How to send money with Wise: Step by Step guide [2026]

Wise (formerly TransferWise) is on a mission to make money transfers instant, convenient, and eventually free. Send fast or instant money transfers to 160+ countries, with low, transparent fees from 0.35%, and the mid-market exchange rate.

Read on for all you need to know – including Wise transfer fees, whether the service is safe to use, how fast it is, how to transfer money, and more. Let’s dive right in.

| Table of contents: |

|---|

How to send money with Wise: In 5 simple steps

Setting up an international or same currency transfer with Wise is very easy, fast and convenient. You can set up your transfer online, or through the Wise mobile app.

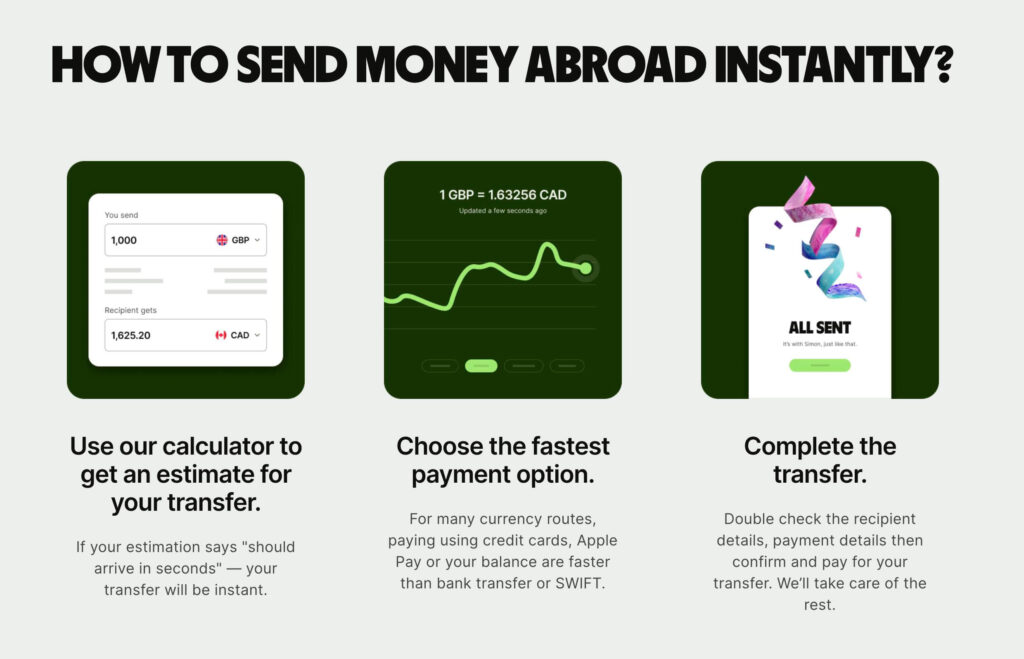

Here’s how to send an international money transfer with Wise:

1. Log into your Wise account online or in the Wise app

You can create your account easily, online or with your phone, by uploading clear images of your ID and address documents, and entering your SSN. The process is intuitive and simple – with no need to even leave home.

2. Select Send Money

Once you’re ready to make a transfer, navigate to the Wise Send Money page. You’re guided through the process by onscreen prompts – and if you ever get stuck you can open a secure in-app chat to get help or advice.

