Revolut card review: All you need to know 2026

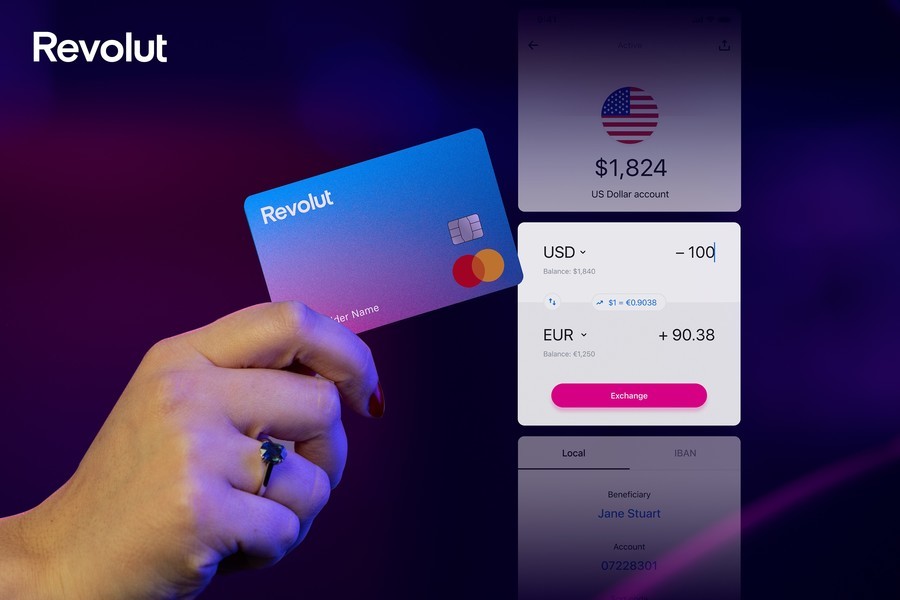

Looking for a way to spend and withdraw in the US and beyond with low fees, powerful international features and a digital account packed with perks? Maybe you’ve heard of the Revolut card.Revolut is a financial technology company offering personal and business accounts and payment cards in the US and many other countries and regions globally.

This guide walks through all there is to know about the Revolut card – including how to get one, how to use it and how much it will cost. We’ll also touch on a few alternatives to Revolut – like the Wise Multi-Currency Card and the Chime card – so you can see which works best for you.

What is Revolut?

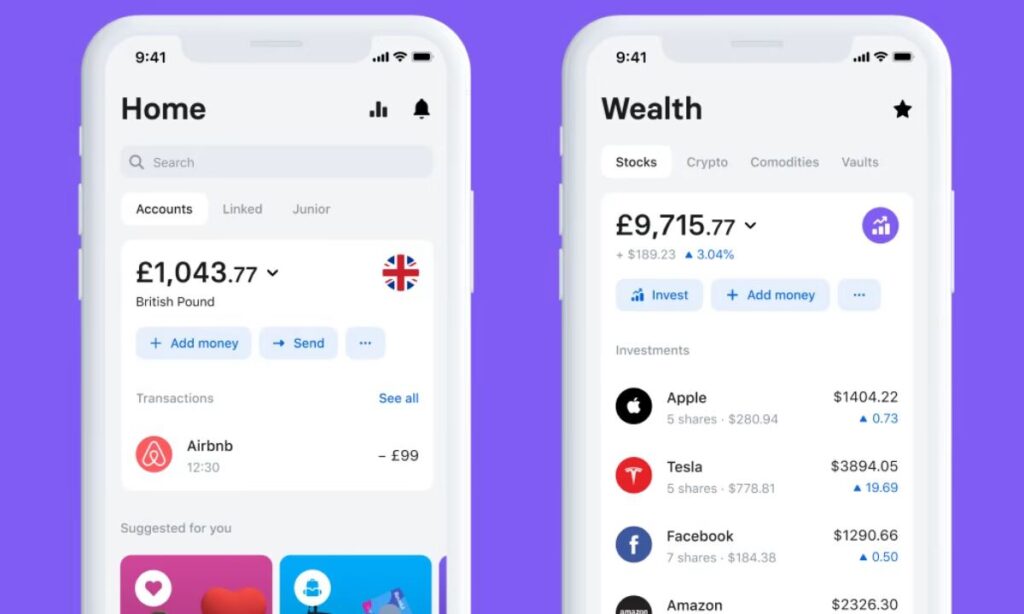

Revolut launched in 2015, and has expanded rapidly to offer personal and business account and card services in many countries around the world. With a Revolut account you can hold around 25 currencies, and spend in 150+ currencies with your Revolut card. You’ll be able to pick from a Standard account which has no monthly fees, and 2 other account plans with ongoing charges, which unlock more features and benefits.

