Visa Travel Money Review 2026: Providers, Fees & Limits

If you’re looking for a secure and easy way to spend and make cash withdrawals when you’re away from home, a Visa travel card could be a good solution.

You can get prepaid Visa cards from banks and non-bank alternative providers, which you load with funds before you head overseas, for simple spending. Some cards – like those from Wise and Revolut – come with options to hold and convert your dollars to a selection of foreign currencies, too. Let’s dive right into our full guide to the Visa prepaid travel card options available for US customers.

Quick summary: Visa travel cards

- Visa is a large and globally accepted payment network – which means your Visa prepaid travel card will work more or less anywhere in the world

- Travel cards are secure for overseas use, and offer extra reassurance as they’re not linked to your checking account

- Some providers, like Wise and Revolut, let you hold and exchange foreign currencies for spending with your Visa travel card

- Lots of different Visa travel card options are available, through banks and non-bank digital providers

What is a Visa travel money card?

A Visa travel money card is a prepaid debit card which you can load with USD from your bank, with a card, or in some cases with cash. You can then securely spend and make withdrawals with the card around the world. Different Visa travel money cards have their own features and fees, so it’s handy to compare a few options to find the right one for you.

| Visa travel cards pros | Visa travel cards cons |

|---|---|

| ✅ Some providers support multi-currency balances, making overseas spending easy ✅ Secure and convenient for international use ✅ Not linked to your main checking account ✅ Visa is a globally accepted network | ❌ Some cards have ongoing or monthly fees ❌ Service fees will apply when you transact |

Where can I get a prepaid Visa card for international use?

There are quite a few different prepaid Visa cards on the US market, through banks and non-bank alternative providers. However, the features and fees of different cards can vary greatly. Here we’ll look at several examples, including specialist alternatives for international use from Wise and Revolut:

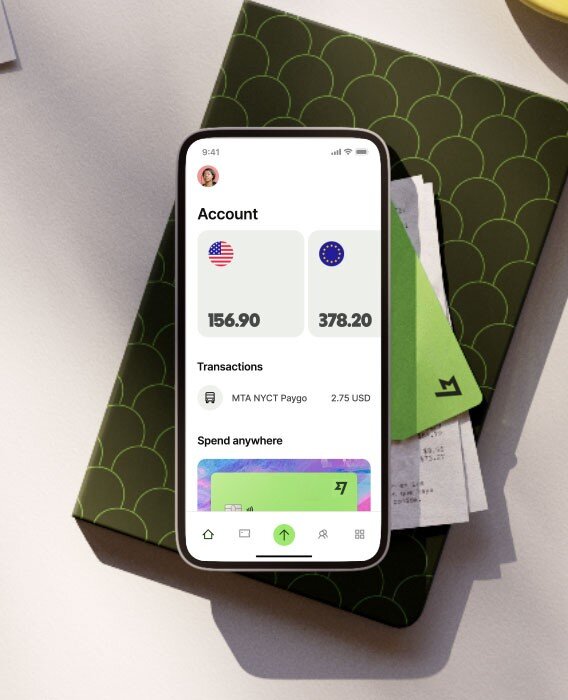

Wise – hold and exchange 40+ currencies in your account and spend globally with your linked debit card. 9 USD order fee, no foreign transaction fee and ongoing charges

Revolut – supports 25+ currencies, with account plan options including some with no ongoing fees, and other with monthly charges of up to 16.99 USD. No foreign transaction fee, and all account plans offer some weekday no fee currency conversion

Republic Bank and Trust Company – get the Everyday Select Rewards Visa Prepaid Card for home and international use, and earn up to 2% cash back. 2.5% foreign transaction fee applies to overseas use

Netspend – choose from a large range of Netspend prepaid Visa cards, issued through a selection of banks and non-bank providers. Fees do vary depending on the card you pick, and can include a foreign transaction charge of up to 2.5%

Which banks offer Visa travel money cards?