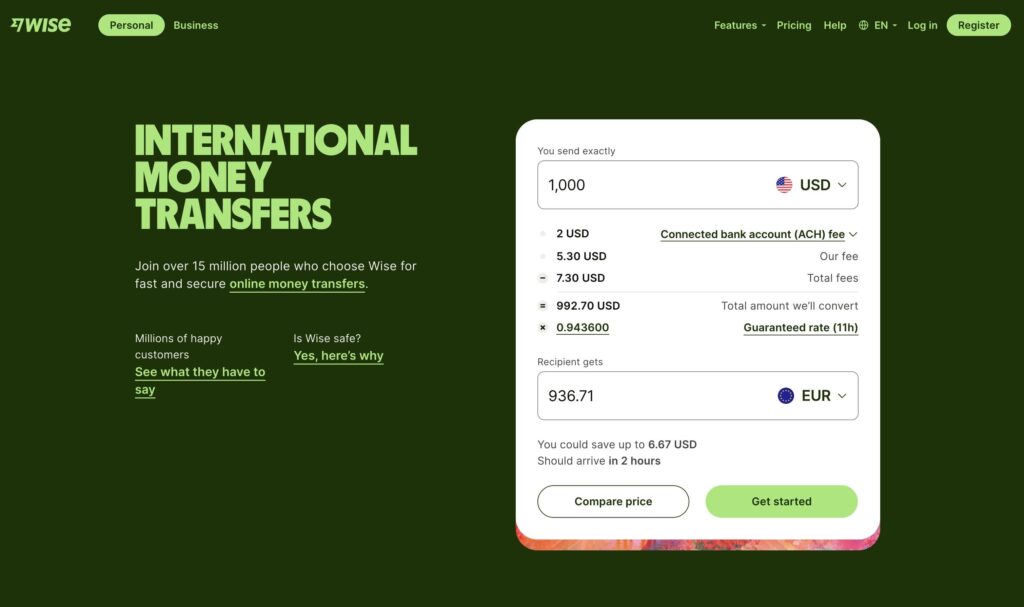

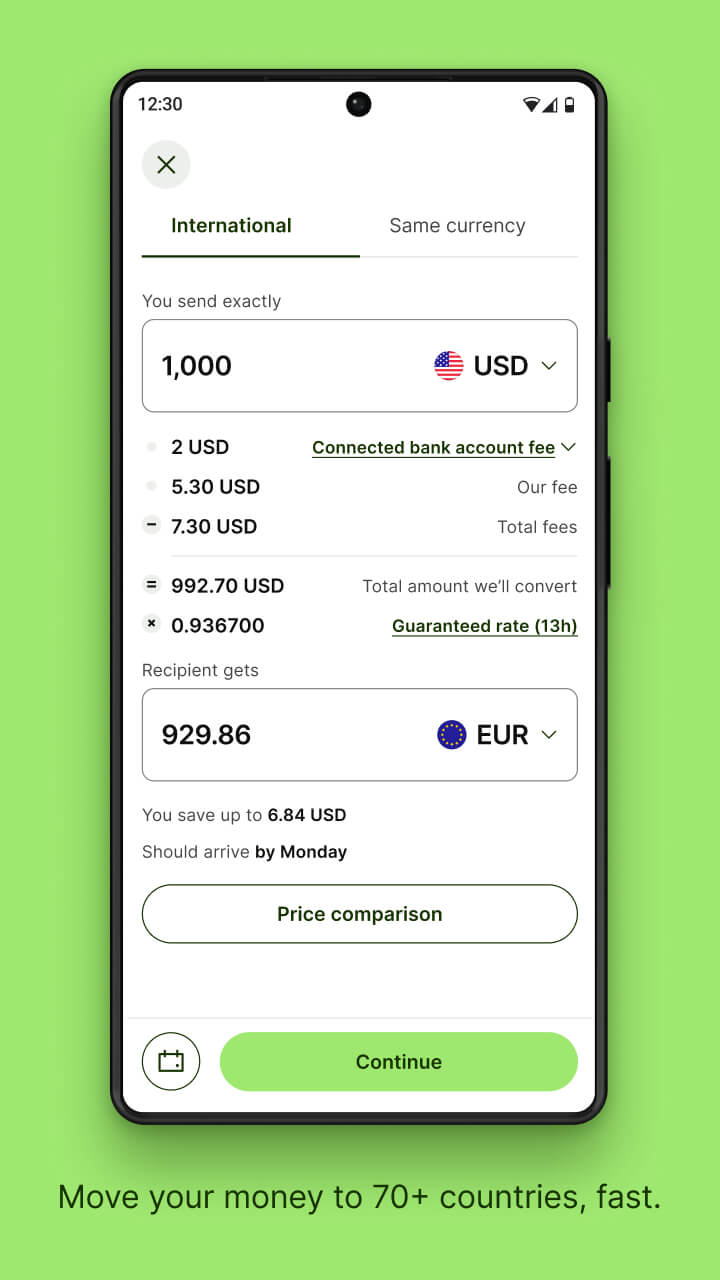

3. Enter the amount you want to send, or the amount and currency you want your recipient to get

You can either choose how much you want to send in dollars or whichever currency you’d like to pay in, or you can enter the amount and currency you want your recipient to get in the end. You’ll see all your options, including payment methods, a fee quote, and an estimated delivery time for each.

4. Pick how you want to pay, add recipient details, and confirm your payment

Choose the payment option that works for you – usually with a card or Apple Pay, or you can use ACH or wire. Generally using a card is quick and convenient but may have a slightly higher fee compared with using a wire or an ACH. Add your recipient’s bank information, and fund your transfer following the onscreen prompts.

5. Once you’ve paid for your Wise transfer, you can track it online or in the Wise app

You’ll be notified when your money is on the way, and you can also follow its progress online or in the app, so you know when it’s safely with your recipient. In many cases, Wise transfers are instant or arrive in seconds – and 90% get there in 24 hours or less.

How much can I save with Wise money transfer?

