monaco 🇲🇨: Is it available? What are alternatives in 2026?

Revolut is not available for residents of Monaco. However, if you happen to have a Revolut account from elsewhere you’ll still be able to use your Revolut card to spend if you go to Monaco for a short visit. If you’re moving your full time residence to Monaco you’re likely to have to give up your Revolut account, though.

The good news is that there are alternatives to Revolut in Monaco. While Monaco has a very developed banking sector, the options available tend to revolve more around private banking, wealth and asset management.

If you’re thinking of a day to day multi-currency account you may prefer a specialist provider like Wise or PayPal. This guide gives a rundown of your key options so you can decide what’s best for you.

Quick summary: Alternatives to Revolut in Monaco 🇲🇨

| Provider | 💡 Great for |

|---|---|

| Wise | Monaco residents, and customers from other countries who want to receive EUR and other currencies, and send, spend, hold and exchange EUR, USD and 40+ other currencies |

| PayPal | Monaco residents who want to spend and send money online in EUR using a linked card |

| Monaco based banks | Monaco residents looking for private banking, wealth and asset management |

About Revolut

Revolut has an enormous 55 million+ customers, and is available in many countries and regions globally including the US, UK and EEA.

However, as Monaco is not an EEA country you can’t currently open a Revolut account if you’re a Monaco resident.

If you live outside of the Principality, and open a Revolut account in your home country, you’ll be able to choose an account from various plans, to hold and manage 25+ currencies in your Revolut account, make local and overseas payments, save and spend with linked cards.

Is Revolut available in Monaco?

- Monaco residents can not hold a Revolut account

- Account holders in other eligible countries can hold a EUR balance

- Account holders in other eligible countries can spend with their Revolut card in Monaco

- Account holders in other eligible countries can send payments to and from EUR

| Revolut can be great for: | Revolut may not be for you if: |

|---|---|

| ✅ Customers in eligible countries who want to hold and send EUR payments ✅ Visitors to Monaco looking for card payments and withdrawals ✅ People who prefer to choose an account from several different plan types ✅ Businesses sending money to Monaco | ❌ You live in Monaco ❌ You need a full suite of banking services including credit and loans |

Can I open a Revolut account in Monaco? 🇲🇨

No. You will not be able to open a Revolut account if your home address is in Monaco.

If you have an account with Revolut already and plan to move to Monaco you’ll need to reach out to Revolut to confirm your options. This is likely to mean you have to close your account when you relocate to remain within the Revolut terms.

Revolut supported countries

You can open a Revolut account if you reside in one of these countries:

Australia, Brazil, European Economic Area (EEA), Japan, New Zealand, Singapore, Switzerland, United Kingdom, United States.

The European Economic Area (EEA) countries include: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Republic of Cyprus, Romania, Slovakia, Slovenia, Spain, Sweden.

Revolut alternatives for Monaco residents: Quick comparison

If you’re looking for a provider like Revolut in Monaco, you’ll probably need to choose a specialist provider rather than a bank. While Monaco is a banking and financial center, its banks mainly focus on high wealth individuals, private banking and asset management. We’ll cover a few banks in Monaco which may suit you if this is what you need, a little later.

If you’re thinking of a more flexible multi-currency account for day to day use, there are still a couple of smart Revolut alternatives – here’s a comparison of some options, with more on each coming right up.

| Alternatives | Features for Monaco | Supported currencies | Account fees | Exchange rates | Limits |

|---|---|---|---|---|---|

| Revolut

| Monaco residents can not hold an account Account holders in eligible countries can hold a EUR balance and spend with Revolut card in Monaco | 25+ currencies for holding and exchange, including USD and EUR | Variable fees depending on your country of residence Accounts with no monthly fees usually available | Revolut rates to plan limits, with fair usage fees after that Out of hours conversion fees may apply | Variable transfer and card spend limits based on account and transaction type |

| Wise

| Monaco residents, and account holders in other eligible countries can open an account with a Wise card, to receive, send, spend, and exchange EUR Business customers in Monaco can open an account | 40+ currencies for holding and exchange, including USD and EUR | Accounts have no monthly fees Variable transfer and conversion fees depending on your country of residence | Mid-market rate | Variable transfer and card spend limits based on transaction type |

| PayPal

| Monaco residents can open an account, send payments and spend online | 25+ currencies for holding and exchange, including USD and EUR | Accounts have no monthly fees Variable transfer fees based on funding method and destination | PayPal rate + 3% or 4% conversion fee in Monaco Other countries may have different fees | Check in the PayPal app for the limits that apply based on your account type |

*Details correct at time of research – 5th June 2025

We’ve selected a few different alternatives to Revolut for Monaco, depending on what matters most for you. If you’re a resident of Monaco you can’t open a Revolut account, although people with a Revolut account in another eligible country will still be able to use their Revolut account in Monaco if they’re there for a visit.