You can get a Visa prepaid card through a bank or non-bank alternative. There are lots out there so we’ve picked a few examples to kickstart your research:

| Providers / Services | Wise travel money card | Revolut travel money card | Republic Bank and Trust Company Visa travel card | Netspend Visa travel card (available through various banks) |

|---|---|---|---|---|

| International coverage | Spend anywhere the Visa network is supported | Spend anywhere the Visa network is supported | Spend anywhere the Visa network is supported | Spend anywhere the Visa network is supported |

| Foreign transaction fees | No foreign transaction fee | No foreign transaction fee | 2.5% | Up to 3.5%, depending on specific card selected |

| Card order fees | 9 USD | None – delivery costs may apply | 2.95 USD | Varied fees – usually around 4.95 USD |

| Monthly fees | No fee | Up to 16.99 USD | Up to 9.95 USD | Up to 9.95 USD |

| International ATM withdrawals | Some no fee withdrawals monthly, before low fees apply | Some no fee withdrawals monthly, before charges apply | 3.95 USD | Up to 4.95 USD |

| Currency exchange | Mid-market rate | Mid-market rate to plan limit | Visa rate | Visa rate |

| Multi-currency account | Supports 40+ currencies | Supports 25 currencies | Not available | Not available |

*Details correct at time of writing, 8th April 2024

Wise Multi-Currency Card

Wise accounts can hold 40+ currencies and don’t have any foreign transaction fee, making them a great pick for international use. You can add money online or in the Wise app and then either convert to the currency you need, or just let the card convert for you when you pay.

- One time card order fee, no minimum balance, no ongoing charges

- Currency exchange uses the mid-market rate with fees from 0.43%

- Spend in 150+ countries, wherever the card network is accepted

Revolut travel card

Revolut has 3 different account plans in the US, including the Basic plan which has no monthly fees. All accounts support 25 currencies for holding and exchange, and offer some weekday no fee currency conversion before fair usage fees begin.

- Choose the account plan that suits your spending needs

- No fee for currency conversion to your plan limit – 0.5% fair usage fee after that

- Hold and exchange 25 currencies for convenient international use

Republic Bank and Trust Company travel card

Check out the Everyday Select Rewards Visa Prepaid Card which allows you to earn up to 2% cash back. Hold a balance in USD, which you can top up online or in person using cash.

- Choose a pay as you go model, or pay a monthly fee of up to 9.95 USD

- 2.5% foreign transaction fee applies to overseas use

- 3.95 USD international ATM fee

Netspend travel card

Netspend has a broad selection of different prepaid Visa travel cards, which can be issued through banks and non-bank alternative providers. Generally cards can be offered on a pay as you go basis, with higher transaction fees – or with a monthly charge which includes some transaction costs.

- Broad selection of different cards which can use used to hold USD

- Visa exchange rate with a fee of up to 3.5% for international use, depending on specific card selected

- Varying international ATM fees based on the card you choose

How does the Visa travel money card work?

Prepaid travel money cards can be helpful as they are not linked to your checking account. Instead you can top up your card conveniently – often online, and sometimes by loading cash in a physical location – before you spend or make cash withdrawals. Cards can be used to save or budget for a specific event like a vacation, and because they’re not linked to your normal checking account they’re secure to use at home and abroad.

How to top up prepaid travel money cards

Providers like Wise and Revolut allow you to top up digitally, online or in the provider’s app. Prepaid Visa cards issued through some banks and other providers may offer these top up methods as well as the option to load cash in a store, or to upload a mobile check. To add money digitally you’ll usually just need to take the following steps:

- Log into the provider’s app

- Select the Add money option

- Enter the amount and currency you want to add

- Pick the way you want to pay

- Confirm, pay, and your money will be added to your balance

How to check your balance on your card

Visa payment cards usually come with linked digital accounts which let you check your balance online or in an app. You can also insert your card into an ATM to get balance advice – but some providers do charge for this service.

International ATM cash withdrawal

Use your Visa prepaid card to make ATM withdrawals internationally, in exactly the same way as you would at home. Just look out for an ATM which displays the Visa logo, and you’re good to go.

Is Visa travel money safe to use?

Travel money cards are considered to be safe to use, particularly as they’re not linked to a checking account. However, you’ll still need to make sure that the specific card you select is issued through a reputable bank or non-bank provider, which is properly licensed and regulated.