The easiest way to see how Wise compares against other providers is to run a quick comparison. Here we’ll look at how much your recipient would get in British pounds if you were sending an example payment of a few different values to the UK, with Wise compared to Western Union and PayPal:

| Sending amount in USD | With Wise, your recipient gets | With Western Union, your recipient gets | With PayPal, your recipient gets |

|---|---|---|---|

| 500 USD | 398.64 GBP | 396.01 GBP 2.63 GBP less than with Wise | 380.15 GBP 18.49 GBP less than with Wise |

| 5000 USD | 3,991.81 GBP | 3,960.72 GBP 31.09 GBP less than with Wise | 3,836.64 GBP 155.17 GBP less than with Wise |

| 10,000 USD | 7984.48 GBP | 7,937 GBP 47.48 GBP less than with Wise | 7,677.43 GBP 307.05 GBP less than with Wise |

*Fees correct at time of writing, 22nd May 2023

As you can see, in our comparison, your recipient would get more with Wise compared to payments arranged through PayPal or Western Union. This is generally because Wise uses the mid-market exchange rate to set up transfers overseas, while many banks and providers add a markup to the rate used to convert your dollars to the currency needed for deposit. This pushes up the costs, even though it’s not always easy to spot.

What is Wise money transfer?

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched as TransferWise in 2011, with a focus on making international money transfers faster, cheaper and more transparent.

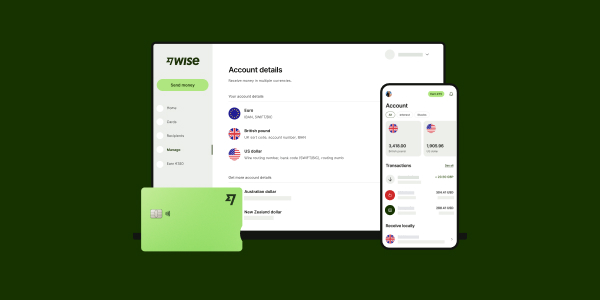

TransferWise later rebranded as Wise, to reflect the fact that their service offering had broadened to include multi-currency account services for individuals and businesses, including linked international debit cards.

Fast forward to 2023, and 16 million people and businesses use Wise, to send 10 billion USD in cross-border transactions every month, saving customers in the region of 1.9 billion USD a year. Wise can do this because they invested in new approaches to sending money overseas, building their own network of accounts around the world, instead of relying on the SWIFT network as banks usually do. This keeps down costs, and allows Wise to pass savings on to customers, while still investing in new ways to add extra features and services to their products.

So – who owns Wise money transfer now? The original co-founders of Wise are still actively involved in the business, and Wise is now floated on the London Stock Exchange, under the ticker WISE.

Is Wise money transfer safe?

Yes, Wise is safe to transfer money.

Wise is a licensed and regulated financial service provider, overseen by a range of bodies around the world. In the US, Wise is FinCEN registered and licensed as a money transmitter in many states. In US states and territories where Wise doesn’t have a license in its own right, it offers services through a partnership with Community Federal Savings Bank.

Pros & Cons of Wise international transfer

| Pros | Cons |

|---|---|

| ✅ Mid market exchange rate for currency conversion ✅ Fast or even instant global payments ✅ Low & transparent fees from 0.35% ✅ Send to 160+ countries in 40+ currencies ✅ Payments deposited directly to bank accounts for convenience ✅ Personal and business accounts and services available ✅ Safe, regulated service | ❌ Variable fees apply depending on destination, payment method and currency ❌ Transfer times vary based on destination ❌ No option for cash delivery ❌ No branch network |

Is Wise better than bank transfer?

Whether sending your payment with Wise or your own bank is best will depend on a range of factors including your personal preferences, where your money is going, and how you’d prefer to pay.

Here’s a quick comparison of Wise vs international bank transfers set up through Bank of America across a range of important features:

| Wise international money transfer | Bank of America international bank transfer |

|---|---|

| Transfer fees: From 0.35% | Transfer fees: No fee to send in foreign currency, 45 USD to send in USD |

| Exchange rates: Mid-market exchange rate | Exchange rates: May include fees and a markup on the mid-market rate |

| Transfer speed: Often fast or instant | Transfer speed: SWIFT payments may take up to 2 days to arrive |

| Ease of use: Online and in app service | Ease of use: Online or mobile service available, or you can call or visit a branch |

| Safety: Fully licensed and regulated | Safety: Fully licensed and regulated |

Wise transfer fees

Wise splits out the costs of currency money transfers so they’re very clear and easy to understand. As part of its mission to bring down costs and make the fees you pay transparent, you’ll always see the Wise charges in advance, so you can compare them to other providers.

Currency conversion uses the mid-market exchange rate, so you can also be confident that there are no extra fees hidden there.

Here are the Wise transfer fees you’ll pay:

- Fixed fee: this covers the fixed costs associated with the transaction and can be around 7 USD for a wire transfer on popular payment routes from the US

- Variable fee: this covers the cost of the currency exchange and can be from 0.35%, with fees of under 0.5% common on many popular routes from the US

When you set up your Wise money transfer online or in the Wise app you’ll be able to instantly see what you’re paying – and what the recipient can expect to get in their account in the end.

