Wells Fargo Card International Fees [2026]

Wells Fargo offers a range of debit cards you can link to checking and other accounts for day to day use, and credit cards which have features and benefits designed to suit different customer needs.

In this guide we’ll take a look at the fees you’ll run into when you use a Wells Fargo card internationally – either when you travel or when you’re shopping online with a retailer based overseas. We’ll cover the fees, limits, exchange rates, and we’ll also provide some alternatives like Wise and Revolut that could offer better travel card options with low transaction fees and better exchange rates.

| Table of Contents |

|---|

Quick summary: Wells Fargo foreign transaction fees

- Wells Fargo charges a 3% foreign transaction fee on international purchases. That means, you’d be paying $30 in fees on a $1000 purchase.

- Alternatives like Wise and Revolut cards do not have foreign transaction fees, and there are no fees applied when you’re spending in a currency you hold enough balance in your account.

- Exchange rates for Wells Fargo cards may include a markup on the mid-market rate, which could result in less favorable rates.

- Wells Fargo’s international ATM withdrawal limits vary by account and card type, with specific limits provided once your card has been issued.

- Wells Fargo cards can be used internationally online, but it’s important to be aware of foreign transaction fees.

| FAQs | Answers |

|---|---|

| Can I use my Wells Fargo debit card internationally? | Yes. Wells Fargo debit cards and credit cards can be used internationally anywhere the card network is accepted. |

| Do Wells Fargo cards have foreign transaction fees? | Wells Fargo charges a 3% foreign transaction fee when you use your debit card in a currency other than USD. However, some credit cards, like the Wells Fargo Autograph Visa card, have 0% foreign transaction fees. |

| How do I avoid Wells Fargo international fees? | You can’t always avoid international ATM fees with Wells Fargo. That’s why picking a specialist provider like Wise or Revolut, which offers some no-fee international withdrawals could be a better alternative. |

| Do I need to tell Wells Fargo I’m traveling internationally? | No, there’s no need to inform Chase of your travel plans, even when traveling abroad. However you should confirm your contact information is up to date so that Wells Fargo can get in touch if they detect any unusual activity. |

Wells Fargo cards foreign transaction fees (debit and credit cards)

Foreign transaction fees apply whenever you transact in a currency other than USD with your Wells Fargo cards. They’re often used for both credit and debit card purchases and withdrawals – although some cards which are designed specifically for travel may waive these fees.

Here are the foreign transaction fees for Wells Fargo debit cards, as well as some of the most popular credit cards available from this bank, including the Wells Fargo Active Cash. This card replaces the previously available Wells Fargo Cash Wise Multi-Currency Card.

| Card | Wells Fargo foreign transaction fee |

|---|---|

| Wells Fargo debit cards | 3% |

| Wells Fargo Active Cash credit card | 3% |

| Wells Fargo Reflect card | 3% |

| Wells Fargo Autograph Visa card | 0% |

| Wells Fargo Autograph Journey card | 0% |

*Correct as of 22nd May 2024. Please note that the card terms of the credit cards feature can change over time. You should always get your information directly from Wells Fargo for the most up to date information.

Foreign card transaction fees from alternative providers include:

- Wise – No foreign transaction fees, it’s free to spend from any currency you hold enough balance in your account.

- Revolut – No-fees applied to spend any currency you hold enough balance in your account

- Chase – 3% foreign transaction fee

How does Wells Fargo compare on international fees?

To set the scene let’s look at how Wells Fargo compares generally on international fees when you use your credit card, debit card, or checking account. We’ll compare Wells Fargo to another major US bank – Chase – and a couple of specialist alternatives, Wise and Revolut.

| Service/fee | Wells Fargo | Wise | Revolut | Chase |

|---|---|---|---|---|

| Card order/annual fees | No annual fee | 9 USD card order fee – no annual or monthly fee | No fee to order the card | Credit cards available from 0 – 550+ USD annual fee No annual fee for debit cards |

| Account maintenance fees | Checking accounts may have maintenance fees – varied by account | No fee | 0 – 16.99 USD/month varying feed based on account tier | Checking accounts may have maintenance fees – varied by account |

| International transaction fees | 0-3% | Free to spend any currency you hold enough of in your account (in 40+ supported currencies) | No-fees applied to spend any currency you hold enough of in your account (in 25+ supported currencies) | 3% where applied |

