Remitly Review [2026]: Transfer fees, exchange rates and speed

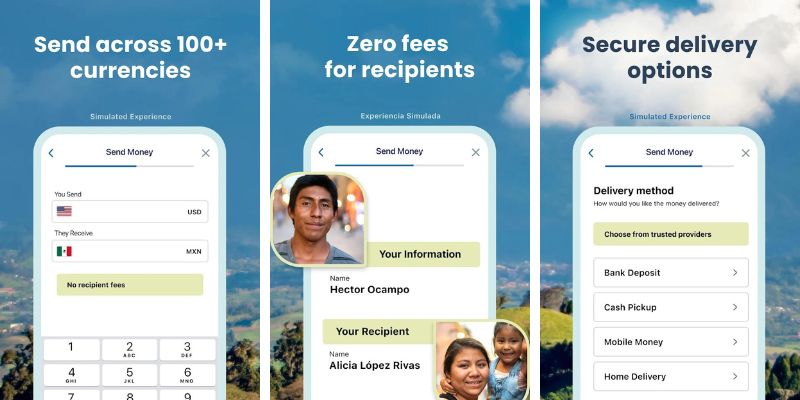

Remitly lets you send a payment overseas from the US in about 100 currencies, on popular remittance routes globally. You’ll set up your transfer online or in an app, and then you can choose to have your money deposited in the recipient’s bank or mobile money account, collected in cash or in some cases delivered to their door. Fees, features and services vary depending on the destination country.

Read on for our Remitly review looking at the full picture including fees, whether it’s safe to use, how fast it is, how to get set up, and more

Remitly is good for

- Personal payments on common remittance routes

- Great range of pay out options including cash collection

- Choose faster Express payments or cheaper Economy transfers

- Multiple language support including Spanish

Remitly: Key points

Key features:

- International transfers in 100+ currencies

- Pay out options include bank and mobile wallet deposit, cash collection and cash home delivery

- Intended for personal transfers only

- Fully digital service, online and in-app

- Fee schedule varies based on the value of payment, pay in and pay out method, as well as destination

Key stats:

Established in: 2011

Send money to: 100+ currencies

Payout options: 4 available: bank and mobile wallet deposit, cash collection and cash home delivery

| Remitly pros | Remitly cons |

|---|---|

| ✅ Safe and established provider ✅ Good range of supported countries and currencies ✅Lots of pay out options available ✅ Pick Express or Economy services depending on whether speed or price is more important | ❌ Exchange rates include a markup ❌ Fees and services vary by transfer type ❌Not all delivery methods are available in all countries |

Overall:

Remitly offers personal transfers in 100+ currencies from the US. You can send money on many common remittance routes, for cash collection or delivery, or to be deposited to a bank or mobile money account. The range of services and how they’re priced does vary quite significantly between countries, so you’ll need to check what pay out options are available for your specific destination, as well as the fees and rates.

How much can I save with Remitly?

Remitly’s fees vary quite a bit depending on where you’re sending money to, how you want to pay, and how you want the money to be received in the end. It’s a smart idea to compare a few providers against your bank to find the best value for your payment – but a specialist service can often offer a cheaper transfer with better exchange rates. Here’s a quick comparison of Remitly against Chase bank, on a payment sent to a bank account. We’ve looked at several different transfer values to illustrate:

| Transfer details | With Remitly your recipient gets | With Chase your recipient gets | Result |

|---|---|---|---|

| Sending 1,000 USD to EUR | 913.50 EUR | 888.62 EUR | Your recipient could get 24.88 EUR extra with Remitly |

| Sending 5,000 USD to EUR | 4,567.48 EUR | 4,488.05 EUR | Your recipient could get 79.43 EUR extra with Remitly |

| Sending 10,000 USD to EUR | 9,135.96 EUR | 8,977.07 EUR | Your recipient could get 158.89 EUR extra with Remitly |

What is Remitly?

Remitly has been around since 2011, and offers digital remittance services you can have paid out to bank accounts, mobile money accounts, collected in cash or even delivered to your recipient’s door. Remitly is only for personal payments and focuses services on people working overseas and sending money home.

Remitly international money transfers

You can send a personal payment with Remitly from the US in 100+ currencies. That’s handy for people sending money to loved ones. Because Remitly also offers deposits to mobile money accounts or for cash collection, it’s easy to get money to someone who doesn’t have easy access to a bank account, too. Just send for cash collection and they’ll be able to collect their money at a nearby agent when they’re ready.

Great for: Personal payments on popular remittance routes, particularly for cash collection and mobile wallet deposit.

How does Remitly work?

You’ll need to register an account to send your first Remitly payment. However, this is very easy to do with just your personal information and SSN or ITIN. Once you’ve set up your account you can send a payment under 3,000 USD, before you need to provide further documents for verification.

To send a payment you’ll just log in online or in the Remitly app, select the country you’re sending to and use the dropdown boxes to navigate your send options in the destination. Different services and fee structures are available in different countries.

