OFX Global Currency Account Alternatives in the US

OFX is a specialist in international transfers and currency risk management, serving personal and business customers in many countries and regions globally. It used to be possible to open an OFX Global Currency Account for business, which was a multi currency account for international businesses, supporting 7 currencies.

However, in the first quarter of 2025, OFX announced that their business multi-currency accounts were no longer available for new customers.

If you’re looking for a way to take and send payments in foreign currencies for your business or for yourself as an individual, you need an alternative – this guide covers some top picks including Wise and Revolut in the US.

Quick summary of the alternatives

| Provider | 💡 Great for |

|---|---|

| Wise Account | Personal and business customers looking to hold 40+ currencies to send, spend and exchange, with mid-market exchange rates and low fees |

| Revolut Account | Personal and business customers who want to pick from several account plans to get the best combination of features and fees for them |

| Airwallex Account | Businesses taking customer card payments in a selection of foreign currencies and looking for ways to spend, send and manage foreign currencies |

| Payoneer Account | Business customers receiving payments by card, PayPal and ACH and looking to manage 10 currencies side by side |

| HSBC Global Money Account | HSBC US Premier customers looking for an add on in-app service to hold and send foreign currencies |

About OFX Global Currency Account

The OFX Global Currency Account supported 7 currencies for holding and exchange, and offered international payments for ecommerce and business customers in many countries and regions globally.![]()

This account came with local details for 7 major currencies like USD, GBP, EUR and CAD, to get paid by customers easily and for free. As of the first quarter of 2025, this account is no longer available for new customers.

Is OFX Global Currency Account available in the US?

No. The OFX Global Currency Account is not available for new customers anymore (as of the first quarter of 2025).

However, if you already have an OFX Global Currency Account account you can continue using it – and also OFX still supports international money transfers for both personal and business use.

Check out the range of OFX services which includes currency risk management solutions to see if they can still help you with managing your money across borders.

Alternatives to OFX Global Currency Account

If you had been looking to open an OFX Global Currency Account you need an alternative. There are a few good options depending on whether you need an account for personal or business use.

We’ve rounded up a few good picks for you to compare like Wise and Airwallex – with a side by side look at features and fees, then more detail about each:

| Providers | 🌎 Supported currencies | 💰 Account and card fees | 💡 Limits to know |

|---|---|---|---|

| Wise Account (personal and business) | 40+ currencies including USD, GBP, EUR and CAD | No ongoing fees No fee to open a personal account, 31 USD one time fee to open a Business account Conversion and payment fees from 0.57% | Transfer limits usually around 1 million GBP (about 1.35 million USD) |

| Revolut Account (personal and business) | 25+ currencies including USD, GBP, EUR and CAD Business customers can exchange 30+ currencies | 0 USD – 16.99 USD/month for personal customers; 0 USD – 199 USD/month for business customers Transfer, fair usage, out of hours and other fees may apply | Usually no limit on holding amount Variable transfer limits based on the currencies being sent |

| Airwallex Account (business) | 20+ currencies including USD, GBP, EUR and CAD | Account has no maintenance fees Fees apply to take customer card payments 0.5% – 1% currency conversion costs apply | Usually no limit on holding amount Variable transfer limits based on the currencies being sent |

| Payoneer Account (business) | 10 currencies including USD, GBP, EUR and CAD | Account has no maintenance fees Fees apply to take customer card and PayPal payments 0.5% currency conversion costs apply within your account, up to 3% when sending a transfer | Various limits apply on withdrawals and payments – check in the Payoneer app |

| HSBC Global Money Account (Personal) | 8 currencies including USD, GBP, EUR and CAD | Account has no maintenance fees You must hold an eligible Premier account to apply – eligibility rules include holding 100,000 USD in HSBC Fees may apply to your underlying account | Maximum daily transfer limit: 200,000 USD to your own HSBC accounts 50,000 USD to any other HSBC accounts |

*Details correct at time of research – 11th June 2025. About Wise pricing: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Wise Account

| 💡 Great for: Personal and business customers looking to hold 40+ currencies to send, spend and exchange, with mid-market exchange rates and low fees |