Here’s a quick rundown of the Wise transfer fees for a 1,000 USD payment on a few popular payment routes, to give you an idea of the fees you may pay with Wise:

| Sending 1000 USD to | Fixed fee | Variable fee | Total fees |

|---|---|---|---|

| The UK | 7.03 USD | 4.35 USD (0.44%) | 11.38 USD |

| France | 7 USD | 3.96 USD (0.4%) | 10.96 USD |

| Australia | 7.34 USD | 3.86 USD (0.39%) | 11.20 USD |

| India | 7.17 USD | 5.63 USD (0.57%) | 12.80 USD |

*Fees correct at time of writing, 12th June 2024

The fees you pay with Wise can vary based on the currency you’re sending, how you pay, and the total value of the transfer. However, Wise will always split out the fees so you can easily see what your transfer costs, and what the recipient will get deposited to their account in the end.

Wise free transfer promo code

Wise fees are already pretty low and transparent- plus currency conversion uses the mid-market exchange rate to offer the best possible deal. However, if you’re looking for an even better deal, you could check out the Wise/Exiap promo to get a fee-free transfer of up to 2000 GBP (around 2,500 USD).

| Wise promo code for fee-free transfers |

|---|

| Exiap has teamed up with Wise to offer readers the opportunity to make a fee free transfer up to the value of 2,000 GBP (that’s around 2,500 USD), to any of the 160+ supported countries. Terms and conditions do apply – but this can be a great way to try out the Wise money transfer service and see if it suits you. Get the Wise promo code here. |

Wise transfer payment methods

Wise offers different payment method options for money transfers, so you can pick the fastest, cheapest or most convenient, depending on what’s most important to you.

For the US, there are 4 Wise payment methods.

- ACH (direct deposit)

- Wire transfer

- Debit card

- Credit card

ACH and wire transfers are often the cheapest available method, while debit or credit cards can be more convenient and fast, but they are often more expensive. You’ll see your payment options and fees before you confirm the Wise money transfer, so you can pick the best one for you. Check out this table to find the cheapest way to pay for your Wise transfer.

Wise exchange rates

So how does Wise currency exchange work? Wise uses the mid-market exchange rate for currency conversion, without any hidden costs or exchange rate markups.

The mid-market exchange rate is the one you’ll find on Google and using a currency conversion tool. It’s also the rate banks and money transfer services get themselves when they buy and sell currencies. However, providers often add an extra fee into the exchange rate they use when they calculate a conversion for a retail customer – known as adding a markup. This is one way providers manage to make a profit even when they claim to offer fee free transfers. It’s common, but it’s not transparent, and it can mean you’re paying fees even when you think you’re getting a free service.

Wise offers a competitor comparison service where you can enter your payment details and see the exchange rates and transfer fees for both Wise and some key US banks and money transfer services. If there’s an option that’s cheaper than Wise, they’ll show you that too, so you know you’re getting the best deal out there for your specific transfer.

How does Wise money transfer work?

Wise built their own payment network to process international money transfers, which reduces the time it takes, and drives down fees compared to the SWIFT network favored by banks.

To do this, Wise has a series of bank accounts in the 160+ countries it supports.

When you pay for a transfer in USD, you make a local payment to Wise’s USD account, which is usually pretty fast and cheap to do. Wise then sends out the agreed amount from their account in the destination country. This way no money really has to cross any borders, making the process fast and frictionless.

Learn more: How does Wise work?

What details do I need for a Wise money transfer?

Wise transfers are usually deposited to your recipient’s bank account. That means you’ll normally need to get your recipient’s bank information (although in some cases you’ll just need their email – more on that in a moment).

Here are the details you’ll usually need to send a Wise money transfer:

- Recipient’s full name

- Recipient’s bank name (BIC/SWIFT may also be needed)

- Recipient’s bank account number

- Additional bank information based on the destination (like a sort code for the UK)

You’ll be guided through the process of entering the required details online or in the Wise app – exactly what’s needed can vary depending on the country you’re sending money to, but on screen prompts will make sure you have everything you need for your payment to be securely processed.

How to transfer money from Wise to bank account

Wise money transfers are deposited directly into your recipient’s bank account. That means that they do not need to have a Wise account to receive a payment through Wise.

Here’s how to transfer money from Wise to a bank account:

- Log into your Wise account online or in the Wise app

- Select Send Money

- Enter the amount you want to send, or the amount and currency you want your recipient to get

- Pick the payment method that suits your needs

- Follow the prompts to add the recipient’s bank details

- Confirm and fund your payment

Once the money has arrived it’ll be added to the recipient’s normal bank account – and you can also add the recipient’s email so they’ll be notified when the money is ready for spending if you’d like.

