How to send money with a credit card [2026 Guide]

You can send money both domestically in the US, and overseas using a credit card. However, sending money internationally using your credit card can mean you run into several different fees including cash advance charges, transfer fees and an exchange rate markup. Pick the wrong service to get your payment moving, and that can quickly mount up.

This guide walks through how to make a credit card remittance, the types of fees to watch out for, and also introduces some options for making cheaper international payments such as Remitly, Wise, and WorldRemit. Read on.

Quick summary: Money transfer with a credit card

Before we dive into the details here’s a quick summary of the providers we’ll cover, looking at options, features and fees for sending money with a credit card.

For international and domestic transfers:

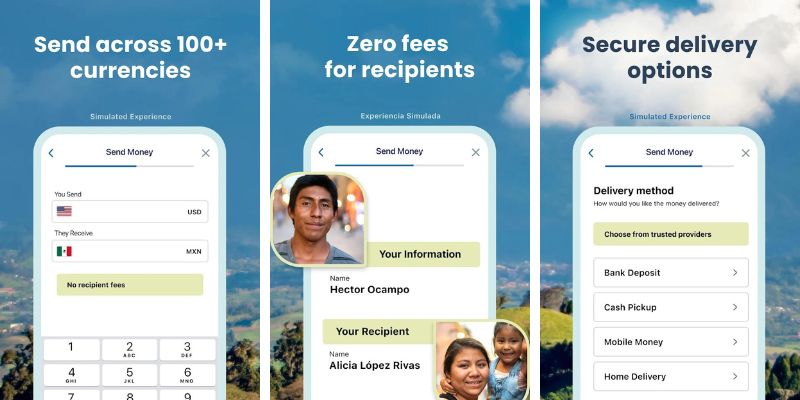

Remitly: International payments in 100+ currencies, you can send money using a credit or debit card with a higher fee, but your money will arrive faster. Remitly accepts Visa or Mastercard in all sending countries.

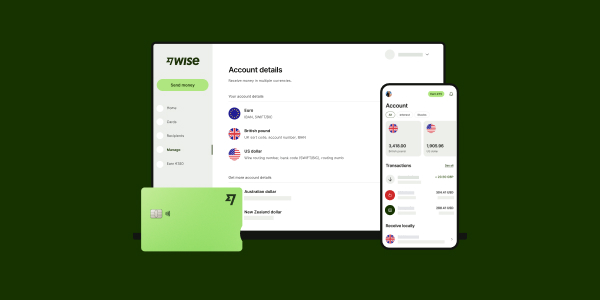

Wise: Send money domestically or internationally to 160+ countries, using your credit or debit card, with low fees and the mid-market rate. Transfer fees will be higher when paying with a credit or debit card, but it’ll arrive faster.

WorldRemit: International payments you can set up with your credit card – for bank or mobile money deposit, as airtime top up, or for cash collection. WorldRemit accepts most cards issued by Visa or Mastercard but doesn’t accept Amex, Diner’s Card or Union Pay.

PayPal: transfer instantly to other PayPal accounts in 200+ countries and regions. Paypal accepts both debit and credit cards as well as PayPal Credit or Debit cards, but your transfer will be more expensive as opposed to paying from your bank or PayPal balance.

For domestic transfers:

Venmo: Domestic transfers in the US which are fast, convenient and super popular. Visa, Mastercard, Discover and Amex credit cards are accepted. However, credit card payments are likely to incur Venmo’s standard 3% fee.

CashApp: Send money with your credit card in USD and to the US, using just the recipient’s name, number of $cashtag. CashApp also accepts Visa, Mastercard, Discover, and Amex credit cards but using a credit card will result in a 3% fee.

Can you send money with a credit card?

Yes. You can send money here in the US, and also to recipients around the world, and pay by credit card. There are a couple of different ways you can send a payment with your credit card, including using your regular bank or choosing a specialist money transfer service.

We’ll cover the options in more detail, as well as some pros and cons as well as alternative ways to send money overseas, in this article.

What is the best way to send money with a credit card?

The best method to send money with a credit card will vary based on your preferences and requirements. Weigh up a few options including:

Remitly for payments to loved ones in the US and in a good range of countries with various payment options and fees depending on your chosen method. They accept Visa and Mastercard as well as prepaid debit cards in the US.

Wise for low cost domestic and international payments that are deposited to bank accounts directly. Mid-market exchange rates apply when sending in a foreign currency. Wise accepts Visa, Mastercard and some Maestro cards.