What is the Revolut card?

All Revolut accounts come with a linked payment card – although the specific card type you get, and some of the fees and limits, can vary based on the account type you hold.

Key features:

- Get a Standard, Premium or Metal card according to your account plan

- No fees applied when you are spending from to any currency you hold in your Revolut account

- No-fees applied to network withdrawals at 55,000 ATMs in the US

- Some out of network ATM withdrawals are without fees, based on limits according to account plan

- All account plans have some currency exchange which uses the mid-market exchange rate

- Virtual cards available

- Premium and Metal plans have some purchase protections in place

| Revolut card pros | Revolut card cons |

|---|---|

|

|

What does a Revolut card do?

With your Revolut card you can spend or withdraw any funds you hold in your Revolut account, in the US or abroad, in person, online, and using mobile payment wallets like Apple Pay. Add money to Revolut in dollars, using a card, bank transfer, or even a cash deposit for some customers, and convert to the currency you need for spending with no foreign transaction fee.

Your Revolut card is contactless and compatible with popular wallets like Apple Pay and Google Pay, to use for spending and withdrawals.

Who is the Revolut debit card for?

The Revolut debit card could appeal to quite a few different customer needs:

- Anyone looking for a no-fee way to make local in network US ATM withdrawals

- Travelers spending in foreign currencies, who want to reduce foreign transaction fees

- People shopping online at home and abroad

- Anyone looking for a virtual card for security

- Customers who prefer to manage their money using just a phone

Is Revolut card safe?

Yes. Revolut is legit and safe to use. The Revolut card in the US is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Visa. In addition, Revolut cards come with in built security measures like instant transaction notifications, in-app card freeze options, and 2 factor authentication.

Revolut card alternatives

Revolut isn’t the only option if you’re looking for a card you can use for low cost spending in the US and abroad. Let’s take a look at how Revolut measures up against a couple of other non-bank alternative providers.

| Revolut Card | Wise Multi-Currency Card | Chime Card | |

|---|---|---|---|

| Availability | A selection of countries and regions including the US, UK, EEA and Australia | Available in most countries around the world | Only US customers

|

| Card order fee | First card on all accounts is without a card fee – only a delivery fee of 5 USD may apply | 9 USD | No fee |

| Monthly or annual fees | Standard: No fee Premium: 9.99 USD/month Metal: 16.99 USD/month | No monthly or annual fee | No fee |

| Multi-Currency Account | 25+ currencies supported for holding, get paid with local USD and GBP account details, and SWIFT details for other country deposits | 40+ currencies supported for holding, get paid with local bank details for 9 currencies, including USD. | USD only |

| International ATM withdrawals | Standard: 400 USD/month no-fee, 2% after that Premium: 800 USD/month fee no-fee, 2% after that Metal: 1,200 USD/month fee no-fee, 2% after that | First 2 withdrawals up to a combined total of $100/month for no fee,$1.50 + 2% (once you’ve withdrawn $100 in a given month, any amount in excess will be charged a 2% fee). | No Chime fee, ATM operator may charge a fee |

| Exchange rates | Mid-market rate to plan limits, 0.5% fair usage fee after that Out of hours or exotic currency fees of 1% may apply | Mid-market rate with conversion fees from 0.43% | No foreign transaction fee, network fees apply for card spending |

| Supported Currencies | Spend in 150+ currencies | Spend in 40+ currencies | Spend wherever the network is accepted |

| Foreign transaction fees | No foreign transaction fee | No foreign transaction fee | No foreign transaction fee |

| Business Accounts | Available | Available | Not available |

| International Money Transfers | Up to 10 USD depending on destination and value | From 0.43% | Not available |

For more information: Wise Multi-Currency Card review and Wise Multi-Currency Card vs Revolut card

How does Revolut card work?

