Wise Review [2026]

This full Wise review covers all you need to know about the services available from Wise, how much they cost, whether it's safe, and how long it takes to send a Wise international payment. Let’s dive right in.

Wise was launched in 2011, with a mission to make international money transfers easier, faster, and cheaper. In fact, the aim is to continually drive down costs until eventually it’s free to make a Wise cross-border transfer.

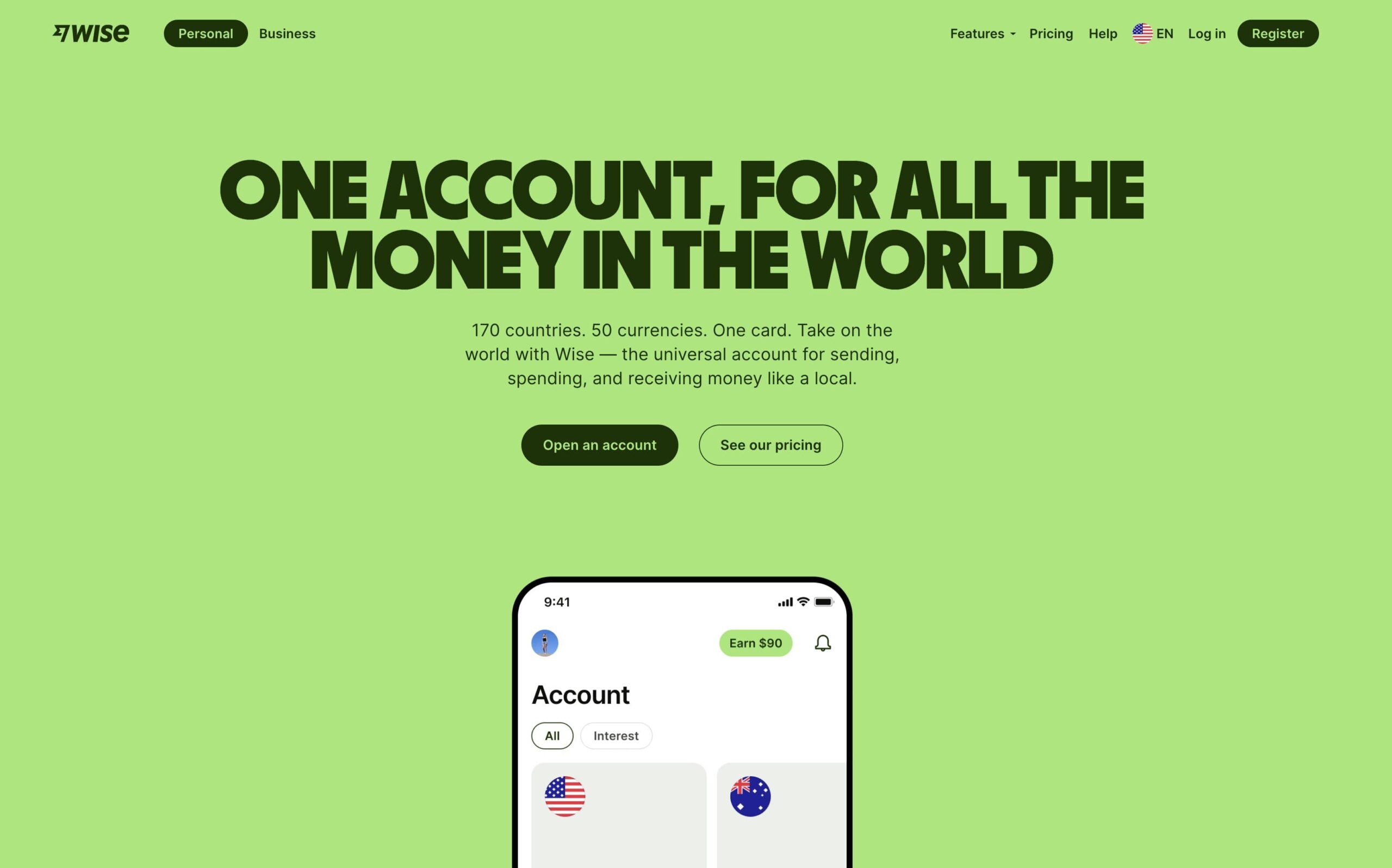

Over time, Wise has expanded its offering beyond money transfers and also offers multi-currency accounts and linked debit cards, that help people and businesses send, spend, hold, receive and exchange 40+ currencies, all in the same place.

Today, Wise is trusted by over 16 million customers, and sends payments worth around 11 billion dollars a month to 160+ countries around the world.

In this Wise (formerly known as TransferWise) review we explain:

Wise is good for

- Mid-market exchange rate for currency conversion

- Transparent fee structure, no hidden fees

- Multi-currency accounts for individuals and businesses

- Receive payments easily from other countries

- Spend internationally with Wise Multi-Currency Card

Wise rating: 4.2 / 5.0

Learn more

Wise: Key points

Wise's key features

- Send payments internationally to 160+ countries, with low and transparent fees

- Open a multi-currency account to hold and exchange 40+ currencies

- Transparent pricing - all costs are clearly shown before you confirm any transaction

- Modern approach to moving money internationally - Wise has its own payment network to improve delivery speed and cut costs

- Spend internationally with Wise Multi-Currency Card, without foreign transaction fees

Key stats

- 16 million customers, sending over $11 billion cross-border transactions every month, and saving customers around $1.5 billion a year