WorldRemit for international payments which can often be sent to banks and mobile money accounts, or for cash collection – often within just a few minutes. WorldRemit accepts Visa or Mastercard.

CashApp for payments to others in the US, or CashApp account holders in the UK, with no need to get the recipient’s bank account details. They accept Visa, Mastercard, Discover or Amex cards.

Venmo for convenient, special payments in the US which are usually deposited quickly or even instantly. They accept Visa, Mastercard, Discover or Amex

What is the easiest way to send money with a credit card?

One of the most convenient and straightforward ways to send money with a credit card is to use a online specialist money transfer service like Wise or Remitly which has a handy app. You’ll be able to download the app and create an account in just a few minutes, to send payments using your credit card even when you’re out and about. We’ll cover more about them next.

Best apps to send money with a credit card

Let’s take a look at some top apps to send money with a credit card from the US. Here are some of the best apps to send money.

Remitly

Remitly supports payments to a good range of countries on common remittance routes. It’s a good pick if you want to send money to a loved one at home with varied pay out methods and different fees depending on how quickly you want your money to arrive.

Transfer fees: With a credit card you’ll need to arrange a Remitly Express payment which can have higher fees than the standard Economy transfer – but your money will also arrive faster.

Which credit cards does Remitly accept?

Pay for your Remitly transfer from the US with a Visa or Mastercard credit card. Remitly accepts Visa and Mastercard debit and credit cards in all sending countries as well as prepaid debit cards in the US. All cards must have an expiration date, a CVV or CVC (the three or four-digit number that’s on the back of your card) and match the name on your profile. Whether or not Remitly accepts American Express cards is not specified on their website.

Wise

You can send money with Wise using a credit card to 160+ countries internationally, as well as sending domestic USD payments here at home.

Wise money transfers use the mid-market exchange rate and low, transparent fees, and can arrive instantly on some payment routes. It’s easy to register for Wise online or in the handy Wise app, for fast and secure transfers you can make 24/7.

Transfer fees: Using your credit card to pay for your Wise transfer will usually be more expensive than using an alternative like an ACH to pay.

Which credit cards does Wise accept?

You can pay for your Wise transfer with a Visa or Mastercard credit card. Some Maestro cards that are 3D security enabled, have 16-digit card numbers and an expiry date are also accepted. American Express cards are not accepted. The card you make the payment with has to be in your name.

Learn more about it here: How to pay by card

WorldRemit

You can send WorldRemit payments online and in-app from the US to a broad range of countries. You can select how you want the recipient to get the money in the end – with options including bank deposits, cash pick up, mobile money payments and airtime top up. Not all services are available in all countries.

Fees: Credit card transfers may have higher fees compared to other payment methods.

Which credit cards does WorldRemit accept?

Pay for your WorldRemit transfer with a Visa or Mastercard credit card – other networks like Amex and Diner’s Cards aren’t accepted.

PayPal

PayPal payments can be deposited into your recipient’s PayPal account almost instantly if you choose to pay using a credit card. You can send payments in USD domestically, or in foreign currencies to any other PayPal user in a supported country – coverage is pretty much worldwide.

Fees: It’s worth noting there’s a PayPal transfer fee if you use a credit card – up to 2.9% for domestic payments, and 5% (to a maximum of 4.99 USD) internationally.

Which credit cards does PayPal accept?

You can pay for your PayPal transfer using a Visa, Mastercard, Discover or Amex credit card as well as prepaid cards.

Venmo

Venmo is a super popular way to send and share payments in the US – but it’s useful to know Venmo can’t be used for international transfers.

You can link a credit card in your name to your Venmo account, to use this to fund transfers.

Fees: It’s worth noting that credit card payments with Venmo are likely to incur a 3% fee from Venmo, and possibly also from your own card issuer, so you’ll want to check out the details before you transfer.

Which credit cards does Venmo accept?

You can pay for your Venmo transfer using a Visa, Mastercard, Discover or Amex branded credit card as well as prepaid cards. All cards must be registered under your name and some may also require your ZIP code to be linked to your Venmo account.

CashApp

CashApp is another fast and popular way to send payments in USD, with some international coverage if you want to send money to a CashApp user in the UK too.

Fees: If you use a credit card though you may have to pay a 3% fee to send your transfer, while many other transactions within CashApp are fee free – check out all the details before you get started.