Wise to Wise transfer

If you’d rather, you can also send a money transfer from your Wise account to another Wise account. Wise to Wise transfers in the same currency are free and fast – they arrive in seconds. If you’re sending in a different currency there may be a small fee to pay, which is shown in the app or on the desktop site before you confirm.

Here’s how to send Wise to Wise transfers:

- Log into your Wise account online or in the Wise app

- Select Send Money

- Enter the amount you want to send, or the amount and currency you want your recipient to get

- Pick Wise Balance as the payment method

- Check everything over, enter the recipient’s information, and confirm your payment

To make the process even easier, you can also find your friends and family on the Wise app if they have active Wise accounts. Just log into the Wise app or on Wise.com, and look for the Recipients tab. Here you can search for a recipient by their phone number or email address, or click the plus sign and follow the steps and enter their account details.

Once you’ve sent a payment to someone, their details will be added into your Wise app so next time you’ll just need to pick out the recipient from your recipient list without entering all their information again.

Send money transfer using email address

We mentioned earlier that you can also use an email address or phone number to send money to someone. In this case, if the recipient has a Wise account with that email address or phone number, Wise will directly deposit the money into their account.

If the recipient isn’t signed up with Wise just yet, Wise will send them an email, asking for their bank details, so the payment can be deposited into their regular bank account instead.

How long does a Wise money transfer take?

More than 60% of Wise transfers are instant (that is, they take less than 20 seconds to be deposited), and 90% of transfers are delivered within 24 hours.

Ultimately the Wise transfer time depends on a few things, including the country you are sending from and to, the currencies involved and the transfer amount. In some cases, if you’re sending a payment out of normal banking hours, it may take a little longer than a transfer arranged during the working day – but in either case, you’ll see an estimated delivery time before you confirm your Wise money transfer, and you’ll be able to track the payment in the Wise app or by logging into your account online.

Here’s a run down of how long payments take to a few popular destinations:

| Sending money from | Sending money to | Payment method | Estimated delivery time* |

|---|---|---|---|

| The US | The UK | Direct debit | Seconds |

| The US | France | Direct debit | 4 hours |

| The US | Australia | Direct debit | 6 hours |

| The US | India | Direct debit | Seconds |

*Speed: The speed of transaction claim depends on funds availability, approval by Wise’s proprietary verification system and systems availability of Wise’s partners’ banking system, and may not be available for all transactions

Is Wise money transfer fast?

Based on our delivery time comparison across several major markets, it’s safe to say that Wise money transfers are fast. Exactly how long it’ll take to get your money deposited through Wise will vary based on the details of the transfer – but you’ll be able to see an estimated delivery time instantly so you can check it’ll be fast enough. Here’s a comparison of Wise transfer times compared to some other major money transfer services in the US.

| International money transfer services | Transfer speed |

|---|---|

| Wise | 60% of payments arrive in seconds, 90% arrive in 24 hours |

| Western Union | Varied based on destination – 0 – 2 banking days is common on major routes |

| PayPal | Funds deposited to the recipient’s PayPal account instantly, but it may take several days for the recipient to withdraw to a bank account, depending on the country they’re in |

| MoneyGram | Varied based on destination – 1 hour to 1 day is common on major routes |

Based on our comparison, Wise payments can be among the fastest options to get your money deposited directly to a bank account in a foreign currency. Because you’ll be able to see a delivery estimate before you confirm your transfer with Wise you can also double check the time it’s likely to take and compare it against other options with no obligation.

Is Wise money transfer instant?

Wise is working towards making money transfers instant all over the world. At present, about 60% of Wise transfers are delivered within 20 seconds – considered to be instant. Instant payments aren’t available on all payment routes, but you’ll be able to see a delivery estimate for your particular transfer before you confirm it. If the estimate is ‘should arrive in seconds’ the payment should be delivered pretty much instantly to your recipient.

It’s also helpful to know that Wise delivery times can vary a bit based on the way you want to pay. You’ll be able to see delivery estimates for different payment options, and can choose from the ‘fast transfer’ options if speed is of the essence. In many transfer routes sending from a Wise balance, or using Apple pay, debit card or credit cards are often the fastest options.

What countries can I send money to with Wise?

Wise offers international transfers to 160+ countries, with more countries being brought online from time to time as Wise extends its services. Check on Wise.com for the most up-to-date list.

How to track your Wise transfer

Track your Wise payment easily, to see when the money has arrived, and to get updates as the transfer passes through the system:

- Log in to your Wise account online or in the app

- Go to Home to see your activity list

- Select the transfer you want to track

You can also get in-app notifications, or add your recipient’s email when setting up a payment, so they’re notified when the money is ready to use.