- Send money to 160+ countries, with fast, or even instant, delivery times

- Hold and spend 40+ international currencies from your Wise account for individuals and business customers

- Wise Multi-Currency Cards to spend and withdraw in 150+ countries, Apple and Google Pay compatible

- Receive payments like a local in 10 currencies including GBP, CAD, AUD, EUR and USD

Pros and cons of using Wise money transfer

- Low, transparent fees fees - no extra costs or markups bundled into the exchange rate

- More than 50% of transfers are instant, 90% are delivered within 24 hours

- Registered with FinCEN, with industry leading approaches to keeping customers’ money safe

- All services are available online or in the Wise app, with multi-lingual support online, in-app and by phone

- Personal, business and enterprise level services available

- No branch network - which means you can’t deposit cash payments

- Variable fees and limits may apply, based on the destination country

- Personal accounts are not interest bearing

Overall

Wise was built to make it easier, faster and cheaper to send money abroad. To make this happen, Wise has created its own payment network to cut out the inefficiencies and excessive costs involved in sending international payments.

Wise’s mission to offer fair fees and continue to drive down costs means their pricing system is transparent. There’s no bundling, exchange rate markups or hiding fees - the costs you pay are always shown upfront before you fund your Wise payment.

If you need to receive, hold or exchange currencies often you could also benefit from the Wise multi-currency account for individuals and business customers. You’ll get the mid-market exchange rate and can hold and exchange 40+ currencies all in the same place.

How much can I save with Wise?

Wise is famous for offering low and transparent fees. But how much can you actually save by choosing Wise?

Well, exactly how much you can save will depend on the factors like the currencies involved and where you’re sending to. But to get a flavor, let’s look at how this works when sending money online from your USD account to a friend in the UK. We’ll look at a few different transfer values and a couple of other specialist services to build a bit of a picture.

| Send amount in USD | With Wise your recipient gets: | With Western Union your recipient gets: | With PayPal your recipient gets: |

|---|---|---|---|

| $1,000 | 789.11 GBP | 776.49 GBP (12.62 GBP less than Wise) | 766.49 GBP (22.62 GBP less than Wise) |

| $5,000 | 3,945.55 GBP | 3,905.50 GBP (40 GBP less than Wise) | 3,832.47 GBP (113.08 GBP less than Wise) |

| $10,000 | 7,891.10 GBP | 7,811.00 GBP (80.10 GBP less than Wise) | 7,664.94 GBP (226.16 GBP less than Wise) |