Which credit cards does CashApp accept?

You can pay for your transfer on CashApp using a Visa, Mastercard, Discover or Amex branded credit card as well as prepaid cards.

How to send money internationally online with credit card

As we’ve noted above, there are quite a few international payment providers which support credit card payments. From our selection of top picks above, you’ll usually find that Wise, Remitly, PayPal and WorldRemit offer international transfers paid for with a credit card.

The basic steps you’ll need to take to make a transfer online include:

- Pick your preferred online money transfer provider

- Register an account online on their website or in the their mobile app

- Set up your transfer by entering the payment amount, choose currency and enter recipient’s details

- Select the option to pay by credit card – check everything over and confirm when you’re ready

This way, you can send money abroad using a credit card. You can send money to your family in India, Mexico, the UK or anywhere else supported by the provider you choose.

How much does it cost to send money overseas using your credit card?

When you send money overseas with a credit card you may pay the following fees:

- Provider’s transfer fee – often low or even waived entirely

- Exchange rate markup – paid to the transfer service, often about 3% of the transfer amount

- Third party charges to intermediary banks – if your payment is processed via SWIFT and sent to a bank account

- Cash advance fee to your credit card issuer – often a fixed amount or percentage fee of around 3% – 5%, detailed in your card terms and conditions

- Interest to your credit card issuer – may start to accrue immediately once you get a cash advance or make a payment

Not all fee types will apply to all payments – but you’ll want to check out exactly which charges can apply to your transfer to make sure you’re not charged more than you’re expecting.Comparing International Transfer Fees

The best way to find the cheapest and easiest option for your international payment is to compare a few providers. In most cases the fees you pay will depend on the payment details – but here’s a roundup of the providers we looked at earlier, and the rates and fees that usually apply to international transfers:

| Provider | International credit card transfer fee | Exchange rate |

|---|---|---|

| Wise fees | Low and transparent fees which varies by destination country | Mid-market exchange rate |

| PayPal | 5% (0.99 USD – 4.99 USD) | Mid-market exchange rate + 3% or 4% |

| WorldRemit | Fees vary by payment type and destination country | Mid-market exchange rate + variable markup |

| Remitly | Fees vary by payment type and destination country | Mid-market exchange rate + variable markup |

When you pick an international payment provider it’s important to look at both the fees and the exchange rate applied. Picking a provider which uses the mid-market exchange rate can often be the cheapest option out there, particularly for higher value payments.

Comparing Domestic Transfer FeesAnd here’s a rundown of the typical fees for the providers we featured earlier which offer domestic transfers paid for by credit card.

| Provider | Domestic credit card transfer fee |

|---|---|

| Wise | 2.92 USD + 4.3% |

| PayPal | 0.3 USD + 2.9% |

| Venmo | 3% |

| CashApp | 3% |

How long does it take to send money with a credit card?

Credit card transfer times may depend on the provider you pick, transfer amount and currency. Many of the providers we featured earlier like PayPal and Venmo offer instant domestic transfers.

International transfers can sometimes take a little longer to process, but you may also be able to transfer money instantly with credit cards – even if the payment is headed overseas.

Card payments, including credit and debit cards, are often one of the fastest ways to get your money moving, even across borders.

- WorldRemit: In most cases, transfers sent using cards arrive within minutes.

- Wise: Debit and credit card payments tend to be instant.

- Remitly: Delivery speeds vary according to destination, but money transfer services, like making a credit card transfer, have quick processing times, with some recipients receiving money in a matter of minutes.

- PayPal: Paypal offers instant transfers subject to fees and if you’re using a credit card to send money to someone else’s PayPay account, the transfer tends to be instant.

- Venmo: Instant transfers made by Visa or Master cards usually take 30 minutes, although this depends on your card provider. If your card is listed as a payment method but isn’t eligible for an instant transfer when you select it, this means that your provider doesn’t participate in Venmo’s instant transfer service.

- CashApp: CashApp offers standard deposits which take 1-3 days and instant deposits which are instant.

Send money with a credit card instantly

If time is of the essence, some providers offer instant transfers for when you need to send and transfer money fast. For example;

- Wise transfers paid with credit cards are faster and payments are normally instant compared to bank transfers, which usually take longer.

- WorldRemit and Remitly also offer fast delivery for debit and credit users, transferring your money within minutes. Simply enter the account details and your money will be transferred instantly.