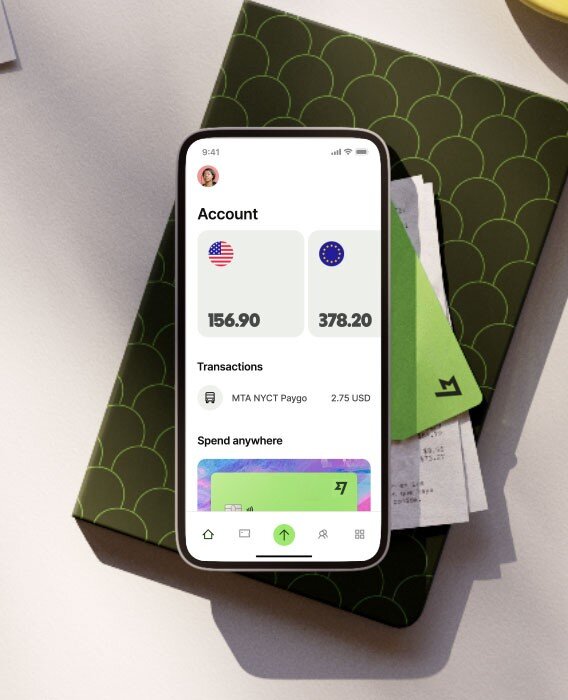

Wise has personal and business account options for US customers which all support 40+ currencies and have easy ways to receive, hold, exchange and send foreign currency payments. This can make Wise a great option for anyone who travels often, or who needs to send regular transfers internationally.

Wise currency exchange uses the mid-market exchange rate with low, transparent fees so you can easily see and compare what you’re paying.

You can also get the Wise Multi-Currency Card, to spend and make cash withdrawals conveniently in the US, and wherever else in the world you happen to be. Cards are supported in 150+ countries and offer some withdrawals with no monthly or annual fees.

- Hold and exchange 40+ currencies with no ongoing fee to pay and mid-market exchange rates

- Get card services for easy spending and withdrawals

- Receive payments in 20+ currencies, send money to 140+ countries

| Wise is great for: | Wise may not be for you if: |

|---|---|

| ✅ 40+ currencies supported ✅ Receive payments in 20+ currencies with low or no fees ✅ Send, spend and exchange with the mid-market rate ✅ Personal and business accounts available | ❌ You want to be able to get in branch services ❌ You need checking services |

Wise fees and limits

| Features | 💡 Wise pricing and limits to know: |

|---|---|

| Account fees | No ongoing fees; No fee to open a personal account, 31 USD one time fee to open a Business account |

| Currency conversion | Mid-market exchange rate with no hidden fee |

| Supported currencies | 40+ currencies including USD, GBP, EUR and CAD |

| Sending international transfers | Conversion and payment fees from 0.57% |

| Receiving international payments | Receive with local account details in 8+ currencies, and SWIFT details in 20+ currencies. It’s free to receive payments with local details (except USD wires, 6.11 USD per transaction), small fees apply if you receive a SWIFT payment. More information on fees for receiving SWIFT here. |

| Limits | Wise limits usually around 1 million GBP (about 1.35 million USD) Generally no maximum limits on how much you can hold in your Wise Account. More information – Wise limits |

| Linked debit cards | Available for use in the US and 150+ countries |

*Details correct at time of research – 11th June 2025. About Wise pricing: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Revolut Account

| 💡 Great for: Personal and business customers who want to pick from several account plans to get the best combination of features and fees for them |

Revolut has different account plans which run from 0 USD – 16.99 USD/month for personal customers, and 0 USD – 199 USD/month for business customers. The most basic plans have some limitations but still offer some no fee transactions and currency exchange, while the most expensive plans are feature packed and have higher no fee transaction limits. All personal accounts support 25+ currencies, while business customers can exchange 30+ currencies.

Accounts offer some no fee transactions monthly, after which fair usage fees may apply. There may also be other costs for specific services like international transfers or currency exchange on a weekend. All accounts offer a linked debit card, although the specific card you get depends on the plan you pick.