*Data correct at time of writing - 13th February 2024

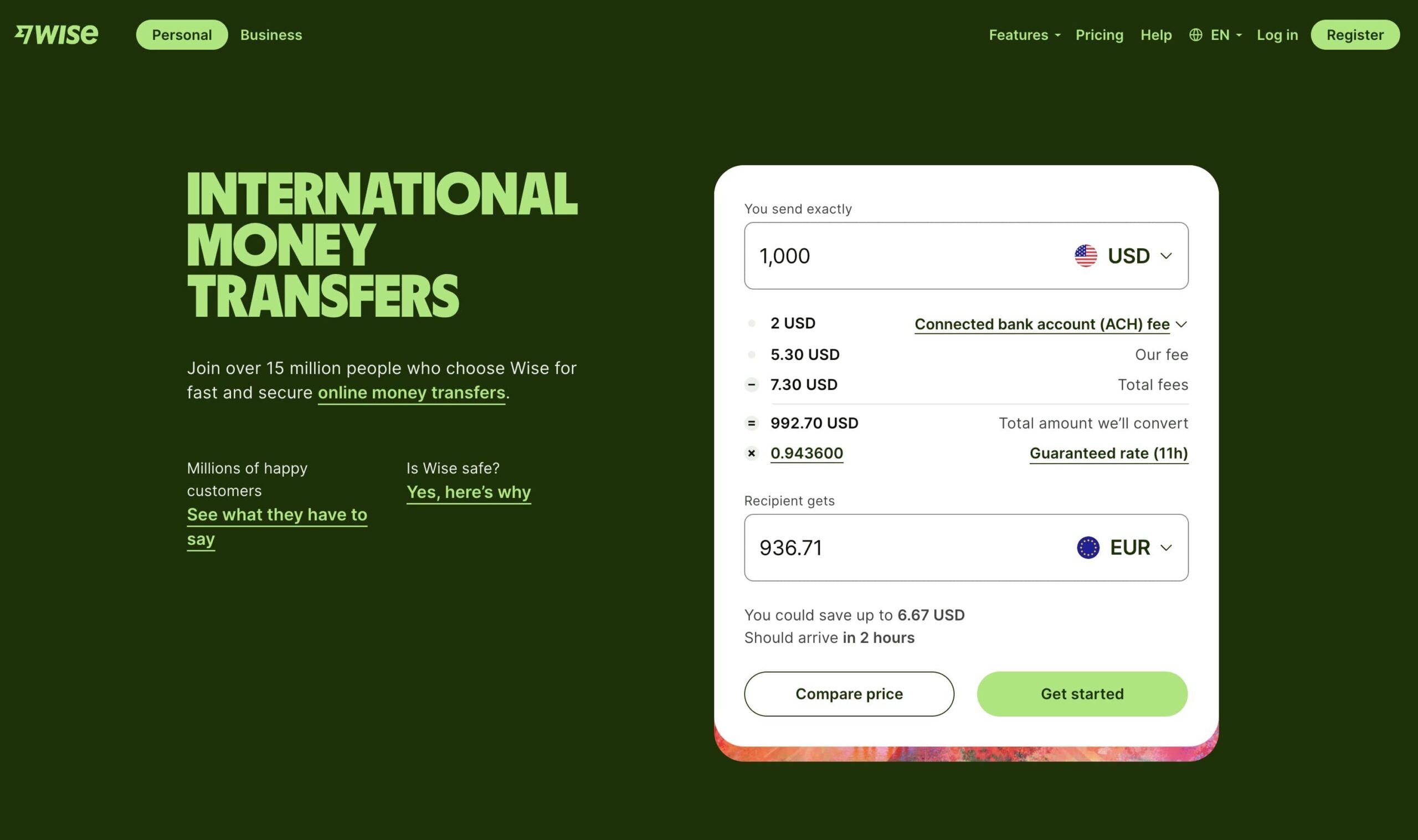

Wise Fee Calculator

According to our comparison, your recipient will get more with Wise. The difference between the costs of using Wise compared to other providers is usually based on the exchange rates available. Because Wise offers the mid-market exchange rate, and while other providers might be adding a percentage markup to the rate they give customers, the savings available from Wise might get bigger with the more funds you’re sending.

See how much you can save - and get more comparisons over on the Wise website or app.

What is Wise (formerly known as TransferWise)?

Wise launched in the UK in 2011, with a mission to make it faster, easier and cheaper for individuals and businesses to send money abroad. Since launch, Wise has expanded globally, and is now available in all but a handful of unsupported countries.

Services offered now include multi-currency accounts and international debit cards, for individuals, businesses and enterprise level customers. Today over 16 million people and businesses around the world use Wise, from individuals using the service occasionally to make small payments, to enterprise level customers moving millions a month.

Wise is built for speed, simplicity, and transparency. It’s easy to create an account and send money — recipients can expect to get their funds quickly after you make payment, and they offer the mid-market exchange rate with transparent fees, making it easy to check and compare the costs of your payment.

In this section, we’ll cover:

Wise money transfer review

Wise customers can send money to 160+ countries around the world. Payments can be made online and in the Wise app, and are deposited right into the recipient’s bank account. That means that your recipient won’t need to create their own Wise account to get their money, money will be transferred directly into their bank account.

Because Wise uses its own payment network the costs can be lower compared to traditional methods. These savings are passed on to customers in the form of low fees - and because Wise cuts out the middle men usually involved with international transfers, your money could arrive faster, too.

Read our complete Wise money transfer review to learn more.

Wise payments can be arranged by inputting the amount you want to send, or the amount you want your recipient to get in the end. You’ll fund the payment by sending dollars to Wise’s account in the US - and Wise will pass on the equivalent in your recipient’s currency from their account in the destination country. It’s fast, cheap, and safe. All Wise services are overseen by regulatory bodies around the world, and you’ll always be able to track your money as it moves, online or in the Wise app.

Great for: Anyone who needs to send money abroad. Whether you’re sending a one off payment as a gift to someone overseas, or making regular transfers to cover an international mortgage or support family members around the world, it’s worth seeing how you can save with Wise money transfers.

How long does Wise money transfer take?

Wise transfers are fast. In fact, more than 50% of Wise's international transfers are instant (delivered in less than 20 seconds), while 90% of Wise payments are delivered within 24 hours.*

Ultimately how long it takes for your Wise money transfer to arrive will depend on the currencies and countries involved, how you pay for your transfer and the value of the payment. If you’re making your transfer out of hours - or if there’s a holiday in the country you're sending to, the money may take slightly longer to arrive on some routes.

Before you arrange your payment you’ll see an estimated delivery time, and you can then track your money in the Wise app to see how it’s getting along.

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions.

What currencies are supported by Wise?

Wise supports 50+ different currencies for money transfer and lets you send money to over 160 different countries from the US. The countries and currencies available are updated all the time - for the latest details on the countries supported by Wise check here.

Wise multi currency account and Wise Multi-Currency Card

If you love to travel or shop online with international retailers - or if you need to receive or send regular international transfers - a Wise multi-currency account (formerly called Borderless Account) could make it easier and cheaper to manage your money across borders.

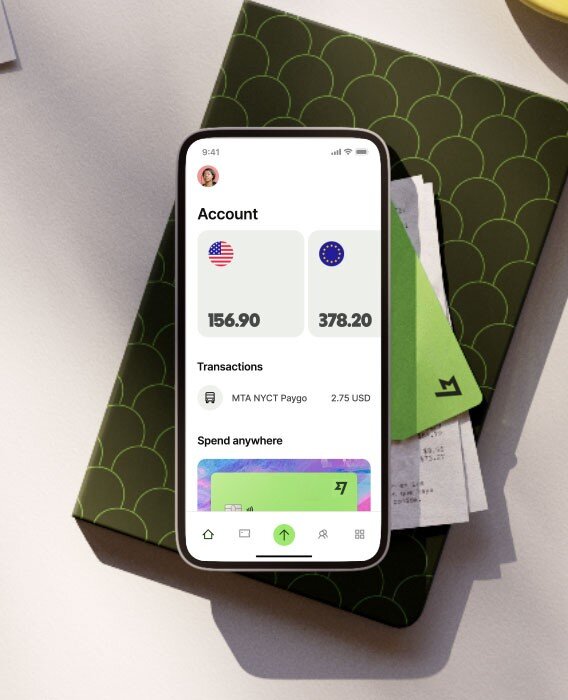

Open your Wise account easily online or in the Wise app to hold and exchange 40+ currencies all in the same borderless account. You can see all your balances at a glance, get account details to receive money internationally, and get a linked international Wise Multi-Currency Card to spend and withdraw all over the world.