Visa Travel money fees & limits

It’s important to check the relevant fees which apply to the specific card you select, particularly if you’re planning on using your card for overseas spending. Some providers have fairly high foreign transaction fees so picking carefully is crucial. Here’s a quick summary of key fees for the cards we’ve selected – other charges may also apply:

| Providers / Services | Wise travel money card | Revolut travel money card | Republic Bank and Trust Company Visa travel card | Netspend Visa travel card |

|---|---|---|---|---|

| Foreign transaction fees | No foreign transaction fee | No foreign transaction fee | 2.5% | Up to 3.5%, depending on specific card selected |

| Card order fees | 9 USD | None – delivery costs may apply | 2.95 USD | Varied fees – usually around 4.95 USD |

| Monthly fees | No fee | 0 USD to 16.99 USD | 0 USD to 9.95 USD | 0 USD to 9.95 USD |

| Domestic ATM withdrawals | Some no fee withdrawals monthly, before charges apply | In network withdrawals have no fee | 1.95 USD | Usually around 2.5 USD |

| International ATM withdrawals | Some no fee withdrawals monthly, before charges apply | Some no fee withdrawals monthly, before charges apply | 3.95 USD | Up to 4.95 USD |

*Details correct at time of writing, 8th April 2024

Visa Travel exchange rates

Different cards will use their own approach to foreign currency exchange when you spend overseas. Here’s a quick roundup:

Wise – mid-market exchange rate with low fees from 0.43%

Revolut – mid-market exchange rate to plan limit, 0.5% fair usage fee may apply after that

Republic Bank and Trust Company – Visa rate with foreign transaction fee of 2.5%

Netspend – Visa rate with foreign transaction fee of up to 3.5%, depending on specific card selected

How to get a Visa card for travel

Most Visa prepaid cards can be ordered online, for home delivery. You might need to wait a few days for your card to arrive – in the US a Wise Multi-Currency Card can take 14 to 21 days, for example. Other providers may offer ways to expedite delivery of your card, but this will come with higher costs.

To register an account with a provider and order a Visa prepaid travel card you’ll usually have to:

- Select the option to sign up, on the provider’s website or app

- Enter your personal and contact information

- Add images of your ID and address documents for verification

- Add some money to your account

- Tap to order your card – it will be delivered to your registered residential address

How to activate your travel money card

It’s common to find you have to activate your new Visa travel card before you can use it. Different providers have their own system for card activation. With Wise, as an example, you’ll need to log into your account online or in the app, and enter the 6 digit code that’s sent to you with your card. Other providers may allow you to activate a card by calling a service center or visiting a bank branch.

How to use a Visa Travel money card overseas

You could use your Visa travel money card overseas just as easily as you do at home. Look for the Visa network symbol which is displayed on ATMs, online and at the payment terminal in stores. Most Visa travel money cards are contactless, allowing you to tap and pay easily.

Supported currencies

Visa travel cards can be used more or less globally. Some, like the cards from Wise and Revolut, allow you to hold a foreign currency balance which can be a convenient option as it allows you to view your budget in advance. Once you have the currency you need you can spend with no additional fees to pay.

Other card options may convert your foreign currency spending back to USD with the Visa exchange rate and a foreign transaction fee, before deducting the final amount from your account.

Conclusion: is a Visa Travel card worth it?

Visa travel cards are globally accepted and available from many different banks and providers in the US. If you’re thinking of using a Visa card specifically for overseas use it’s useful to get a card from a provider which supports holding a foreign currency balance, as this can keep down your foreign transaction costs. It’s also a convenient way to see your travel budget in advance, and allows you to lock in a good exchange rate when you see it. Use this guide to compare a few options, like Wise and Revolut, and see which might suit your specific needs.

Visa Travel money FAQs

What is the best prepaid Visa for international travel?

There’s no single best Visa prepaid card, so the one which works best for you might just come down to your spending habits and personal preferences. If you’re looking for a card to use overseas, check out the options from Wise and Revolut as they both let you hold a foreign currency balance which is a good way to keep costs down when you travel.

Is a Visa travel card a credit card or debit card?

The Visa travel cards we’ve covered in this guide are prepaid debit cards. You’ll also find some banks issue credit cards on the Visa network, so do look carefully at the terms and conditions of the card you’re signing up for so you know how to use your card most effectively.

Is Visa travel money a multi currency card?

If you get a Visa card from a provider like Wise and Revolut you can hold a foreign currency balance for overseas spending. Some other providers issue Visa prepaid cards which can only be used to hold a balance in USD – but you can still spend internationally more or less anywhere in the world.

How much does a Visa travel card cost?

Different Visa card issuers have their own fees which may include card order charges, or monthly costs. Compare a few options to make sure you’re getting the one which has the best balance of features and fees based on your specific preferences.