- Variety of account plans to suit different customer needs

- Some no fee transactions and currency exchange available

- Some accounts with no monthly fee offered for business and personal customers

| Revolut is great for: | Revolut may not be for you if: |

|---|---|

| ✅ People who want to choose from different account tiers to suit their needs ✅ Some no fee transactions monthly, including weekday currency exchange ✅ Good range of supported currencies with ways to send global payments ✅ Personal and business accounts available | ❌ You want full feature account access without ongoing fees ❌ You prefer branch service |

Revolut fees and limits

| Features | 💡 Revolut pricing and limits to know: |

|---|---|

| Account fees | 0 USD – 16.99 USD/month for personal customers, and 0 USD – 199 USD/month for business customers Transfer, fair usage, out of hours and other fees may apply |

| Currency conversion | Weekday currency conversion with the Revolut rate to plan limit, then fair usage fees apply – out of hours fees apply on weekends |

| Supported currencies | 25+ currencies including USD, GBP, EUR and CAD Business customers can exchange 30+ currencies |

| Sending international transfers | Variable fees, with fee discount on some account packages |

| Receiving international payments | Receive with local and SWIFT details in a selection of currencies |

| Limits | Variable transfer limits based on the currencies being sent |

| Linked debit cards | Available for all accounts |

*Details correct at time of research – 11th June 2025

Airwallex Account

| 💡 Great for: Businesses taking customer card payments in a selection of foreign currencies and looking for ways to spend, send and manage foreign currencies |

If you have a US business you can open an Airwallex Account with no account opening or maintenance fees, and get a range of features including ways to hold 23 currencies and receive payments in 20+ currencies from others. There are ways to take customer card payments which makes this a good choice for digital first business customers, and you can also issue your own debit cards for yourself or your team. Cards are digital as standard and can not be used in an ATM.

Airwallex currency conversion has a fee of 0.5% or 1% depending on the currencies in question, and many transfers from your account are free. There are charges for SWIFT transfers.

- Great range of supported currencies for business customers

- Take customer payments by card and bank transfer easily

- Manage business finances with expense and debit cards for team members

| Airwallex is great for: | Airwallex may not be for you if: |

|---|---|

| ✅ Digital businesses taking card payments ✅ Managaing business finances across multiple currencies conveniently ✅ Good value currency exchange and payments ✅ Excellent selection of currencies covered | ❌ You need an account for personal use ❌ You want to make ATM withdrawals |

Airwallex fees and limits

| Features | 💡 Airwallex pricing and limits to know: |

|---|---|

| Account fees | Account has no maintenance fees Fees apply to take customer card payments |

| Currency conversion | 0.5% – 1% currency conversion costs apply |

| Supported currencies | 20+ currencies including USD, GBP, EUR and CAD |

| Sending international transfers | Send payments using local methods with no fee 15-25 USD for SWIFT transfers |

| Receiving international payments | Receive in 20+ currencies with local account details |

| Limits | Usually no limit on holding amount Variable transfer limits based on the currencies being sent |

| Linked debit cards | Available – ATM use not supported |

*Details correct at time of research – 11th June 2025

Payoneer Account

| 💡 Great for: Business customers receiving payments by card, PayPal and ACH and looking to manage 10 currencies side by side |

You can open a Payoneer Account for your business to hold and manage 10 currencies, and take payments from customers by card, PayPal and ACH. This makes Payoneer a solid choice for US business owners who work digitally, and who need to connect with clients easily. You can get a Payoneer debit card for spending once you have a balance, and also access other features such as hiring tools as your business grows.

Payoneer has no ongoing account fees. Bear in mind that the costs of currency exchange and payments can vary quite a lot depending on the details of the transaction. Fees may depend on the currencies involved and your usual transactions in the account.

- Hold and exchange 10 currencies

- Get paid by cards and with PayPal, plus take bank payments easily in the US

- Card services available

| Payoneer is great for: | Payoneer may not be for you if: |

|---|---|

| ✅ Getting paid by customers globally using popular payment methods ✅ 10 curenies to choose from ✅ Ways to send money to Payoneer and banks around the world ✅ Easy accounts with no ongoing fees | ❌ You need a personal account ❌ Your’re sending international payments to non Payoneer recipients – fees can be up to 3% |