Get local account details in 8+ currencies: GBP, EUR, USD, AUD, NZD, CAD, HUF, SGD, TRY to get paid easily - like a local - from 30+ countries. All with no monthly service charge and no minimum balance requirements to worry about.

| Wise account details | ||||

|---|---|---|---|---|

| 🇦🇺 Australian dollar | 🇨🇦 Canadian dollar | 🇪🇺 Euros | 🇬🇧 British pound | 🇭🇺 Hungarian forint |

| 🇳🇿 New Zealand dollar | 🇷🇴 Romanian lei | 🇸🇬 Singapore dollar | 🇹🇷 Turkish lira | 🇺🇸 US dollar |

Learn more here: Wise account review

💡 Great for: Anyone who lives, works or studies abroad, people who travel frequently, or who have international income or outgoings - or even just love to shop online with international retailers. Maybe you get paid often from international clients, or you have a vacation home and need to cover your costs abroad. Or perhaps you want a Wise Multi-Currency Card you can use online and in person, with low fees and the mid-market exchange rate - check out the Wise multi-currency account to see how easy it is to hold, convert, send and spend in a broad range of foreign currencies.

Wise business account and debit card

Wise Business customers can make international transfers, open a business multi-currency account and spend with link debit cards. They benefit from the same perks individual Wise customers do - and get a great range of business friendly features too:

- No monthly fee and no minimum balance requirement, 31 USD one-off payment for full account functionality

- Mid-market exchange rate and low, transparent fees for making international payments

- Get paid using local account details in 10 currencies, and withdraw money from Amazon, Stripe and other PSPs and marketplace platforms

- Order international debit and expense cards for you and your team

- Add team members and manage user permissions

- Make batch payments - pay up to 1,000 people in a range of currencies, by uploading a single file

- Compatible with cloud based accounting services like Xero and Quickbooks for easy reconciliation

- API to automate workflow

Great for: All businesses which have customers, suppliers or staff members abroad. Check out Wise Business whether you’re looking to start up or scale up, or already operating at corporate or enterprise level.

How Wise (formerly TransferWise) works

Wise has built its own payment network which is cheaper and faster to operate compared to SWIFT - the system often used by banks to send international transfers.

The way Wise works is actually surprisingly simple. Instead of moving money across borders through complex payment networks, Wise has its own network of accounts in all the countries it operates in. When you make a payment in dollars you send it in USD to the Wise account in the US, using an ACH, a card or a wire, for example. Wise then transfers the equivalent amount from their account in the destination country, in the currency you need. That means no money really has to cross borders, cutting the costs and the time involved.

Regular banks on the other hand typically use the SWIFT network - a network of partner banks which pass payments between themselves until they reach the correct destination account. SWIFT is established and reliable - but also expensive and slow. Each bank involved in the payment chain can add an intermediary fee which is tricky to predict and pushes up prices. Learn more on Wise vs international bank transfer.

With Wise, because there are no intermediaries, there are also no surprise costs - allowing a more transparent payment structure.

How much does Wise cost?

Wise uses mid-market exchange rate with transparent pricing. That means they’ll convert your USD using the mid-market exchange rate - the one you’ll find on Google - and then transparently split out the costs associated so you can check and compare them against other providers.

Wise has a mission to make it cheaper and more transparent to convert currencies, and send payments overseas. In fact, over time, Wise is making efforts to drive down the costs customers pay, to make it easier for everyone who needs to manage their money across currencies.

Wise money transfer fees

Whenever you make a Wise payment, you’ll pay a fee which is shown to you prior to confirming the transaction. Wise international transfers have a couple of different transparent costs:

- Fixed fee: covering the fixed costs associated with the transaction. For major currencies this is usually 4.14 USD - 4.31 USD when paying by wire

- Variable fee: covering the cost of the currency exchange. For major currencies this is typically around 0.42% of the transfer value

The costs you pay do vary a little based on your preferred payment method - ACH and wire tend to be the cheapest options.

Whichever payment method you pick, you’ll always see the full fee before you confirm the transaction. Here are the Wise transfer fees for a few major currencies, when paying by wire transfer as an example:

| Sending 1,000 USD to | Variable fee (USD) | Fixed fee (USD) | Total fee (USD) |

|---|---|---|---|

| EUR | 4.86 USD (0.49%) | 4.17 USD | 9.03 USD |

| GBP | 4.95 USD (0.5%) | 4.18 USD | 9.13 USD |

| AUD | 4.66 USD (0.47%) | 4.25 USD | 8.91 USD |

| CAD | 5.25 USD (0.53%) | 4.33 USD | 9.58 USD |

| SGD | 5.64 USD (0.57%) | 4.38 USD | 10.02 USD |

*Fees correct at time of research 13th February 2024

Wise account and Wise Multi-Currency Card fees

Wise personal accounts are free to open, with no monthly or annual ongoing fees. Getting local account details in 10 currencies is free, and holding money in any of the 40+ supported currencies is also free.

For the Wise Multi-Currency Card, you’ll pay a one time card order fee, with no ongoing fees applied after that. Spending any currency you hold is free, and if you don’t have the currency you need in your balance, Wise uses the currency that has the best rate possible, and charges a small currency conversion fee.