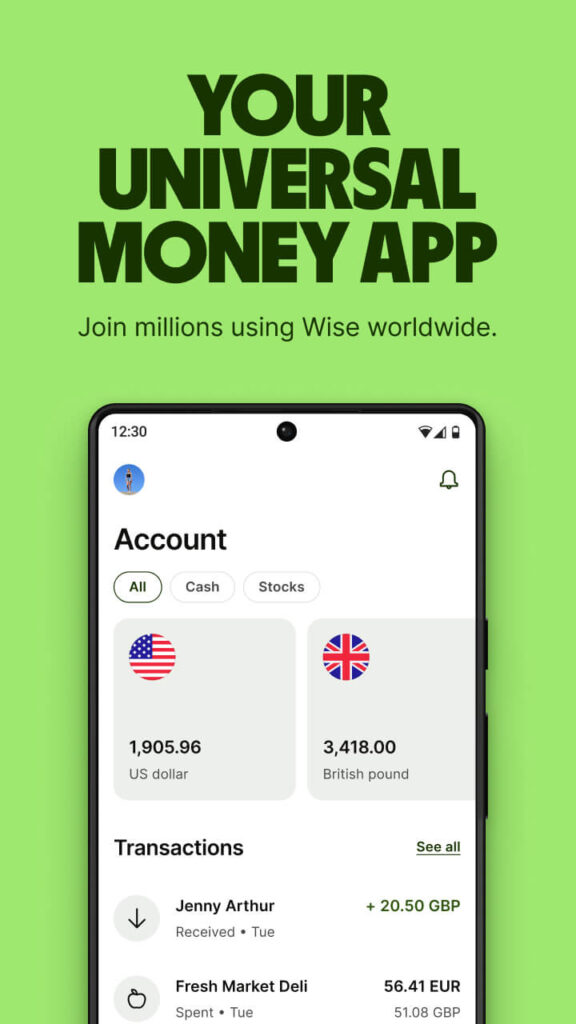

Wise money transfer app

You can get the Wise money transfer app on the Apple App Store and in the Google Play Store. The app is pretty intuitive to use and allows you to send transfers, review your account balance, check card transactions and track payments, right from your phone.

Here are a few of the features available on the Wise money transfer app:

- Check exchange rates and set up rate alerts to let you know when your desired rate is available

- Send payments to 160+ countries right from your phone

- Track transfers conveniently, to see when they are available to your recipient

- Review your Wise account balance and receive instant transaction notifications

- Fund payments with Apple Pay or Google Pay, or use your phone’s camera to add your payment card details

Learn more about the Wise money transfer app:

How to transfer money using the Wise app

Set up payments in USD – or send money overseas to any of the countries supported by Wise, right from your phone or smart device.

Here’s how to transfer money using the Wise app:

- Log into the Wise app and select Payments, then Send Money

- Enter the amount you want to send, or the amount and currency you want your recipient to get

- Pick the payment method that suits your needs

- Check everything over, and confirm your payment

- You’ll be able to pay using a mobile wallet, or use your phone to scan your card for a card transfer if you’d prefer

Wise transfer limits

Wise offers high transfer limits, which vary depending on the currencies being sent and received, as well as the way you want to pay. Here’s a quick summary of the key Wise US transfer limits you’ll want to know about:

| Payment method | Accounts in licensed states | Accounts in Nevada, Guam, or the Virgin Islands |

|---|---|---|

| Transfer on personal or business account | 1 million USD | Personal accounts: 50,000 USD per transfer and up to 250,000 USD in a year Business accounts: 250,000 USD per transfer and up to 1 million USD in a year |

| ACH payment | Personal accounts: 50,000 USD per 24 hours, and up to 250,000 USD over a 60 day period Business accounts: up to 400,000 USD over a 60 day period. | Personal accounts: 10,000 USD per day, and up to 250,000 USD over a 60 day period Business accounts: up to 400,000 USD over a 60 day period.

|

| Debit or credit card | 2,000 USD per 24 hours and 8,000 USD per 7 days | Not available |

Wise large transfers

Wise is safe to send large amounts of money internationally, and has high transfer limits so individuals and businesses can make high value payments without worrying. In fact, Wise offers progressively lower fees based on the value of transfers you make. Discounts are applied automatically, so you don’t need to enter a code or jump through any hoops to benefit.

Here’s how the discount works – the discount brackets are set up in GBP, but if you’re sending a different currency, the amounts can be converted from GBP to the currency you need using the mid-market rate.

| Volume of payments in a calendar month (GBP) | Discount (%) |

|---|---|

| 0–100k | 0 |

| 100k–300k | 0.1 |

| 300k–500k | 0.15 |

| 500k–1m | 0.16 |

| 1m+ | 0.17 |

Learn more about sending large amounts with Wise:

How does Wise compare to other money transfer services?