Payoneer fees and limits

| Features | 💡 Payoneer pricing and limits to know: |

|---|---|

| Account fees | Account has no maintenance fees Fees apply to take customer card and PayPal payments |

| Currency conversion | 0.5% currency conversion costs apply within your account |

| Supported currencies | 10 currencies including USD, GBP, EUR and CAD |

| Sending international transfers | Fees of up to 3% when sending a transfer – final fee depends on destination and currency |

| Receiving international payments | Receive in 10 currencies with local details |

| Limits | Various limits apply on withdrawals and payments – check in the Payoneer app |

| Linked debit cards | Available |

*Details correct at time of research – 11th June 2025

HSBC Global Money Account

| 💡 Great for: HSBC US Premier customers looking for an add on in-app service to hold and send foreign currencies |

HSBC offers the HSBC Global Money Account for US Premier customers which can be linked to your eligible USD account. By adding in this in-app tool, you can hold and exchange 8 major currencies, to send payments to your own or other people’s HSBC accounts conveniently. You may be able to access preferential foreign exchange rates compared to the standard HSBC rate, and your payments to other HSBC accounts may not have a transfer fee. Bear in mind that markups and other costs may apply.

This account does not have a debit card and is intended as an additional service to existing customers. To be a Premier customer you’ll need to meet eligibility rules which can include holding a minimum relationship balance of at least 100,000 USD with HSBC.

- Hold and exchange 8 major currencies

- Send instant payments to other HSBC accounts with no transfer fee

- Get preferential foreign exchange rates

| HSBC is great for: | HSBC may not be for you if: |

|---|---|

| ✅Existing HSBC US Premier customers ✅ People who want to send to and from HSBC accounts in foreign currencies ✅ Anyone who manages their money in app primarily ✅ Customers looking for global banking services from a major bank | ❌ You don’t want to hold a high balance with HSBC ❌ You need to send money to accounts with institutions other than HSBC |

HSBC fees and limits

| Features | 💡 HSBC pricing and limits to know: |

|---|---|

| Account fees | HSBC Global Money account has no maintenance fee, but you must also have a USD Premier account which may have fees |

| Currency conversion | HSBC exchange rate which may include a fee |

| Supported currencies | AUD, CAD, EUR, GBP, HKD, NZD, SGD,USD |

| Sending international transfers | Send to other HSBC accounts only – payments may have no fee, and can be instant |

| Receiving international payments | Receive from your own linked HSBC accounts |

| Limits | Maximum daily transfer limit of 200,000 USD to your own HSBC accounts and 50,000 USD to any other HSBC accounts |

| Linked debit cards | Not available |

*Details correct at time of research – 11th June 2025

| ⭐ Read more – Best multi currency business accounts in the US |

Are these OFX Global Currency Account alternatives safe?

Yes. All of the OFX Global Currency Account alternatives we have examined in this guide are safe to use with normal precautions. Here’s a quick look at some of the features which make them a good choice:

Wise Account – Broad range of manual and automatic anti fraud tools running 24/7, with secure long ins and verification. More information – Is Wise Account safe to hold money?

Revolut Account – Industry level security built into the app as standard, including ways to freeze and unfreeze your card if you need to

Airwallex Account – View your account information and transactions at any time with your phone, and rely on high level security from a reliable provider

Payoneer Account – Easy in app chat tools if you have a problem, with lots of safety features available in the app, online and when using the card

HSBC Global Money Account – high level security built in and backed by the tools offered by one of the world’s biggest banks

OFX Global Currency Account alternatives in the US: Conclusion

Unfortunately the OFX Global Currency Account is no longer available to new customers. However there are some good OFX Global Currency Account alternatives out there depending on whether you need an account for personal or business use, and the types of transactions you’ll want to make often.

This guide rounds up a few top picks like Wise which has 40+ currencies for both personal and business customers, and Airwallex which is a great option for businesses operating online and taking customer card payments in a range of currencies.

FAQs

What is the best alternative to OFX Global Currency Account in the US?

There’s no single OFX Global Currency Account alternative in the US – the right one for you depends on the type of transactions you want to make.

You might want to consider the Wise Account for personal and business customers looking to send, spend and exchange, with mid-market exchange rates and low fees, or the Revolut Account to pick from several account plans, for example. Or check out the Airwallex Account and Payoneer Account for business, and the HSBC Global Money Account for HSBC US Premier customers