| International ATM withdrawals | Credit cards – 10 USD or 5% cash advance fee applies Debit cards – 5 USD | First 2 withdrawals up to combined value of 100 USD in value – no Wise fee After that, 2% + 1.5 USD per withdrawal | No-fees applied up to 400 USD/month 2% after that | Credit cards – 10 USD or 5% cash advance fee applies Debit cards – 5 USD |

| Exchange rate | Visa/Mastercard rate for card spending International money transfer rates include a markup | Mid-market exchange rate | Mid-market exchange rate to account limits | Visa/Mastercard rate for card spending International money transfer rates include a markup |

| International money transfer | No fee for online and mobile payments 35 USD for branch or phone payments

| Low and transparent fees, starting from 0.35% | International transfers of $200 USD or greater will incur a fee of up to 5% on the transaction amount. International transfers less than $200 USD will incur a fee of up to $10.00, depending on the amount of the transfer. | Online and mobile payments – 5 USD for payments under 5,000 USD, waived above that amount 50 USD for branch or phone payments |

*Information correct at time of writing: 22nd May 2024.

**Credit cards featured are the Wells Fargo Active Cash Card and the Chase Freedom Unlimited Card – card terms change over time, and other credit cards are available from these banks, which may have varied terms.

As you can see, the international fees used by both Wells Fargo and Chase are relatively similar. While big banks offer a broader range of services than many specialist providers, they may also have higher fees for transacting internationally compared to providers which have been built to bring down the costs of currency conversion and overseas spending.

Alternatives like Wise and Revolut use different approaches to international fees, which can mean lower overall costs and more transparency. More on these alternative options a little later.

Wells Fargo card alternatives

Using your normal bank card when you’re overseas can be convenient – but it’ll probably also be pretty expensive compared to alternatives. Here’s a reminder of some of the costs involved with Wells Fargo and if you choose a card from a different provider for your overseas spending.

| Service/fee | Wells Fargo | Wise | Revolut | Chase |

|---|---|---|---|---|

| Card type available | Credit and debit cards | Wise Multi-Currency Card | Revolut debit card | Credit and debit cards |

| Card order/annual fees | No annual fee | 9 USD card order fee – no annual fee | No fee | Credit cards available from 0 – 550+ USD annual fee No annual fee for debit cards

|

| International transaction fees | 0-3% | Free to spend any currency you hold in your account (40+ supported currencies) | No-fees applied to spend any currency you hold in your account (25+ supported currencies) | 3% where applied – some travel credit cards may waive this fee, but come with an annual charge |

| International ATM withdrawals | Credit cards – 10 USD or 5% cash advance fee applies Debit cards – 5 USD

| First 2 withdrawals up to combined value of 100 USD in value – no Wise fee After that, 2% + 1.5 USD per withdrawal* | No-fees applied to 400 USD/month 2% after that | Credit cards – 10 USD or 5% cash advance fee applies Debit cards – 5 USD

|

| Exchange rate | Visa/Mastercard rate for card spending | Mid-market exchange rate | Mid-market exchange rate to account limits | Visa/Mastercard rate for card spending |

Information correct at time of writing: 22nd May 2024. *The ATM operator may charge their own fees

If you’re planning to travel, having a few different means of payment can make sense – then you’ll always have a back up plan if your primary payment method doesn’t work for any reason. Instead of relying on your normal bank’s credit or debit card, why not get a specialist account and card from an alternative provider to use when you travel – you could cut your costs and get a better exchange rate, and some services offer cards and accounts with no ongoing fees to worry about. Here’s a bit more about the providers we picked out:

Wise Multi-Currency Card

💡 Great for: Low cost currency conversion, and a digital account to hold 40+ currencies with no ongoing fees

- Foreign fees: No foreign transaction fees. Currency conversion fees from 0.35%.

- Exchange rates: Mid-market exchange rate

Open a Wise Account online or in the Wise app, to hold 40+ currencies all in the same place. When you convert currencies in your account, send payments, or to spend with your card, you’ll get the mid-market exchange rate and low fees from 0.35%. There are no ongoing costs and no minimum balances, so you can simply use your Wise Multi-Currency Card whenever you travel and just pay for the services you need.