If you’re looking for an account you can open from Monaco, you may prefer one of these alternatives:

- Wise: Great Revolut alternative in Monaco if you want the mid-market rate for conversion when you send payments, with a broad suite of services in EUR and 40+ other currencies

- PayPal: Great Revolut alternative in Monaco for online shopping and sending payments to other PayPal account holders locally and internationally

- Banks in Monaco: Great Revolut alternative in Monaco if you want private banking, wealth management and investment services – usually for high net worth individuals only

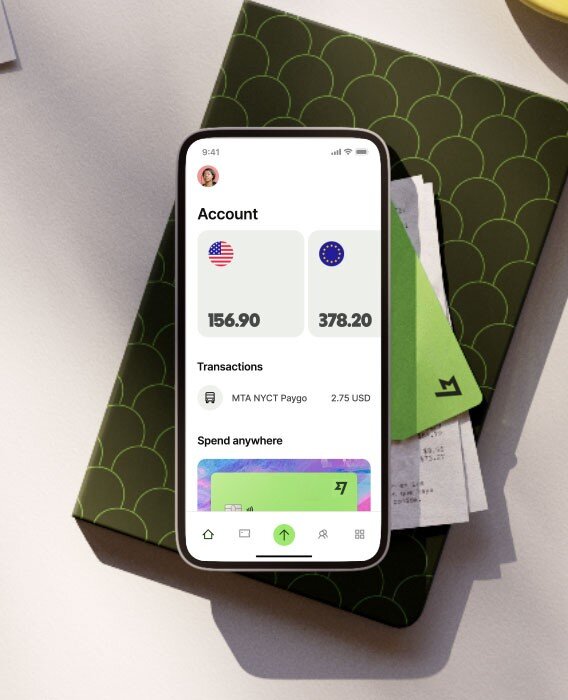

Wise

| ⭐ Monaco residents can open an account, linked debit card and access a full set of Wise services including holding and exchanging 40+ currencies ⭐ Wise account holders can receive EUR with local or SWIFT details and send EUR payments ⭐ Account holders in Monaco and other eligible countries can spend with their Wise card in Monaco |

Monaco residents can open a Wise account, order a card, access multi-currency balances in 40+ currencies and get more or less all of the services Wise offers.

Wise Account holders can hold a EUR balance, send EUR payments and spend with a Wise Multi-Currency Card in Monaco.

In total 40+ currencies are supported for holding and exchange, with mid-market exchange rates and low fees. Accounts have no ongoing fees to pay, and customers can receive EUR with local details for free, and with SWIFT details for a small fee.

| Wise can be great for: | Wise may not be for you if: |

|---|---|

| ✅ Monaco residents and non-residents looking for a way to send and receive overseas payments ✅ Account holders who want to hold EUR alongside 40+ other currencies ✅ Customers who live in or travel to Monaco and want to spend and withdraw with a Wise Multi-Currency Card ✅ Anyone looking for mid-market rate currency exchange | ❌ You want full banking services like loans and credit ❌ You prefer to manage your money in a branch |

Wise supported countries

You can open a Wise account if you reside in one of these countries:

Andorra, Australia, Austria, Bahrain, Belgium, Bouvet Island, Brazil, Bulgaria, Canada, Cayman Islands, Chile, China, Colombia, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, French Guiana, Georgia, Germany, Gibraltar, Greece, Guadeloupe, Guam, Guernsey, Monaco 🇲🇨, Hungary, Iceland, India, Ireland, Israel, Isle of Man, Italy, Japan, Jersey, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Macao, Malaysia, Malta, Martinique, Mayotte, Monaco, Netherlands, New Zealand, North Macedonia, Norway, Philippines, Poland, Portugal, Qatar, Réunion, Romania, Saint Barthélemy, Saint Martin, Saint Pierre and Miquelon, Saudi Arabia, Singapore, Sint Maarten, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, United Kingdom, United States.