Is Remitly safe to send money?

Remitly is a registered Money Services Business with the US Department of Treasury.

That means that Remitly is safe as long as you use it as the service is intended. You should only send money to people you know and trust.

Learn more: Is Remitly safe?

How safe are my Remitly login details?

Very safe. Remitly offer extensive security measures through the account verification process including:

- Two factor authentication (2FA) feature to make accessing your account more secure

- Phone verification sent to your phone when you sign in to Remitly with your password

- Internet security – Secure Socket Layer (SSL) with 256-bit encryption, which is the industry standard

In the European Union and the UK, 3D Secure (3DS) is a security feature used on card payments. It helps reduce the risk of someone else using your card without you knowing about it.

Remitly pricing

You’ll often find you can make a couple of different types of Remitly transfer: Express or Economy.

Economy Service – Offers a longer delivery time frame (3 to 5 business days) at lower transfer fees.

Express Service – Offers a much shorter delivery time frame (minutes) at higher transfer fees.

The amount depends on where you’re from and where you’re sending money to. Exchange rates are shown once you have selected which country and how much you wish to send.

Remitly often offer new customers or first time users promotional rates and fees and if you are an existing customer, available promotions will appear on the green banner at the top of the page.

How long does Remitly transfer take?

You can make money transfers overseas within minutes when paying with a debit card and selecting the Express option.

Transfers using the Economy option and paying by your bank account will take 3 – 5 business days.

Remitly limits – How to increase your transfer limit

Like many money transfer service companies, Remitly has limits on how much money you can transfer.

Previously, Remitly offered accounts in 3 different tiers, which all had their own limits for payments in a 24 hour, 30 day and 180 day period. At the time of research (September 2024), Remitly is in the process of moving customers over to a new system which will give a higher, flat, limit per transaction, for verified accounts.

With the new system, Remitly will give a higher 30,000 USD limit per transaction, for verified accounts in the US. To increase your limit to 30,000 USD, you need to provide more identification.

In this guide, we covered Remitly limits and some alternatives with higher transfer limits: Remitly transfer limits

How to use Remitly

Here’s how to get started quickly with Remitly:

- Download Remitly app from Apple App store or Google Play store.

- Login and create an account. Provide your full name, date of birth, email address, last 4 digits of your SS number or ITIN.

- Choose the country and how much currency you want to send. Select Express or Economy speed.

- Provide details of where the international money transfer is going including full name, bank account details or mobile phone number or cash up location or home delivery.

- Pay Remitly.

Remitly will advise you where your money is and when it arrives via text message.

The details you’ll need when you’re sending money

If you’re sending money to a recipient’s bank account you’ll need their full banking information including account number of IBAN, bank name and address, and the SWIFT code. For cash collection transfers you usually just need the recipient’s name as shown on their government issued ID document.

Remitly payment methods

You can pay for your transfer from the US by credit or debit card, or with a bank transfer (ACH).

Payout methods

You can choose different pay out options depending on where you’re sending money to, including:

- Bank account deposit

- Mobile money account deposit

- Cash collection

- Cash home delivery

How to track Remitly transfer

Track your Remitly transfer online or in the Remitly app, once the money is on the way.

How to create an account

You can open a Remitly Tier 1 account instantly with the following information:

- Your full name

- Your residential address

- Your date of birth

- The last 4 digits of your SSN

You can then start to send a payment with no need to upload any documents. However, to increase your payment limits and reach a Tier 2 or 3 account you have to provide documents and more information about yourself. More on what documents are acceptable, and how Remitly’s account tier limits work coming up later.

What documents you’ll need

To increase your account limits you have to provide some paperwork, usually including proof of ID and address.

ID documents can include:

- Passport

- U.S. Military ID

- Permanent resident card (Green Card)

- Employment authorization card

- National ID issued by a foreign government

Proof of your address may be:

- A utility bill in your name

- A lease agreement

- A pay stub

- A bank or card statement

How long does Remitly verification take?

You’ll usually be able to send a payment pretty much instantly with a Tier 1 Remitly account, just by entering your name, address and the last few digits of your SSN or ITIN. If you’re upgrading to a higher tier account and need to have your documents checked, you may have to wait a day or two.

Do I need a bank account for Remitly?

You’ll need a bank account, credit or debit card to pay for your Remitly transfer. However, you can send money to someone who does not have a bank account by selecting cash collection as the delivery option.

Helpful hints

- Make sure your ID is valid and not expired

- Make sure it shows your full name, your current address and date of birth

Ways to receive your money

Different services are available in different destination countries. You may be able to choose the following pay out options:

- Bank account deposit

- Mobile money account deposit

- Cash collection

- Cash home delivery

Which countries can I send US dollars to from the United States?

Remitly accessibility

Remitly is available online and in an app, and you can chat to a team member when you have a problem. Chat is 24/7 and in English, French and Spanish. Phone services are also available 24/7 in English and Spanish. The app is available in an impressive list of languages for ease of use globally.