Is it safe to use internationally? Yes. Wise is fully regulated, and you can freeze and manage your card in the Wise app, with instant transaction notifications so you’re always in control

Learn more: Wise Multi-Currency Card review

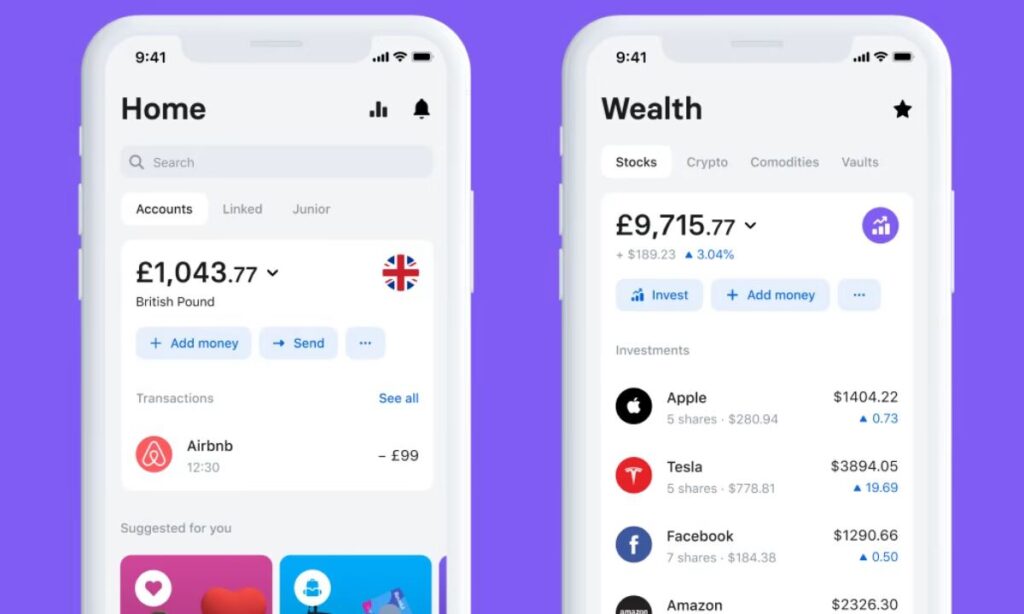

Revolut debit card

💡 Great for: Choice of account plans with high no-fee international ATM withdrawals

- Foreign fees: No foreign transactions fees, and no ATM fees to 400 USD/month

- Exchange rates: Mid-market rate to your plan limits. There is a 1% currency exchange fee outside of foreign exchange market hours.

Revolut accounts offer a fairly broad range of features – with good international options even with the standard plan without monthly fees. You’ll be able to hold 25 currencies, withdraw internationally up to 400 USD no-fee, and get currency conversion up to 1,000 USD/month without fees on the standard plan. If you’re happy to pay a monthly fee you can unlock even more travel benefits like lounge access and insurance.

Is it safe to use internationally?: Yes. Revolut cards can be managed in the app and Revolut is licensed in a range of countries

Learn more: Revolut card review

Chase cards

💡 Great for: Select Chase travel credit cards have no foreign transaction fee and offer rewards when you spend on travel

- Foreign fees: Debit cards have a 3% foreign transaction fee, credit card fees vary and can include foreign transaction fees, annual charges and interest

- Exchange rates: Visa/Mastercard network rate

Chase has a range of cards which you might consider if you’re looking for a credit card which can be used overseas. Some Chase travel reward cards waive the foreign transaction fee, and reward travel spending – but they’ll usually mean paying an annual fee of anything up to 550 USD, so you’d want to weigh up the overall costs. Chase cards are available on both the Visa and Mastercard networks, and are accepted globally.

Is it safe to use internationally? Yes. Chase is a large international bank which is fully regulated and licensed

Can I use my Wells Fargo card internationally?

Wells Fargo issues debit cards primarily on the Visa network, and has a range of credit card options which are mainly Visa, but with one option if you’d prefer a card on the Mastercard network.

Visa and Mastercard are both widely globally accepted, which means you shouldn’t run into any issues using your Wells Fargo cards overseas – just look out for the network symbol when you shop or make withdrawals.

If you’re a Wells Fargo customer, using your bank issued cards internationally may be convenient and secure. However, it may not be necessarily the cheapest way to spend in foreign currencies, due to Wells Fargo foreign transaction fees and currency conversion fees.

This guide looks in detail at the fees you pay when you use Wells Fargo internationally – and some ways to cut or avoid these charges.

Does Wells Fargo charge foreign transaction fees?