| More information – How to open a Wise Account ⭐ |

Wise pricing and limits

| Wise pricing & limits | |

|---|---|

| Wise Account | Monaco residents can open a Wise multi currency account with 40+ supported currencies including USD and EUR |

| Wise Multi-Currency Card | Available for residents of Monaco and in many other countries for spending and withdrawals internationally, including in Monaco |

| Wise limits | Often no holding limit, transfer limits are set high – usually in the region of 1 million GBP or the equivalent Wise offers fee discounts on larger transfers or conversions in the Wise Account (over 20k GBP or equivalent in value) sent in one transfer or in multiple transfers within a month. Learn more on Wise large amount transfers guide. |

| Wise fees | No ongoing fees, low, variable conversion fees based on currency |

| Wise exchange rate | Mid-market exchange rate. You can find live Wise Euro exchange rates here. |

*Details correct at time of research, 5th June 2025

PayPal

| ⭐ Monaco residents can open an account and link a card ⭐ Monaco residents can send payments locally and overseas, to other PayPal accounts ⭐ Monaco residents can spend online securely and conveniently |

Monaco residents can open a PayPal account and hold a EUR balance. You can then receive payments in euros, or link a card to send payments locally and overseas, to other PayPal accounts. Monaco residents can also spend online securely and conveniently and hold a balance in other currencies.

In total PayPal has 25+ currencies for holding and exchange, including USD. PayPal accounts have no monthly fees, with no fee to spend online if no currency conversion is needed. For payments, variable transfer fees apply based on funding method and destination.

| PayPal can be great for: | PayPal may not be for you if: |

|---|---|

| ✅ Secure online shopping ✅ Sending local payments to PayPal funded with a linked card or bank ✅ Receiving family and friends payments ✅ Card spend in Monaco if you have a PayPal card from an eligible country | ❌ You shop or spend overseas – 3% or 4% currency conversion fees apply ❌ You need to send money for deposit to bank accounts |

PayPal supported countries

You can open a PayPal account in many countries, including Monaco 🇲🇨. You can find the full list of countries here.

PayPal pricing and limits

| PayPal pricing & limits | |

|---|---|

| PayPal account | Accounts for spending and sending payments in 25+ currencies, from a linked card. Monaco residents can receive and hold a balance in EUR and other currencies |

| PayPal card | Not available to Monaco residents PayPal cards are available in various countries and regions globally, and can be used in Monaco for spending |

| PayPal limits | Check in the PayPal app for the limits that apply based on your account type |

| PayPal fees | No monthly fees, No fee to spend online if no currency conversion is needed. For payments, variable transfer fees apply based on funding method and destination |

| PayPal exchange rate | PayPal rate + 3% to 4% conversion fee |

*Details correct at time of research, 5th June 2025

Banks in Monaco 🇲🇨

As we’ve seen, banks in Monaco tend to reserve their services for high net worth individuals. While the definition of high net worth may vary, this can mean having in the region of 5 million GBP in investable assets – about 6.75 million USD. Services offered tend to revolve around investments, asset management, estate planning and options for corporate and institutional customers. If you’re interested in exploring, some options include:

- Societe Generale Monaco – with five branches and one business center in Monaco, Societe Generale – branded as SG MONACO in the Principality, has been present in the region for over 100 years, offering retail banking and wealth management services

- BNP Paribas – headquartered in Paris, this French universal bank offers wealth management services to customers in Monaco

- Compagnie Monegasque de Banque (CMB) – CMB has private banking, wealth management and corporate and institutional services for clients in Monaco. Part of the Mediobanca Group., CMB has had a presence in Monaco since 1976

- Banque Edmond de Rothschild Monaco – Rothschilds Monaco has services including private banking and asset management for Monaco clients, with electronic banking services once you have an account

Can I transfer money from Monaco with Revolut?

If you live in Monaco you can’t open a Revolut account. However, Revolut does support EUR services, including payments, for people in other countries. That means that if you have a Revolut account somewhere else, you can still make transfers in euros.