- PayPal, Venmo and Cashapp also offer instant transfers, but with linked Visa or Mastercard debit cards.

Best ways to transfer money from a credit card to a bank account

If you need to send a payment to someone from your credit card, or move money from your credit card to a bank account in your own name, you may have a few different options. Exactly what you’re able to do will depend on the credit card you hold – and the processes and fees may vary based on which option you pick.

We’ll look in more detail at these common ways to transfer money from a credit card to a bank account:

- Use your card to fund a standard bank transfer or wire transfer

- Send a payment with a money transfer provider

- Get a cash advance and deposit the funds into your bank

Sending a wire transfer using credit card

Some banks allow credit card users to arrange wire transfers paid for using the credit line on their card. If this is possible you’re likely to find it listed as an option within your online banking service – or you can call into a branch to ask if it’s available directly.

If you’re setting up the bank wire from your credit card online, the basic steps are likely to look like this:

- Log into your online banking service

- Look for the wire transfer option and enter the payment amount and currency

- Add your recipient’s banking information

- Select the option to pay using your credit card

- Check over the fees and exchange rate, and confirm – you may need to complete a security step at this stage

Using an online money transfer provider

There are quite a few options to send money with a credit card both locally in the US and internationally through a specialist service. Dedicated online money transfer companies can often offer faster transfers, and may have lower fees and better exchange rates for international payments compared to your bank. Most providers like Wise, Remitly and WorldRemit accept credit cards as a payment method.

Here’s how to make a payment by credit card through an online money transfer provider:

- Compare a few online money transfer providers to see which has the lowest overall costs for your transfer

- Register an account – this can be done online or in the provider’s app

- Set up your transfer by entering the payment amount, currency and recipient’s details

- Select the option to pay by credit card – check everything over and confirm when you’re ready

It’s worth noting that compared to other payment methods, such as prepaid cards, paying by credit card can be relatively pricey. However, it may still be cheaper overall compared to using your bank to make a wire transfer. Compare the payment options for your preferred provider to check you’re getting the best available deal.

Getting a cash advance

Most credit cards allow customers to get a cash advance by either withdrawing funds from an ATM or visiting a branch of the issuing bank for counter service. This can be convenient – but it’s often expensive. While each card is different, it’s common to find there’s a cash advance fee to pay, plus interest charges which start to accrue instantly. Usually your options to get a credit card cash advance will include:

- Use your card to make an ATM withdrawal if you have an active PIN

- Visit a branch of the issuing bank and ask for a cash advance over the counter

- Write yourself a check if you’ve been issued a checkbook with your credit card

It’s also worth noting that other types of credit card transactions, including making peer to peer payments and some money transfers, could incur cash advance fees. Double check the terms and conditions of your specific card to make sure you’re not caught by surprise.

What to consider before sending money with a credit card

Using a credit card to send a payment can be fast and convenient, but it’s not always the cheapest option. Here are a few things to think about before you get started:

- Your card issuer is likely to charge extra fees which can include a cash advance and foreign transaction fee if you send in a different currency

- You’ll usually find you pay interest instantly when you pay for a transfer with credit card, and the rate may be higher than the purchase rate applied

- The way you use your credit card, including the amount you spend and the way you repay, can impact your credit score

Pros and cons of sending money overseas with a credit card

| Pros of sending money with a credit card | Cons of sending money with a credit card |

|---|---|

|

|

When you might want to use a credit card to send money

We’ve already mentioned that sending money with a credit card can be a costly option. However, it does still have some advantages, depending on the situation. While you probably don’t want to reach for your credit card to make frequent payments, here are some occasions on which you might prefer it:

Emergencies: If you have an emergency and need to get money to someone fast, you may find using a card – including credit and debit cards – is the quickest option available. This is especially relevant if you’re sending a payment to someone who can’t easily access a bank. In this case, specialist services like MoneyGram and Western Union can help you make a transfer to someone which can be picked up in cash, or PayPal can be used for transfers to other PayPal accounts globally.

Reward Points: You may also consider using your credit card for more frequent transactions if you’re earning rewards or cashback on your spending. Before you decide to use your credit card to send a payment in order to earn rewards, double check you’ll actually earn points on your payment – and weigh up the extra costs you’ll need to pay against the benefit of the extra rewards.

Are the fees worth it?

Most services charge extra fees for using credit cards to send money domestically or in the US. If you are able to consider alternative payment methods – like a debit card or ACH transfer – you’re likely to reduce the overall costs of your transfer.