Wells Fargo charges foreign transaction fees whenever you use your card for making international purchases. These fees are usually 3% of the total transaction amount and will depend on your specific Wells Fargo card. We’ll cover the fees in the next sections.

Digital banking solutions such as Wise and Revolut make great alternatives if you’re looking to avoid these fees and offer international money transfer services without charging a foreign transaction fee. We’ll cover more on them later, and see how they compare to Wells Fargo cards for international transactions.

Wells Fargo international ATM fees

ATM cash withdrawal fees apply when you want to withdraw money from your account when you are abroad. Fees can also apply when you use an ATM to check your balance or get a statement.

ATM costs vary depending on whether you’re using a credit or debit card – here’s a rundown of the key costs to know about for the cards we featured above – don’t forget you’ll also be paying the 3% foreign transaction fee if it applies to your card type.

| Card | ATM withdrawal fee | ATM inquiry fee | ATM operator fee |

|---|---|---|---|

| Wells Fargo debit cards | 5 USD | 2.5 USD | Varies depending on country and ATM |

| Wells Fargo Active Cash credit card | 10 USD or 5% cash advance fee applies + interest | Not available | Varies depending on country and ATM |

Here’s a reminder of the total costs of ATM withdrawals from the providers we looked at earlier, as a comparison:

- Wise Multi-Currency Card – First 2 withdrawals up to combined total of 100 USD – no Wise fees; 2% + 1.5 USD per withdrawal after that

- Revolut debit card – No-fees applied to 400 USD/month; 2% after that

- Chase credit cards – 10 USD or 5% cash advance fee applies; Debit cards – 5 USD

Wells Fargo card exchange rates

If you’re using Wells Fargo to get foreign currency, send a wire, cash a foreign check or similar, you’ll get the Wells Fargo exchange rate. This will include a markup on the mid-market rate – which means you’ll get a worse rate than the one you find on Google or using a currency converter.

When you’re spending with a Wells Fargo card, the chances are that the exchange rate you’ll get will be set by the network the card was issued on – Visa or Mastercard. The rates used by card networks are generally considered to be quite fair.

However, there are a couple of issues – firstly the rate you get will be the one that’s live when your payment is processed, not when you actually make the purchase. That means you’ll only be able to see the applicable exchange rate after you have already paid. And secondly – usually the bigger issue – even where the network rate is good, you’ll still have to consider the foreign transaction fee used by the bank. At about 3% usually, this pushes up the costs, effectively meaning you get a worse exchange rate overall.

One final hurdle to know about when using a card overseas – dynamic currency conversion (DCC). This is where you’re asked if you’d rather pay in USD or the local currency where you are.

Paying in USD sounds easy because you don’t need to work out the currency conversion to see exactly what your purchase cost. However, it’ll actually mean you get an exchange rate set by the merchant, which can also include extra fees. Avoid DCC by asking to pay in the local currency wherever you are – this will help you avoid surprise costs and poor exchange rates.

Exchange rates from our alternative list of providers include:

- Wise – Mid-market exchange rate

- Revolut – Mid-market exchange rate to account limits

- Chase – Visa/Mastercard rate for card spending. International money transfer rates include a markup

Wells Fargo currency exchange fees

Wells Fargo uses the Visa/Mastercard rate for card spending and international money transfer rates include a markup, which means you could pay more in hidden fees. There are no fees for online and mobile international money transfers but there is a 35 USD fee for branch or phone payments.

Wise – Wise uses the mid-market exchange rate with no foreign transaction fees and low fees from 0.35%.

Revolut – Revolut also uses the mid-market exchange rate up to account limits.

Chase – Chase uses the Visa/Mastercard rate for card spending and international money transfer rates include a markup.

Wells Fargo card foreign transaction limits

Wells Fargo cards are subject to limits, which can vary based on the card type. If you have a debit card you can see the applicable limits in your online banking. Credit card holders will be able to find the limits in the card terms and conditions. If you’re making an ATM withdrawal the ATM operator may also apply limits – which can be lower than those your own bank uses.

Wells Fargo international ATM withdrawal limits

International ATM withdrawal limits for Wells Fargo vary depending on the account and card and are subject to the available balance in your account. You’ll receive your withdrawal limit, alongside other important information such as purchase limits, when your card is issued and you can confirm or manage your card’s daily limits through the Wells Fargo website as well as the app or by calling the number on the back of your card.