Finally, receiving payments into your account is free in 8 currencies, for USD getting paid by ACH is free, while wire payments have a small fee of 4.14 USD per transfer, and there is a fixed fee of 10 CAD to receive CAD via SWIFT.

Here’s a quick summary of the most important Wise account and card fees:

| Service | Wise fee |

|---|---|

| Open your Wise multi-currency account | Free for personal customers Business customers can open an account for free, or pay 31 USD for full feature access |

| Hold 40+ currencies | Free |

| Get local bank details for 10 currencies | Free |

| Order a Wise Multi-Currency Card | 9 USD for personal customers 5 USD for business customers |

| Spend currencies you hold using your card | Free |

| ATM withdrawals | First 2 ATM withdrawals up to total value of 100 USD/month, for no fee After this, a fee of 1.5 USD + 2% applies (ATM operators might charge their own fees) |

| Convert a currency using your card | From 0.42% |

| Receive money in EUR, GBP, AUD, NZD, RON, HUF, TRY & SGD | Free with local account details |

| Receive USD by ACH or bank debit | Free |

| Receive USD by wire & Receive CAD by SWIFT | 4.14 USD fixed fee to receive USD wire transfers. 10 CAD fixed fee to receive CAD SWIFT transfers. |

| Send international payments | From 0.42% currency conversion fee + fixed fee which varies by currency |

| Send high value international payments | Volume discounts of up to 0.17% on payments over the equivalent of 100,000 GBP/month |

Wise exchange rate

Wise uses the mid-market exchange rate - that’s the one you’ll find on a currency converter tool or with a Google search - without any hidden fees.

That’s different to many banks or international payment providers, which might be adding extra costs into the exchange rates they offer in the form of a markup. These fees can be tricky to spot, so customers end up paying more than they need to without ever realizing it.

Is Wise (formerly TransferWise) safe and legit?

Wise is regulated by FinCEN in the US, and the appropriate financial regulatory bodies in all the countries it operates in. Wise transfers are made using leading edge technology, and with a dedicated anti-fraud team on hand to ensure money is kept safe. Here are some key facts about Wise safety and security:

- Regulated by FinCEN in the US and other global regulators

- Customer funds are safeguarded using leading financial institutions

- Wise is regularly audited to check everything is working smoothly

- Advanced data protection and 2-step authentication processes are used

- Round the clock fraud prevention systems including both technology and a dedicated team

- Wise is a publicly listed company, with some 16+ million customers and 5,000 employees - and is trusted by 17 banks and 300,000 business and enterprise customers

Is Wise (TransferWise) a bank?

TransferWise is a financial technology service, not a bank. Wise is regulated by a selection of authorities around the world, and uses similar fraud detection tools and security technologies to banks. Customer funds are safeguarded - that means they’re held securely in Wise’s partner banks, separate from Wise’s own company funds.

Can I trust Wise?

Yes. Wise has millions of customers and handles billions in transactions every year. They’re independently regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States and by other agencies around the world. They use state-of-the-art security to keep all of your information secure, and they have excellent reviews from customers.

Is Wise safe for large transfers?

Sending large amounts can be stressful, but Wise is safe when sending a large amount of money. Wise safeguards your money, meaning it is kept in completely separate accounts to the ones used by Wise for the day-to-day running of the business. Read more about what safeguarding means and how it differs from financial protection schemes such as FDIC deposit insurance. The maximum you can send in one transfer is $1,000,000 USD.

Where is Wise regulated?

- United States: Financial Crimes Enforcement Network (FinCEN) registered and licensed as a money transmitter in the states listed here. In other US states and/or territories, money transmission services are offered through partnership with Community Federal Savings Bank.

- Australia: The Australian Securities and Investments Commission (ASIC), holds an Australian Financial Services Licence (AFSL) and registered with the Financial Intelligence Unit (AUSTRAC) as a money remitter.

- Belgium and the European Economic Area (EEA): The National Bank of Belgium (NBB) as an Authorized Payment Institution, with passports rights across the EEA.

- Canada: Registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business (MSB) with registration number M15193392.

- United Kingdom: Authorized as an Electronic Money Institution (EMI) by the UK Financial Conduct Authority.

How to use Wise (formerly TransferWise)

Let’s take a closer look at how Wise works, for money transfer and account services. In this section, we’ll cover how to open an account, Wise account verification, and more on how to send money with Wise.

How to open a Wise account online

Before you can send money from the US, you’ll need to create an account with Wise.

Here’s how to open a Wise account:

- Head on over to the Wise sign up page or download the app

- Sign up for an account using your email and a strong, unique, and secure password

- Alternatively, you can sign up by using your Google or Facebook account

- Add the type of account you want to open – personal or business

- Confirm your country of residence

- Follow the prompts to upload your ID for verification

- Once your account is verified, you’re all set and you can make a transfer

Wise account verification

Wise needs to keep everyone’s money safe, and that means verifying your identity. They’ll sometimes need to ask you for identity documents — this might happen when you first create your account, or when you make a transfer.

Depending on how much you’re transferring and where you’re sending the money, you’ll need to provide an ID document and a proof of address. Do make sure all identification documents are up-to-date and the images are clear. Otherwise Wise could ask you to complete the verification steps again. This is to comply with local and global financial regulation - the same rules apply when you apply for a new bank account, for instance.