Revolut cards are issued on either the Visa or Mastercard networks. You’ll get either a Standard card, a Premium card or a Metal card, depending on the account type you choose. You can use your card just like you would any other payment card, to spend online or in person and make ATM withdrawals.

Top up your Revolut account, and you can then spend and withdraw up to the account balance (subject to limits which we’ll explore later) using your card. Cards are contactless and compatible with popular mobile wallets like Apple Pay and Google Pay.

Revolut Virtual Cards

Revolut accounts all come with the option of one or more virtual cards. Virtual cards have different card numbers to your physical card, and can be used for online and mobile spending. As they don’t have the same numbers as your normal card, they can increase security, and you can simply lock or dispose of the details after use if you’d like to. Fees may apply to get more than one virtual card, depending on your account type.

To get your Revolut virtual card just log into the app and go to the ‘Cards’ tab. Tap ‘Add card’ and ‘Virtual debit card’, to generate your card and see the details.

Revolut card fees & limits

Let’s walk through the fees you may need to pay when ordering and using a Revolut card. We’ll also look at some of the most important limits that apply in just a moment.

| Service | Revolut card fee |

|---|---|

| Monthly fee | Standard: No fee Premium: 9.99 USD/month Metal: 16.99 USD/month |

| First card issued to your account | No-fee for all plan types |

| Early downgrade or cancellation fee | Standard: No fee Premium: Up to 20 USD if canceled or downgraded within 10 months Metal: 55 USD if canceled or downgraded within 10 days, 30 USD if canceled or downgraded within 10 months |

| Standard delivery | Standard: 5 USD Premium: No fee Metal: No fee |

| Expedited delivery | Standard: 16.99 USD Premium: No fee Metal: No fee |

| Replacement cards | Standard: 5 USD Premium: 30 USD Metal: up to 70 USD |

| Virtual cards | Standard: 1st card is without card fee to get,, 5 USD after that Premium: No fee Metal: No fee |

| Disposable virtual cards | Standard: Not available Premium: No fee Metal: No fee |

| In network ATM withdrawal | No-fee for all plan types |

| ATM withdrawal (out of network) | Standard: 400 USD/month no-fee, 2% after that Premium: 800 USD/month no-fee, 2% after that Metal: 1,200 USD/month no-fee, 2% after that |

*Details correct at the time of research – 12th July 2023

Revolut exchange rates

Revolut accounts can hold and exchange around 25 different currencies, and all account plans come with some currency exchange you can access with the mid-market rate and no extra fees. Once you exhaust your plan limit you’ll pay a 0.5% fair usage fee to change from one currency to another. There’s also a 1% fee if you exchange currencies out of hours or on the weekend, and if you’re exchanging THB or UAH.

Revolut card limits

Here are a few of the important limits you should know about when using a Revolut card.

| Service | Revolut card limit |

|---|---|

| ATM withdrawal | 550 USD/day and 1,050 USD/week for accounts opened in the last 120 days

1,050 USD/day and 1,750 USD/week for accounts open from more than 120 days |

| Card purchase | To the maximum amount held in your account |

| ACH and peer to peer transfers | To the maximum amount held in your account |

| Instant card transfers | 1,000 USD/day |

*Details correct at the time of research – 12th July 2023

How to get Revolut card

Once you have a verified Revolut account you can order and use a Revolut card.

Here’s how to get a Revolut card:

- Open the Revolut app and go to the ‘Cards’ tab.

- Tap ‘Get card’ and then ‘Physical card’

- Enter the card type you want

- Create your PIN code

- Provide your address and submit the order

You’ll see an estimated delivery date when you order your card. If your card doesn’t arrive by this date, you’ll need to reorder a new card.

How to activate your Revolut card

To activate your card once it’s arrived, just make a physical card payment or withdrawal by inserting your card into a payment terminal or ATM and entering your PIN. Your card can then be used for contactless payments.

How to use a Revolut card?

Use your Revolut card just as you would any other card, to pay in stores, online, and using a mobile wallet like Apple Pay. You can also make cash withdrawals at an ATM. You’ll be able to spend and withdraw up to Revolut limits or the amount in your account balance, depending on which is the lowest.

How to top-up your Revolut card

You can add money to your Revolut account with a card or by bank transfer, by mobile check, and some customers in the US are also eligible for cash deposits.