Here’s a summary of your options:

| Provider | Money transfers from Monaco |

|---|---|

| Revolut | Revolut is not available in Monaco, but EUR transfers are supported for customers with accounts in eligible countries |

| Wise | You can make transfers from Monaco to bank accounts, and to WIse accounts, around the world with Wise |

| PayPal | You can send money with PayPal in Monaco, to other PayPal accounts at home and abroad |

Can I transfer money to Monaco with Revolut?

Yes. If you have a Revolut account from another country, you could make a EUR transfer to a bank in Monaco.

However, as Monaco residents can’t open a Revolut account, you can’t make a Revolut to Revolut transfer to Monaco.

| Provider | Money transfers to Monaco |

|---|---|

| Revolut | Revolut account holders in countries other than Monaco can send money for deposit to bank accounts in Monaco |

| Wise | Wise customers can send money to Monaco, to banks and to other Wise accounts in the Principality |

| PayPal | PayPal customers can send money to other PayPal account holders in Monaco |

Learn more – Best ways to transfer money to Monaco

Can I open a Revolut Business Account in Monaco?

No. Revolut Business is not offered in Monaco. However, both Wise and PayPal support large and small business customers of various types. Here’s a summary.

| Provider | Business accounts in Monaco |

|---|---|

| Revolut | Revolut is not available for business customers in Monaco |

| Wise | Wise Business is available in Monaco for account services, with a full suite of services and a linked card |

| PayPal | PayPal merchant accounts are available in Monaco |

Can I use my Revolut card in Monaco?

If you have a Revolut account from the US, UK, EEA or another country or region supported by Revolut, you can continue to use it when you visit Monaco. Payments in Monaco use euros, and Revolut accounts support EUR as a balance currency.

More information – Can I use my Revolut card in Monaco?

If you live in Monaco and want to get a multi-currency debit card you may like the Wise Multi-Currency Card instead. This is available in Monaco, linked to the Wise account, and offers easy ways to pay and make cash withdrawals, with the mid-market rate and low, transparent fees.

More information – Can I use Wise Multi-Currency Card in Monaco?

Tips for Monaco visitors using Revolut

- Revolut accounts can hold euros, so if you’re planning a trip to Monaco, keep an eye on the exchange rate and convert some spending money to EUR when you see a good opportunity

- Check your spending, withdrawal and transaction limits so you’ll not be stuck without access to your account

- Always pay in euros in Monaco. You may be asked if you’d prefer to pay in your home currency, but this is likely to mean you get a far worse exchange rate

- Travel with a couple of cards, and a small amount of cash, so you’ll always be covered no matter what type of payment you need to make

Revolut launch date in Monaco

There is currently no specified Revolut Monaco launch date, and no Revolut Monaco waiting list you can join.

As Revolut is expanding all the time, it’s worth checking their website from time to time to see if this has changed.

Conclusion: Does Revolut work in Monaco? 🇲🇨

Revolut does not offer accounts to individual or business customers who are based in Monaco. However, if you have an account with Revolut from the US or another eligible country, you can continue to use your account and card as usual when you visit the Principality. If you fall in love with Monaco and decide to move there, you’ll likely need to give up your Revolut account.

For Monaco residents there are some strong Revolut alternatives, depending on how you need to transact. The providers we’ve explored in this guide include:

- Wise: Great Revolut alternative in Monaco if you want the mid-market rate for conversion when you send payments, with a broad suite of services in EUR and 40+ other currencies

- PayPal: Great Revolut alternative in Monaco for online shopping and sending payments to other PayPal account holders locally and internationally

- Banks in Monaco: Great Revolut alternative in Monaco if you want private banking, wealth management and investment services – usually for high net worth individuals only

Revolut in Monaco FAQs

Can I use Revolut in Monaco?

If you’re a Monaco resident you can not open a Revolut account.

If you’re already a Revolut account holder from somewhere like the US you can hold a EUR balance and spend with your card in Monaco as usual. You can also send EUR payments to Monaco.

If you relocate to Monaco you’ll probably have to close your Revolut account and look for an alternative like Wise or PayPal.

If you are about to move to Monaco, these guides be helpful: Cost of living in Monaco, and Currency in Monaco

What are the alternatives to Revolut in Monaco?

As an alternative to Revolut in Monaco you might want to look at Wise which has a multi-currency account and card which is available to Monaco residents.

You can also open a PayPal account if you mainly want to send payments and shop online – or check out the options from Monaco banks if you want more complex services like asset and wealth management.