Here’s the verification documents that Wise usually accepts:

Examples of accepted identification

Passport with photo

Driver's License with photo

State ID

Immigration ID or Residence Permit

Examples of address documents

Driver's License

State ID

Bank or credit card statements

Gas or electricity bills

US government documents

Helpful hints

Make sure your id is valid and not expired

Make sure it shows your full name, your current address and date of birth

How long does verification take with Wise?

Verification may be done instantly - this is often the case if you’re sending a relatively low value payment from a bank account in your own name. If you need to upload additional documents verification can still be done on the same day in some cases - or certainly within a couple of working days. Make sure your documents are up-to-date, and the images you sent are clear.

How do I know if my Wise account is verified?

Once verification is complete, you'll receive a notification. Plus, your transfer will be automatically processed, and you’ll get an email saying it’s moving through the system. And don’t worry - if you’re looking to get paid through Wise, you can receive money on Wise without verification. It’ll simply be deposited to your normal bank account automatically.

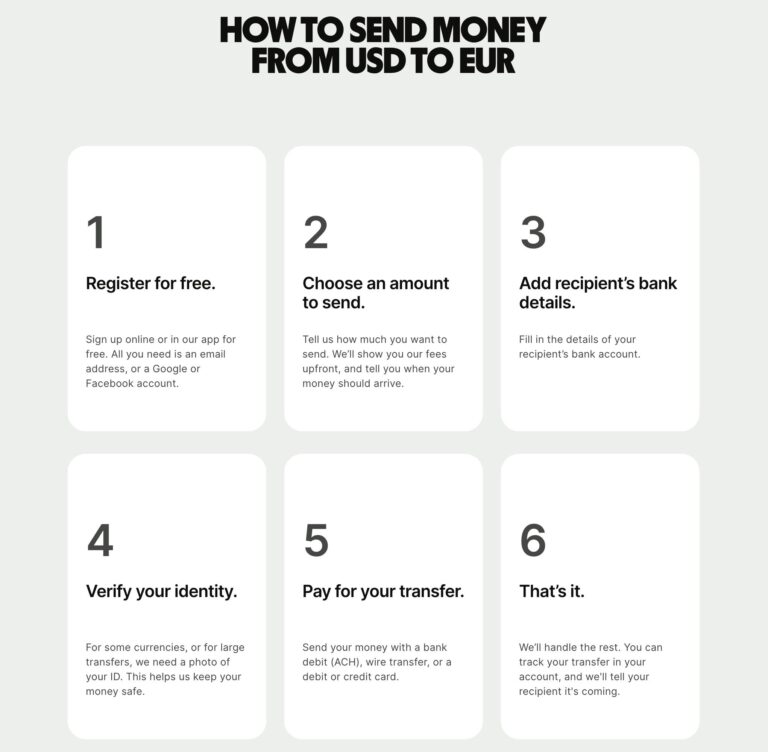

How to send money with Wise

Let’s look at how to send money with Wise - the entire process can be completed online or in the Wise app, so you don’t even need to leave home.

Here’s what you need to do to send money with Wise:

- Log into Wise in-app or online and choose ‘Send’

- Choose where you want to send from, your transfer type and your chosen currency

- Enter your transfer amount and your recipient

- Choose how you want to pay

- Send digital copies of your ID if you’re prompted for verification

- Double check the summary Wise provides and press ‘Confirm’

- Pay and track your international money transfer

Wise payments can arrive fast - even instantly. More than 50% of transfers arrive instantly, and 90% are there in 24 hours*. You’ll see a delivery estimate before you confirm your payment, and you can also track the money in the app or via the desktop site.

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions.

The details you'll need when you're sending money with Wise

When you make a transfer, you’ll need to provide Wise with information about where you want the money to go. You’ll be able to get this information from the person receiving the money, and if they don’t know all the details, they can get them from their bank.

💡 Here’s what Wise expects you to provide:

- Payment details, including the amount and currency

- The recipient’s name and address

- Bank details of the recipient’s account

The bank account details you’ll need vary between countries, but you’ll be shown the information needed when you’re setting up your transfer.

Alternatively, Wise has a “Money to Email” service. If the recipient has a Wise account already associated with their email, the money will be transferred to their account in that currency. If they don’t have that currency balance, Wise will automatically create one for them and add the money to that currency balance. Finally, if they don’t have a Wise account, Wise will send them an email, asking for their account details. You can also use this method, if you want the recipient to provide details to Wise.

Wise money transfers can be sent to these countries:

Europe

- Andorra

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- Georgia

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Monaco

- Norway

- Poland

- Portugal

- Romania

- San Marino

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- The Netherlands

- The United Kingdom

- Vatican City

- Ukraine

Americas

- Argentina

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Mexico

- United States

- Uruguay

East Asia

- Bangladesh

- China

- India

- Japan

- Nepal

- Pakistan

- South Korea

- Sri Lanka

Oceania

- Australia

- Fiji

- New Zealand

Southeast Asia

- Hong Kong

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

Middle East

- Israel

- UAE

Africa

- Botswana

- Egypt

- Ghana

- Kenya

- Morocco

- Nigeria

- South Africa

- Tanzania

- Uganda

- Zambia

How to pay for your transfer with Wise

Wise offers several payment methods that let you fund your overseas transfer:

- Wire (bank transfer)

- ACH

- Debit card

- Credit card

If you’re paying by bank transfer or wire transfer, Wise requests that you don’t pay until you’ve arranged to send money. They will then provide bank account details and a reference number so that your payment goes to the right place. For more information: Wise payment methods

If you make a card payment via credit card, your provider may charge your card as a “cash advance”. This can mean higher interest rates, and could also result in you starting to pay interest on the amount immediately. Check with your card provider to see if that’s likely to happen to you.