Remitly is mobile optimized

Remitly is extremely easy to use on your mobile phone as it was designed specially for mobile use. It’s mobile friendly for both the person sending the money and the person receiving the money. Their website and mobile app allows you to do the whole process including signing up, providing id, sending money overseas and tracking the delivery.

Remitly will send text message alerts so you can see where your money is during the transfer.

Supported currencies

You can send money in 100+ currencies from the US, with Remitly.

Money transfers can be sent from these countries:

United States, Australia, Austria, Belgium, Canada, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Malta, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Spain, Sweden, United Arab Emirates, United Kingdom

Money transfers can be received in these countries:

Algeria, Andorra, Anguilla, Antigua and Barbuda, Armenia, Australia, Austria, Barbados, Belgium, Belize, Benin, Bhutan, Bosnia And Herzegovina, Botswana, Brazil, Brunei Darussalam, Burundi, Cabo Verde, Cambodia, Canada, Cayman Islands, Chile, China, Colombia, Congo Brazzaville, Costa Rica, Croatia, Cyprus, Czech Republic, Côte d’Ivoire, DR Congo, Denmark, Dominican Republic, Ecuador, Egypt, Equatorial Guinea, Estonia, Finland, France, Georgia, Ghana, Gibraltar, Greece, Guatemala, Guinea, Guyana, Hong Kong, Hungary, India, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kenya, Kuwait, Lesotho, Malawi, Malta, Moldova, Mongolia, Montenegro, Mozambique, Nicaragua, Nigeria, Norway, Pakistan, Philippines, Poland, Portugal, Puerto Rico, Qatar, Romania, Rwanda, Samoa, San Marino, Saudi Arabia, Senegal, Seychelles, Slovakia, Solomon Islands, South Africa, Spain, Sri Lanka, Suriname, Sweden, Switzerland, Tajikistan, Tanzania, Timor Leste, Trinidad and Tobago, Turkmenistan, Uganda, United Kingdom, United States, Uruguay, Uzbekistan, Vanuatu, Zimbabwe.

Remitly reviews

Remitly scores 4.1 out of 5 stars on TrustPilot, which aggregates live customer review data.

Over 80% of customers give a 5 star review, with customers commonly commenting on the reliability and ease of use of the service. Where customers have been less impressed with the service, the issue is commonly around security checks and verifications being required. These can slow down a payment or even mean that Remitly can not process the transfer requested.

Is Remitly trusted?

Yes. Remitly has a loyal customer base, and is a trustworthy service. In fact, Remitly offers a money-back guarantee, so if you’re not completely happy with their service, they will refund you.

Remitly Customer Care Support

| Support channel | Remitly contact information |

|---|---|

| Phone | Phone numbers vary depending on where you’re calling from, and are available on the Remitly app or desktop site |

| Chat | By logging into your Remitly app or visiting the desktop site |

Remitly alternatives

Not sure if Remitly is right for you? Compare their coverage, costs and services with these Remitly alternatives:

Remitly vs Wise – Wise uses the mid-market exchange rate and splits out the costs of your payment overseas, which can make it easier to check and compare the costs

Remitly vs WorldRemit – WorldRemit could be a good choice if you want to send a smaller value payment or if you want your money to be collected in cash, deposited to a mobile money account, or used as airtime topup

Remitly vs Xe – Xe Money Transfer can help you send payments more or less anywhere in the world

Remitly vs TorFX – TorFX is UK based and offers international transfers and currency risk management services.

Remitly Passbook account

Passbook was an account that doesn’t require a social security number (SSN) that an immigrant living in the United States may find difficult to get.

Unfortunately on May 1, 2023 Remitly has announced that they’ll be stopping this service and won’t be accepting new accounts.

Conclusion: Is Remitly a good way to transfer money?

Remitly is a popular digital service for sending payments home to loved ones, which can be deposited in bank and mobile money accounts, or collected as cash at a Remitly agent. The range of options available from Remitly varies based on the country you’re sending to, so you’ll need to check out the pay out features and fees for your specific transfer. Often you can pick a faster Express payment or a cheaper Economy payment, depending on your preference.

Use this guide to decide if Remitly is right for you, and don’t forget to compare some Remitly alternatives to see what else is on offer.

Remitly international money transfer FAQs

Is it safe to transfer money with Remitly?

It’s safe to transfer money to people you know and trust with Remitly. They’re a reliable provider, but the service is intended for personal payments to friends and family only.

How does Remitly apply exchange rates?

Remitly adds a markup to the mid-market exchange rate to calculate the rate used to convert customer payments for deposit. Compare the Remitly’s rate for your transfer with the rates available from a few other providers to check if it is the best value for you.

Does Remitly have a mobile app?

Yes. Remitly has well rated apps on both Apple and Android phones.

Is Remitly legit?

Remitly is legit, properly licensed and regulated, and a safe way to send payments within their specific guidelines.