Can I use a credit card to send cash to someone?

Yes, although not all money transfer services provide this option, and coverage usually depends on the country you’re sending to. Check out providers like Western Union and Remitly, which offer credit card payment options for transfers that can then be collected in cash through an agent.

Can I use my credit card for Western Union?

Yes. Western Union allows credit card payments in the US when you set up your transfer online or through their app. Fees can be higher when paying with credit card, so you’ll need to weigh up the convenience and cost for your specific transfer.

Western Union accepts Visa, MasterCard, and Discover credit cards for transfers made on their website and mobile app. For transfers made via phone, they accept Visa and MasterCard credit cards, while American Express and Discover cards are not accepted for telephone money transfers.

Using a credit card to transfer money domestically

If you want to send a payment to someone in the US with a credit card, you’ll be able to pick from the payment providers below. It’s worth noting though that not all US payment providers can support credit card payments – Zelle for example will only let you link a debit card, not a credit card, to use its services.

Wise – Domestic payments in the US are available online or in the Wise app, with Visa and Mastercard credit cards supported

Venmo – Fast and popular for social payments and split bills, but paying with credit card has extra fees

CashApp – Send payments in USD easily with just a name or $Cashtag – unlike with some payment types, you’ll be charged a fee to pay with credit card though

PayPal – Deposit instant payments to PayPal accounts globally – there are fees for credit card payments internationally and locally in the US

Alternatives to sending money with a credit card

If it’s not absolutely essential that you pay with a credit card, it’s good to know that there are cheaper, faster and better ways of sending money abroad.

- Wire transfer – Fast way to move money domestically and internationally, although bank wire fees for overseas payments can be high

- Connected bank account (ACH) – Send money locally in the US, or use an ACH transfer to send money internationally for a lower fee, with a specialist provider

- Debit card – often one of the cheapest options to send payments with a specialist, which can result in a fast, or even instant transfer wherever you need your money to go

Specialist money transfer providers such as Wise and WorldRemit often accept more than one payment method. You can transfer money fast with low fees, and better exchange rates while choosing the best payment method for yourself.

Conclusion: International money transfer using credit card

Transferring money from a credit card can be easy and fast, but the high fees involved will make this an option most people want to reserve for emergencies.

Using your credit card to send a payment via your bank can mean relatively high fees, bad exchange rates if you’re sending internationally and immediate interest charges. If you need a more cost-effective method, you might want to consider cheaper alternatives.

For domestic transfers, PayPal, Wise and Venmo can be good alternatives with fast payments and transparent fees. If you are looking to send money internationally, Wise, WorldRemit and Remitly offer speedy transfers, good exchange rates and lower fees compared to many banks.

FAQs on send money abroad with a credit card

Can I make a SWIFT payment with a credit card?

SWIFT payments involve using an intermediary bank to facilitate the sending and receiving of electronic payments globally. This network uses SWIFT codes to send payments abroad quickly and safely, rather than physically transferring money and allows you to send money via electronic or credit card payments.

Can I use a credit card to make a wire transfer?

Yes, you can use a credit card to make a wire transfer. However, they are usually expensive as they tend to be treated as a cash advance by the card issuer, due to the fact that the money is credit. This means that you’ll end up paying a cash advance fee alongside a high interest rate as well as the wire transfer fee itself.

Can you transfer money with a credit card?

Yes. Transfer money with a credit card by getting a cash advance, sending via the bank that issued the card, or using a specialist online money transfer service like Wise, Remitly or WorldRemit. .

How long does it take to transfer money from a credit card to a bank account?

The amount of time it takes to transfer money from a credit card to a bank account can vary, but it’s usually one of the fastest methods around – payments may even arrive pretty much instantly.

How much does it cost to transfer money from a credit card to a bank account?

Moving money from your credit card to a bank account is usually expensive, with cash advance fees and interest to pay on top of any specific transfer fees.

How can someone pay me with a credit card?

If someone needs to send you money and they want to pay with a credit card, using a third party specialist service like Wise, Remitly or Western Union can be a convenient option. Payments are arranged online or through an app, and can be deposited to your bank account or collected in cash, depending on the service selected.

Can I use my credit card for Remitly?

Yes. You can set up a Remitly payment and pay with your credit card for convenience. As always, fees may apply from your card issuer, so you’ll need to make sure you understand the full cost before you confirm.