Here are the ATM withdrawal limits for the alternative providers we looked at earlier:

- Wise – Daily default limit of $250 and maximum limit of $1,000. Monthly default limit of $1,500 and maximum limit of $6,000

- Revolut – Withdrawal limits are determined by how long your account has been active. There is a daily limit of $550 and weekly limits of £1,050 for accounts opened within 120 days and a daily limit of $1,050 and weekly limit of $1,750 for accounts that are older than 120 days.

- Chase – $500 a day

Are Wells Fargo cards Visa or Mastercard?

Wells Fargo issues both Visa and Mastercard credit cards. Their cards are mainly on the Visa network but the specific network (Visa or Mastercard) will depend on the type of Wells Fargo credit card you have.

How to avoid foreign transaction fees

The chances are you’ll run into some fees when you transact internationally. However, there are a few ways you can help understand and limit the costs involved:

- Read your card terms and conditions to look at international ATM and foreign transaction fees in particular

- Avoid using a credit card for cash withdrawals if possible – fees tend to be high and you’ll pay interest immediately

- Watch out for extra fees imposed by ATM operators – these are usually shown on screen before you confirm a withdrawal

- Always pay in the local currency to avoid the high costs associated with DCC

- Check your network’s exchange rate – available online – so you can see what to expect

- Use a card from a specialist service like Wise or Revolut to get transparent fees and a better exchange rate

If you’re interested, you can check out our other guides from this series:

- Best cards without foreign transaction fees

- American Express foreign transaction fees

- Capital One foreign transaction fees

- Chase foreign transaction fees

- Discover foreign transaction fees

- Bank of America foreign transaction fees

Wells Fargo no foreign transaction fee credit card

Wells Fargo also offers credit cards with no foreign transaction fees, making them a great option for frequent travelers. These include the Wells Fargo Autograph Visa Card and the Wells Fargo Autograph Journey Card, which both offer a range of attractive features and benefits.

Wells Fargo Autograph Visa Card:

- Annual fees: None

- Bonus points: 20,000 points when you spend $1,000 in the first 3 months

- Rewards: 3X points on restaurants, travel and more

- Additional features: Travel and emergency services assistance, cellular telephone protection,

Wells Fargo Autograph Journey Card:

- Annual fees: 95 USD annual fee

- Bonus points: Earn 60,000 points after spending $4,000 in the first 3 months

- Rewards: 5X points on hotels, 4X on airlines and 3X on restaurants

- Additional features: Lost baggage reimbursement, trip cancellation and interruption protection and travel and emergency services assistance

For more options, read our guide on Best cards with no foreign transaction fees.

Can I use my Wells Fargo card internationally online?

Yes, you can use your Wells Fargo card internationally for online transactions, and Wells Fargo’s cards, including credit and debit cards, are generally accepted by most online merchants worldwide. When making international online purchases, it’s important to be aware of any foreign transaction fees that may apply, which is 3% of the transaction amount, depending on your specific card.

Conclusion: Wells Fargo card international fees

Wells Fargo has a good selection of credit and debit cards – most of which are issued on the Visa network. All Wells Fargo cards should work internationally wherever the card’s network is accepted – however, there’s often a 3% foreign transaction fee, plus ATM withdrawal costs if you’re overseas.

Alternative providers like Wise and Revolut may be able to offer better exchange rates and a more flexible way to manage your money across currencies when you spend online with international retailers or travel.

Wells Fargo foreign transaction fees FAQs

Does Wells Fargo waive foreign transaction fees?

Wells Fargo waives foreign transaction fees on certain credit cards, like the Wells Fargo Autograph Visa Card, which has 0% foreign transaction fees.

Does the Wells Fargo debit card have foreign transaction fees?

Yes. There’s a 3% foreign transaction fee when you spend with a Wells Fargo debit card in a currency other than USD.

How do I know if I have to pay foreign transaction fees?

Check your card or account terms and conditions to spot any foreign transaction fees that will apply to your account.

—–

Some of the Wells Fargo debit and credit cards are not included in this guide because they are no longer available for new customers. These cards include:

- The Wells Fargo Propel American Express® card

- Fargo Cash Back College Card – The Wells Fargo Cash Back College℠ Card

- Wells Fargo Cash Wise Visa card: The Wells Fargo Cash Wise Visa®

- Wells Fargo Platinum Card

- Hotels.com Rewards Card

Sources: You can find all Wells Fargo credit cards here, and Wells Fargo debit cards here.