So is Wise worth trying compared to using other providers? Let’s compare Wise to some popular money transfer service providers so you can pick the one that’s right for you:

- PayPal vs Wise: PayPal transfers are quickly deposited to the recipient’s PayPal account, but can come with higher fees compared to Wise – plus, the recipient will then need to withdraw their money to a bank account for easy spending

- Western Union vs Wise: Western Union offers in person transfers from the US, plus there are options for cash collection services globally, however, the exchange rate you get is likely to include a markup, which can mean higher overall costs compared to Wise

- OFX vs Wise: OFX is a good pick if you prefer to talk through your payment on the phone, as they have a 24/7 phone service, as well as currency risk management services. Exchange rates include a markup, which can mean higher overall costs

- Remitly vs Wise: Remitly offers different fees and delivery times, depending on how you want to pay and what’s important to you – well worth comparing against Wise as Remitly’s promotional exchange rates can be very good

Can you send domestic transfers with Wise?

Yes. You can send domestic transfers in USD with Wise. You can set up a domestic transfer with Wise in the same way that you’d send an international payment – just pick ‘same currency’ instead of ‘international’ when you arrange the payment online or in the Wise app.

How do I receive money from Wise in the US?

You’ve got a couple of options to receive Wise payments in the US – you can have the money deposited to your normal bank account, or if you have a Wise account yourself, you can also have the payment added to Wise for future spending.

To have money deposited to your normal bank account you’ll just need to give the sender your regular bank account details, such as your account number and routing number. If you’d prefer to get paid to a Wise account you can also open a free Wise account online or in app, to get local bank details for 10 currencies – USD, CAD, GBP, EUR, AUD, NZD, SGD, TRY, RON and HUF.

Here’s how to receive money in USD to your Wise account:

- Log into your Wise account online or in the Wise app

- Tap Open, and select USD to open a USD currency balance

- Choose between inside US for domestic, and outside US for international transfers

- You’ll see your USD account details, and can use the ‘copy account details’ function to give to the sender

Receiving payments into Wise account is free in 8 currencies. If you’re getting paid in USD, you can receive an ACH for free, but USD wire transfers have a fixed fee of 6.11 USD per transaction. If you’re getting paid in CAD, local transfers are free, but there’s a 10 CAD fee to receive a CAD SWIFT payment.

Learn more: How to receive money from abroad with Wise

Do I need a Wise account to receive money through Wise?

No. You don’t need a Wise account to receive a Wise payment. Just give the person sending you money your normal bank account information, and the money will be deposited to your regular bank account for convenience.

Fees to receive Wise payments

Generally, with Wise transfers, the sender pays the transfer fees. That means there’s no fee to receive a Wise transfer.

The key exception here is that if you’re sent a payment in a currency that’s different to the currency of your bank account, your own bank might charge a currency conversion fee before the funds are deposited. This may mean that the total amount is less than the delivery amount calculated by Wise before sending out the transfer. Have the sender make the transfer to you in the currency of your bank account to avoid this.

How to withdraw money from Wise

Most Wise money transfers are deposited directly to the recipient’s bank account. However, in some destination countries Wise supports other methods such as depositing to a mobile wallet.

If you’re received a payment to your Wise account, you can withdraw it by transferring the money into your bank account. Or, you can order yourself a Wise Multi-Currency Card, to withdraw cash at an ATM locally or internationally.

Here’s how to withdraw money from Wise to your bank account:

- Log into your Wise account online or in the Wise app

- Select the balance you want to withdraw from and tap Send

- Choose the bank account you want to send your money to

- Enter the amount you’d like to withdraw

- Review your transfer and confirm to send

Wise Business money transfers

Wise Business offers low cost multi-currency accounts to entrepreneurs, self-employed and business owners, which have many of the features of a Wise personal account, plus a few handy extras too.

Here are a few of the things you can do with a Wise Business account:

- Hold and exchange 40+ currencies with the mid-market exchange rate

- Send payments to staff, and suppliers in 160+ countries

- Make batch payments to up to 1,000 accounts at a time

- Integrate with cloud based accounting platforms like Xero

- Add and manage user permissions so team members can access account details when needed

How to make business payments with Wise

Making a Wise business payment is easy and can be done from your phone, smart device or laptop:

- Log into your Wise Business account and select Send Money

- Enter the amount you want to send, or the amount and currency you want your recipient to get

- Pick the payment method that suits your needs

- Check everything over, and confirm your payment

Batch payments for business

If you’re paying a large group of staff, or suppliers, even in multiple currencies, you can cut down on admin time with batch payments. Just upload a single spreadsheet detailing the transfers that need to be made, and up to 1,000 transfers can be made at once, quickly and without any extra hassle.