Wise does charge slightly differently, depending on how you choose to pay for your transfer, with an ACH or wire payment from a bank account having a low fee, and debit or credit cards charging slightly more. Card payments can often be delivered fastest - but you’ll be able to see the delivery estimates for different payment options before you decide on how to pay.

Payout methods

Wise payments usually arrive directly in the recipient's bank account. However, Wise does support other payout methods on some payment routes. You'll see your options when you set up your payment. The recipient does not need to have a Wise account, to be able to receive a transfer sent with Wise money transfer.

Wise money transfer limits

Wise offers several payment methods that let you fund your overseas transfer. Wise does have some sending limits, but they are very high so you usually don't have to worry about it. You can send up to 1 million USD ($1,000,000) when you transfer money, depending on how you pay for it. For example, paying by card does have lower limits.

Here’s a look at a few major currencies and the limits which apply when you send to these currencies using Wise:

- GBP transfer limit: 5 million GBP

- EUR transfer limit: 6 million EUR. If you want to send more than 1.2 million EUR, you’ll need to transfer it from your Wise account

- CAD transfer limit: 1.5 million CAD by wire or online bill payment

Learn more here: Wise limits

Sending large amounts with Wise

Wise can be used safely for high value payments, too.

The variable fee applied to international payments with Wise gets cheaper for higher value transfers. Discounts are automatically applied to qualifying accounts - there’s no need to get in touch with Wise to make arrangements. That means you could instantly get even better value when sending high value transfers - usually over the equivalent around 100,000 GBP (about 126,000 USD at the time of writing).

The default limit for transfers is 1 million USD, but higher limits can be arranged on request. You may need to provide more information about the payment to comply with financial service rules - but the Wise team can guide you through that if it’s needed.

For example, if you’re making a transfer to move the funds from a property sale or inheritance you may be asked to show a bank account statement to show the money being deposited to your account and documents to verify the source of the funds.

Learn more: Wise large transfers

Learn more

Why should you use Wise for your international money transfer?

Not sure if Wise is for you? Ultimately, the best transfer provider will depend on exactly where you’re sending to, the value of your transfer, and your personal preferences.

Here are a few things to think about if you’re considering Wise for your next overseas payment:

- Fast transfers: More than 50% of Wise payments are instant, and 90% arrive in 24 hours*

- Low and transparent fees: Wise has low fees and a transparent fee structure, giving you the mid-market exchange rate, with all costs split out so it’s easy to spot and compare them

- Keeps your money safe: Wise is safe to use, including being regulated by official bodies around the world, and using 24/7 fraud detection and prevention tools

- Easy to set up: Wise account creation is quick and online or via the Wise app

- It’s convenient: The Wise app is very easy to use, to create an account, send money or add money to their account easily. You’ll also be able to get transaction and transfer notifications keep you informed as your payment progresses

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions.

Wise isn’t always the answer of course. It may not be the best option if you’re looking to pay with cash or cheque, if the recipient does not have a bank account, or if the recipient needs the money to be received as cash. If any of these situations apply, check out these alternatives to Wise for money transfer.

Wise accessibility

You can use Wise from your desktop, or get the Wise app with an Apple or Android device. Wise has customer support in a range of languages, and a handy FAQ section online where you can get answers and troubleshooting support for common problems.

Wise.com reviews

You shouldn’t just rely on our review of Wise, it’s also worth exploring what other customers say. We read some customer reviews on TrustPilot. For starters, more than eight in ten customers said that Wise was “Excellent” or “Great.”

Positive reviews focussed on transparent fees and quick transfers:

“I’ve used it a few times now to move money and it has been done fast and securely. Saved me a large amount that I would have otherwise lost to currency exchange fees and poor conversion rates from banks - saving money is earning money! The customer service has been excellent as well, they give quick and helpful replies.”

‘Great money transfer services, best on the market. I move money £ -> $ $ -> £ a few times per month and Wise have never let me down. Fast, efficient, and safe process. Both the app on my Android and Windows 10 laptop work seamlessly and being able to send right from my bank account or debit card makes it flexible. I'm now starting to use the scheduled transfers and it's one less thing to worry about! I highly recommend using, ditch all the others, Wise is the best.’

Negative reviews mentioned bank fees (which are outside the control of Wise), delays in transfers, issues with getting verified, or account suspension:

“After money has been received by TransferWise, it takes approximately 2 days for the recipient to receive. It would be better if it was delivered faster.”

All in all, though, Wise scores very well, with a TrustPilot TrustScore of 4.2 out of 5. Check out the latest Wise reviews on TrustPilot.

Wise customer support

There are a couple different ways to contact Wise customer support, including by phone, and using live chat through your Wise account or app dashboard. There’s also a super helpful FAQ and Help Center online to answer a lot of common questions.

Check out the best Wise customer support options for you, by logging into your Wise account online or in the Wise app.

Wise customer support info

365 days a year

365 days a year Phone: +1 888 908 3833

Phone: +1 888 908 3833 Live chat support available

Live chat support available Website: https://wise.com/help/

Website: https://wise.com/help/

Wise (TransferWise) alternatives

Before you decide how to arrange your international payment, check out a few Wise alternatives. Here are some to get you started:

PayPal vs Wise – PayPal is well known and established - but their costs can be higher than Wise, including the exchange rate markup. Your recipient will also need a PayPal account.