The process to add money to a Revolut card is very easy. To give an example here’s how to add money to Revolut and pay using your linked credit or debit card:

- Log into the Revolut app and tap ‘Add money’

- Add your card details

- Enter the amount and currency you’d like to top up

- Tap ‘Add money securely’

Revolut card cash withdrawal

Make Revolut ATM withdrawals at home and abroad, with no fees for in-network withdrawals, and some no-fee out of network withdrawals based on your account plan.

Here’s how to make a Revolut cash withdrawal:

- Find an ATM that supports your card network

- Insert the card into the ATM and enter your PIN

- Follow the prompts to enter the amount you want to withdraw

- Check, confirm, and take your money and card

How to use Revolut overseas?

You can use your Revolut card overseas more or less anywhere that the card network is supported. Revolut cards are issued on either the Visa or Mastercard network, which are both widely available globally. Just make contactless payments as you would at home, where contactless is supported, or use your physical card and PIN to spend and withdraw elsewhere.

There are a number of countries where you can’t use your Revolut card, usually because of international sanctions. This list does change from time to time, so if you have questions about your destination, it’s best to check with Revolut directly to see if the country you’re headed for. At the time of writing, (July 2023), Revolut cards can’t be used in Russia.

Related: Best international debit cards for overseas travel

Supported currencies

You can spend with your Revolut card in about 150 currencies, anywhere the card network is accepted. Major supported currencies include USD, CAD, MXN, GBP, EUR, AUD and BRL.

Revolut card for business

Revolut has accounts for US business owners, including Standart plans with no monthly fees, and accounts with more features and monthly charges of up to 149.99/USD a month. All accounts come with either plastic or metal cards for the business owner and team members, although fees may apply to get the cards depending on the account and card type you prefer. Higher tier accounts can earn cash back on business card spending of up to 1.9%.

If you want to issue cards to team members, you can set and track expense limits, and automate much of the accounting process by reminding staff to submit receipts for reconciliation. As with Revolut personal accounts, you can hold 25 currencies and spend in 150 currencies, making this a good choice for businesses going global.

Conclusion: Is the Revolut card worth it?

The Revolut card is a good option for people looking for a way to manage their money with nothing more than their phone. You’ll get a multi-currency account and card, to hold 25 currencies and spend in 150 currencies, with some free overseas ATM withdrawals and currency exchange which uses the mid-market exchange rate, based on the account tier you select.

Compare the Revolut card against cards from alternative providers, like the Wise Multi-Currency Card or the Chime card. Wise is a great pick for people who need to send, spend, hold, receive and exchange dozens of currencies, with 40+ currencies for holding, and your own bank details to get paid in 9 currencies like a local. Chime has no foreign transaction fees, and very few account fees, for a flexible USD based account you can manage through an app.

Use this guide to see which works best for you, to cut the costs of spending at home and abroad.

Revolut debit card FAQs

Is a Revolut card free?

All Revolut accounts come with a first card that doesn’t have a card order fee, although delivery charges may apply. There may also be a fee for some card services, depending on your account tier and usage.

Is the Revolut card a Visa or Mastercard?

Revolut cards are issued on both the Visa and Mastercard networks which are both globally accepted.

Is Revolut a credit card or debit card?

The Revolut card is a debit card linked to an online and in-app multi-currency account.

Can foreigners in the US use Revolut?

If you have a Revolut card issued outside of the US and want to spend or withdraw in USD, you can. Foreign residents of the US can also apply for a Revolut US card as long as they have a valid ID, proof of address and ITIN.

Can US citizens use Revolut?

Yes, Revolut is available for eligible US personal and business customers. Verification steps are required, so you’ll need to provide some paperwork including an SSN, ID and proof of address.

How long does it take for a Revolut card to arrive?

You’ll get a delivery estimate when you order your Revolut card, which can vary based on the card type and your location. Expedited delivery is available, although you may need to pay a fee.

How do I withdraw money from Revolut?

Make Revolut ATM withdrawals anywhere you see your card network is supported. You can also send payments from Revolut to your linked bank account, or to others, if you’d like to.

Can I deposit cash into Revolut?

Some US customers have the option to deposit cash into a Revolut account, If this is available for you it’ll show in the app – fees apply. If you can not deposit cash you can add funds with a card, bank transfer or mobile check deposit.