Wise API

Wise Business offers customers access to a powerful API that can be used to automate invoice payments, recurring transfers, standing orders, or payments to staff – cutting down admin time significantly. You can also generate payments from invoicing software, simplify expense reporting, and keep an eye on the market by tracking exchange rates.

Can you cancel a Wise money transfer?

Whether or not you can cancel a Wise transfer will depend on which stage of processing the transfer has reached.

- If you’ve set up a transfer but not paid yet, you can cancel the payment yourself

- If you’ve set up a transfer and the money is still on the way to Wise, you can cancel the payment yourself

- If you’ve set up a transfer and the money is being processed by Wise, you can ask Wise directly to cancel the transfer for you

- If you’ve set up a transfer and the money has already been sent by Wise to the recipient the payment can not be canceled

Once Wise has sent the payment to your recipient they can no longer retrieve the funds. In this case you’ll need to contact the recipient directly to ask for the money back.

Here are the steps you need to take to cancel a Wise transfer, if the money has not yet been sent out by Wise:

- Log into Wise and go to Home to see your activity list

- Find the pending transfer you want to cancel

- Click Cancel transfer

- If you haven’t paid yet, click I didn’t pay, and then Cancel transfer

- If you’ve already paid, click I paid, and enter your bank account details if needed

How do I contact Wise in the US?

The easiest way to contact the Wise money transfer customer service team is to log into your account online or in the Wise app and select the best contact method based on the issue you have. In app chat services are available in a broad selection of languages, and can often be the quickest way to resolve a problem.

| Wise customer support information |

|---|

| 🗓️ 365 days a year 📞 Phone: +1 888 908 3833 🖥️ Live chat support available 📩 Website: https://wise.com/help/ |

About Wise money transfer

In a hurry? Here’s a quick run through of the key points we discovered about using Wise money transfers in the US.

Key features:

- Mid-market exchange rate used for currency conversion

- Low money transfer fees from 0.35% with transparent costings every time

- Over 60% of payments are instant, 90% arrive in 24 hours

- Send payments to 160+ countries for bank deposit, right from your phone

- Fast domestic transfers supported within the US

- High payment limits, making Wise suited to both individual and business customers

- Licensed and regulated in the US and internationally

Key stats:

- Over 16 million people and businesses use Wise

- Wise payments can be sent to 160+ countries

- 60%+ of Wise transfers are instant

- Wise processes over 10bn USD in cross-border transactions every month.

- Get Wise account details in 10 currencies to receive convenient local payments

- Receive payments to Wise through SWIFT in 15 currencies

Summary: Wise offers low cost money transfers within the US, and to 160+ countries globally. If you’re sending money abroad, your dollars are converted to the currency you need using the mid-market rate and low, transparent fees you can check and compare in advance. Transfers are also pretty fast – over 60% are instant or arrive in seconds. All in all, that makes Wise well worth a look next time you’re sending money to someone locally or internationally, to see if you can save.

Conclusion: Is Wise good for money transfer?

Wise is on a mission to make moving money across borders instant, convenient, transparent and eventually free. While Wise services aren’t quite free just yet, they do offer the mid-market exchange rate – which is transparent and easy to compare – and low fees which in our comparisons meant that the overall costs of using Wise were lower than alternative providers.

Overall, Wise is definitely worth looking at, to see if you could save on your specific money transfer. Payments can be made to 160+ countries, and can arrive quickly or even instantly. Plus you’ll be able to set up, track and review your payments from your phone for convenience. Compare Wise money transfer costs for your particular payment, to see how they measure up against competitors.

Wise online money transfer FAQs

Is Wise safe to transfer money?

Yes. Wise is licensed and regulated in the US and internationally, so it’s a safe service to use when sending money.

Is Wise better than bank transfer?

Whether Wise or a regular bank transfer is better for you will depend on your specific situation and preferences. In our comparisons, Wise often came out with lower overall costs for international transfers compared to banks and other providers. Compare the costs and convenience of both, to see which works best for you.

Does Wise work in the US?

Yes. In the US Wise offers international transfers to 160+ countries, personal and business account services, and personal debit cards for spending in 150+ countries.

What is the Wise USD transfer limit?

The Wise USD transfer limit depends on the way you want to pay and where in the US you’re based. You could send up to 1 million USD per transfer with some payment methods, making Wise suitable for even high value USD transfers.

Does a Wise transfer go directly to a bank account?

Wise transfers can be deposited to bank accounts directly. In some countries, you can also send money to mobile wallets – or you could have the money added to your recipient’s own Wise account if they’d prefer.

Will my Wise transfer be instant?

Over 60% of Wise transfers are instant or arrive in seconds. Whether or not your Wise transfer will be instant depends on where you’re sending money to and how you want to pay. You’ll see a delivery estimate before you confirm your transfer.