Revolut vs Wise – You can open a Revolut account without monthly fees or upgrade to a paid plan for more features. Hold around 25 currencies, get saving and budgeting tools, and some no-fee currency conversion within account limits.

Xe money transfer vs Wise – With Xe, you can send international payments almost anywhere in the world. Fees and rates vary by destination.

Remitly vs Wise – Remitly offers great range of payout options if you want your recipient to collect their payment in cash or have the money delivered to a mobile wallet.

WorldRemit vs Wise – WorldRemit offers cash collection options if you’re sending money to someone who doesn’t have easy access to a bank or ATM

Wise (TransferWise) vs PayPal

If you’re not sure whether to use Wise or PayPal for your next international payment, this side by side comparison might help. Here’s a look at some of the key features of each provider as a starting point:

| Feature | PayPal | Wise |

|---|---|---|

| Send payments to | Send to PayPal accounts in 200 countries | 160+ countries, 50+ currencies |

| Multi-currency accounts | Hold and convert 24 currencies in your PayPal Balance account | Available for 40+ currencies |

| Currency conversion | Includes a markup on the mid-market exchange rate | Mid-market exchange rate with no markup |

| Debit card available | Yes | Yes, Wise Multi-Currency Card |

| Credit available | Yes | No |

| Fully licensed and regulated | Yes | Yes |

| Open a business account | Yes | Yes, Wise Business Account |

And here’s a look at some key pros and cons of both Wise and PayPal to help you make up your own mind on the Wise vs PayPal debate:

| PayPal | Wise | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Wise (TransferWise) vs Revolut

Wise and Revolut both offer some overlapping services, including multi-currency accounts and international payments. Let’s look at a quick Wise vs Revolut head to head to compare:

| Feature | Revolut | Wise |

|---|---|---|

| Send payments to | Globally - excluding a handful of unsupported destinations | 160+ countries, 50+ currencies |

| Currencies available for holding and exchange | Available for 25+ currencies | Available for 40+ currencies |

| Debit card available | Yes, Revolut debit card | Yes, Wise Multi-Currency Card |

| Spend with your card in | 140+ currencies | 150+ countries |

| ATM withdrawal fees | No fee up to $400/month, then 2% | 2 free withdrawals to $100 value/month, then $1.5 + 2% |

| Fully licensed and regulated | Yes | Yes |

| Open a business account | Yes, Revolut Business Account | Yes, Wise Business Account |

Conclusion: TransferWise review

Wise has great options for sending low cost, fast international payments - and Wise accounts also offer easy ways to hold, send, spend and receive dozens of foreign currencies.

Whenever you exchange money with Wise you get the mid-market exchange rate with no markups. That means you’ll only ever pay a low, transparent fee for the services you use, and you’ll always know the full cost of your transaction upfront before you commit. Because of this revolutionary approach to pricing, Wise might often be one of the cheapest - if not the cheapest provider on the market.

Wise money transfer review FAQs

Is Wise good for international money transfer?

Wise offers international money transfers with low transparent costs, and it always uses the mid-market exchange rate.

The recipient doesn’t need to have a Wise account of their own, they can simply receive the money directly into their bank account, in the currency they need.

How much does Wise money transfer cost?

Wise has low, transparent transfer fees. You’ll see the cost for your payment before you confirm, and you can also check out how much they charge using their calculator. The Wise fee will be made up of a small percentage of the overall transfer amount, plus a fixed fee. Charges do vary depending on where you’re sending money, and how you choose to pay, but you’ll always get the mid-market exchange rate with no hidden fees.

Is Wise legit?

Yes. Wise is regulated by FinCEN in the US, and the appropriate financial regulatory bodies in all the countries it operates in.

How long do Wise money transfers take?

The exact time it takes varies based on the destination and the way you pay. However, more than 50% of transfers are instant, 90% are delivered within 24 hours.

How does Wise apply exchange rates?

Wise uses the mid-market exchange rate and does not add a markup for calculating exchange rates.

Wise offers the mid-market exchange rate for cross-currency transfers, any currency conversion between Wise account balances and while spending internationally with Wise Multi-Currency Card.

Does Wise have a mobile app?

Yes, the Wise app is available for both Android and Apple devices. The app is fully featured and well-reviewed, scoring 4.7 (Android) and 4.4 (Apple) out of 5.

The app is very easy to use and you can make transfers, access your Wise Account (formerly called Borderless Account), and manage your Wise Multi-Currency Card.

Where is Wise located?

Yes, the Wise app is available for both Android and Apple devices.

The app is very easy to use and you can make transfers, access your Wise account, and manage your Wise Multi-Currency Card.

Is Wise the same as TransferWise?

Yes, they are the same. Wise was founded as TransferWise in 2011, but re-branded in February 2021. You can read more about the re-brand and the reasons behind it here.

More information about Wise

Wise Multi-Currency Card is linked to Wise account which allows you to hold, exchange and send 40+ currencies. Use your Wise Multi-Currency Card to spend in 150+ countries.

- Read more ⟶

- 4 min read

Wise offers personal and business multi-currency accounts which you can use to hold 40+ currencies, spend in 150+ countries, and get paid like a local from 30+ countries.

- Read more ⟶

- 3 min read

You can receive international payments with Wise easily, and often for free. Wise account offers local account details in 10 currencies including EUR, GBP, and AUD. Click to learn more.

- Read more ⟶

- 4 min read